Properly managing business expenses is a challenge for many small businesses. It gets even more complicated when you add in managing your employees’ expenses as well. Creating best practices for expense management helps you keep a handle on issues such as overspending and fraud.

And more than that, it helps your employees by letting them know their spending limits, which receipts the company needs to reimburse spending, and how quickly they will be reimbursed for any out-of-pocket expenses.

While it may seem like a lot of extra work for an already overworked small business owner, using some or all of these best practices can save you considerable time and money in the long term.

• Create an expense management policy

• Require accountability

• Build in the approval process

• Consider using credit cards

• Specify required documentation

• List preferred vendors

• Spend time analyzing expenses

• Create a reimbursement policy

• Use expense management software

1. Create an expense management policy

The best way to manage expenses properly is with an expense management policy. That policy should include specific guidelines regarding the following.

• Allowable expenses: Be crystal clear about what expenses are allowable. If you establish limits, provide details. For example, if you set a $50 limit for dinner, specify that in your policy.

• Disallowed expenses: For example, if your policy is to not pay for alcoholic beverages, state that in your policy. Being specific about what is not allowed is just as important as specifying what is allowed, and it will help you and your employees avoid unnecessary expenses.

• Process: Do you have a process for submitting expense reports? It’s important to provide step-by-step instructions for employees to follow when submitting expenses. It’s impossible to hold employees accountable if you don’t provide them with the proper instructions.

• Per diems: If you would rather use per diems when setting expense limits, consider geographic location. For example, if you set hotel per diems for business travel, the per diem should be higher in New York City or San Francisco than Milwaukee or Kansas City.

• Submission deadlines: Whether your employees submit complete reports or individual expenses, give them a submission deadline. Outline consequences for late submissions, and indicate if you have a grace period.

• Simplicity: Employees typically respect and adhere to established guidelines. Problems usually stem from not understanding or knowing the policies. Spelling them out makes it easier for your employees to follow your policy and easier for you to process and approve business expenses.

2. Require accountability to prevent fraud

Expense report fraud is real. Establishing an expense management policy can reduce or eliminate unauthorized expenses, but never assume fraud can’t happen at your company. When reviewing expense reports, look for:

• Suspicious receipts, including any written on or altered receipts

• Duplicate submissions

• Repeated policy violations

• Inflated expenses

• Repeated reimbursements for small amounts

While these occurrences don’t necessarily indicate fraud, they merit further investigation.

3. Build in the approval process

Whether you have an automated system (see below) that automatically forwards expense reports or expenses to the appropriate party for approval, or they need to be forwarded by your employees, make sure they know exactly where they’re supposed to go. This ensures the appropriate party is looking at the expenses and approving them. This eliminates delays in processing both business expenses and reimbursements.

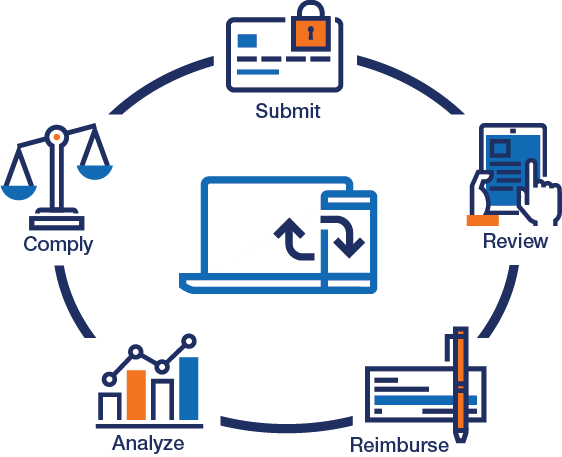

4. Automate the process

Besides using expense management software, the best way to automate the expense management process is with workflows. If an expense report requires two approvals, create a workflow that automatically sends the report to the appropriate parties. Follow it with a second workflow that sends the approved report to accounts payable for reimbursement. This eliminates delays and ensures the report is being routed to the right people.

5. Consider using corporate credit cards

You may feel like you’re relinquishing control by giving employees a corporate credit card, but in reality, it’s much easier to impose spending limits when employees use a company credit card. In many cases, you’ll reduce or even eliminate the need for employee reimbursements.

Many expense management software applications offer such cards, which carry no interest or other fees and allow you to implement expense controls for each card issued.

6. Specify required documentation

When setting expense policies, specify your documentation requirements. For instance, some businesses require documentation on expenses above $50, while others require a receipt or documentation for any expense, particularly those that are reimbursable. It’s okay to require documentation for all expenses, no matter how small, as long it’s documented in your policy.

7. Create a list of preferred vendors

While not useful for managing general expenses, listing preferred vendors for corporate expenses such as airlines, hotels, rental cars, and even restaurants can produce significant savings. It’s up to you to decide if employees can still use other vendors or if they need to choose from the list.

8. Spend time analyzing expenses

While it’s important to create policies that employees can follow, it’s equally important to devote time to expense analysis by reviewing expenses regularly. This includes examining your expense categories to see if expenses have remained consistent or if they’ve risen. It’s also helpful to review individual employee spending regularly to uncover any spending issues.

9. Create a reimbursement policy

Reimbursing expenses is an important part of the expense management process, and creating a reimbursement policy is critical. The policy may be part of your overall expense management policy, or you can maintain it separately. Be clear about what expenses are reimbursable and what expenses your employees are responsible for.

When creating a reimbursement policy, indicate whether an item that violates policy can be reimbursed. For example, if your policy has a maximum of $30 for lunch, and your employee turns in receipts for $40, is your policy to reimburse only $30 or the entire amount? Being specific will avoid issues later.

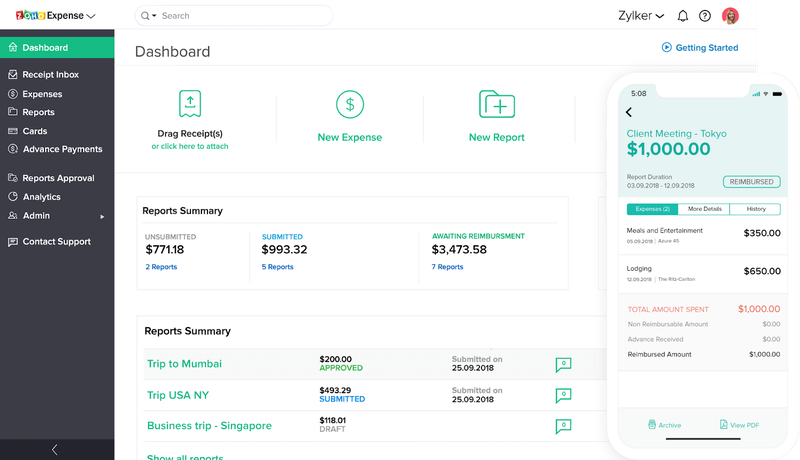

10. Use expense management software

The optimum way to pull these best practices together into one cohesive expense management policy is to use expense management software. This specialty software manages expenses, keeps employees on track, and helps you better manage business expenses. You can create extensive reports which can pinpoint problem areas that need to be addressed.

Start managing expenses properly

As a small business owner, managing employee expenses may not be a priority, but it should be. Missing receipts, fraudulent expenses, and inaccurate reporting can all contribute to runaway expenses, something small businesses may not recover from.

By creating an expense management policy, developing a transparent reimbursement policy, and using expense management software, you can get your employee spending under control and reduce expenses faster than you may have thought possible.

The post Expense Management Best Practices for Your Small Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint