Wage garnishments are tough. The government or some third party sends you a notice, sometimes with a court order, to reduce the wages of one of your trusted employees and then send the difference to them.

The government can garnish wages for unpaid taxes, unpaid student loans, and, of course, the most common, child and spousal support. Creditors can also take your employees to court and get a garnishment ordered to settle a debt.

Read on to learn how to calculate and apply wage garnishments.

Overview: What is wage garnishment?

Wage garnishments are deductions that you, as employer, are directed to take out of employee paychecks to pay for some type of liability the employee has incurred. The most common wage garnishment is child support, but any debt can be settled with a wage garnishment in court.

The deduction is taken out after payroll taxes and withholding but before other tax free deductions, such as insurance and 401(k) contributions. Garnished wages minus voluntary deductions is equal to taxable wages.

What types of debts are eligible for wage garnishment?

Here are the liabilities that may cause you to start garnishing wages from an employee.

1. Child and spousal support

Divorces are usually messy in every way, and child or spousal support actions can potentially put your business in the middle of them. The best strategy is to clearly communicate with your employee about any legal documents you receive ordering garnishments for spousal or child support.

When divorce is happening, your employee is responsible to report their wages though you may be contacted to confirm the numbers. Make sure you know how to access the payroll register on your payroll software to be able to quickly print a report of their wage history.

The government limits total court-ordered garnishments for child and spousal support to 50% of eligible wages (remember that is gross wages minus FICA taxes and income tax withholding) if the employer has remarried, and 60% if they have not.

You may also have to do a higher than typical wage garnishment for a new employee whose wages were not correctly garnished at their last job.

If they owe back child support or spousal support, the garnishment will be increased until it is paid back. If the back payments are more than 12 weeks late, the maximum garnishment increases to 65% of earnings.

2. Government debt

Government debt most commonly comes in the form of IRS garnishment for unpaid federal taxes. The federal government is the only creditor that can start wage garnishment without a court order.

The federal government can garnish up to 15% of an employee’s wages, and this is most commonly for delinquent student loans.

The IRS does wage garnishments a little differently. It calculates an amount that is exempt per pay period based on the number of dependents. This will be sent to the employee in the mail with publication 1494 and you will be notified what this amount is.

Any amount of pay above the exempt amount goes to the IRS. This includes bonuses, if an employee has already been paid the exempt amount for a pay period, the entire bonus would go to the IRS to pay down the levy.

3. Other creditors

Any creditor can go after your employee’s wages with a court order. It is a long process to get to wage garnishment, and if you have a good relationship with an employee, you’ll probably hear about the issue well before you get the notice in the mail.

Just as with child and spousal support, the employee will be responsible for reporting their wages. Keep in close communication with them through the process to make sure you set up the garnishment correctly, send the money to the correct third party, and end it when the debt has been paid.

How much of an employee’s wages can be garnished?

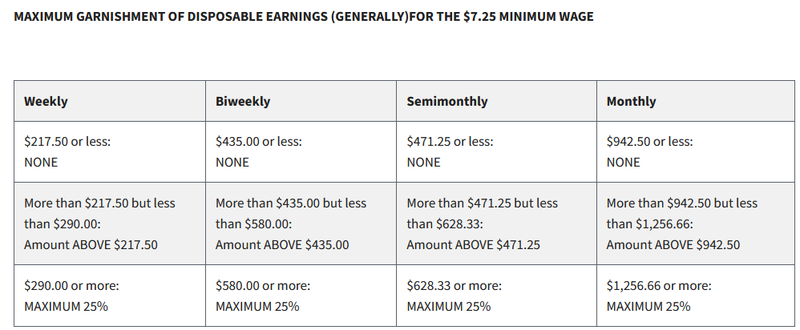

Linda Podsednik is a minimum wage employee who was recently hit with a student loan wage garnishment. Take a look at the below table from the Department of Labor to see how you would calculate her wage garnishment.

Minimum wage employees can have their wages garnished, but the department of labor limits the amount if they do not work 40 hours a week.

The above graphic is for third-party debts. Child and spousal support has a 50% of earnings limit if your employee is married to a new spouse. Those limits rise to 60% if your employee is married, up to 65% if they are not, to pay back child support.

The federal government can garnish up to 15% for non-IRS debts and the IRS sets an exempt amount and garnishes everything above that amount.

Wage garnishment frequently asked questions

What deductions come before garnishment?

Payroll taxes (social security and Medicare) and income tax withholding are deducted from wages before garnishments. This is how the max garnishment amounts are calculated.

How do you know when wages will be garnished?

If you have a good relationship with employees, you’ll likely know beforehand. It can also be helpful to request that employees let you know ahead of time so that you can set up the garnishment in your software.

Otherwise, you’ll get a notice in the mail spelling out either the dollar amount of the garnishment or how it should be calculated.

What deductions can an employer make?

As an employer, you can garnish employee wages for items such as damage to company property, paying back advances, or a till shortage. There are two things you must do to if you’re going to do this:

• The garnishment cannot push the employee pay below minimum wage for the pay period.

• You must declare in an employment contract that the garnishment can or will happen and the contract must be signed by the employee.

How do garnishments show up on a pay stub?

Garnishments should show up with other pay deductions on a pay stub. At my company, it is just called “wage garnishment,” regardless of why it’s happening.

When do wage garnishments go away?

For debt, the garnishment will go away when the debt is repaid. For child support, it is when the youngest child turns 18 or some other agreement happens with the employee and their ex-spouse. With spousal support, it depends on the divorce decree.

Don’t eat this garnishment

Wage garnishments can be awkward. You’re literally taking money out of an employee’s paycheck for something that was certainly stressful in their life.

The best way to go about it is to just garnish what was called for. Don’t be vulnerable to pleas from the employee to ignore the order, because that would put your company at risk.

The post How to Set up a Wage Garnishment appeared first on The blueprint and is written by Mike Price

Original source: The blueprint