If you work solo, chances are the only receipts you need to manage are your own. But once you hire employees, you’ll also need to start managing their expenses as well. The easiest way to do that is by having your employees submit expense reports. An expense report is designed to report on any business-related expenses an employee incurs, either by using a company credit card or by using their own funds.

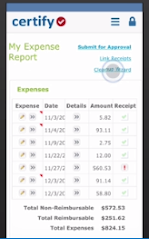

The easiest way to manage expenses and process expense reports is to use expense management software, which automates the entire process. These applications offer easy online expense report creation and submission.

They also help your employees follow established expense report policy by scanning receipts, matching receipts with expenses, automatically routing reports for approval, and then reimbursing employees for any approved out-of-pocket expenses.

However, if you’re not using expense management software, you can follow these steps to make sure that the expense reports you receive are submitted accurately and in a timely manner.

1. Have a policy in place

If you ever have to reimburse employees for out-of-pocket expenses, or your employees frequently travel for business, you have to have an expense management policy in place. An expense management policy covers everything from what is an allowable expense to how quickly your employees will be reimbursed for any business-related expenses they may incur.

An expense management policy also covers things like per-diem amounts for travel, as well as maximums for certain expenses. The policy should also include your receipt policy and the deadlines for submitting expenses.

Remember, it’s impossible to properly manage expenses if there is no policy in place.

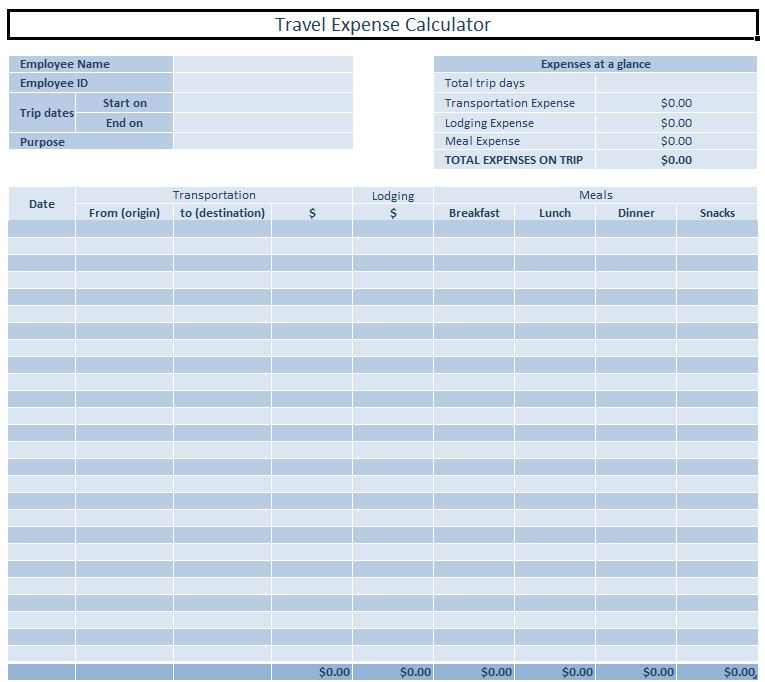

2. Create a template to record expenses

If you’re not using software to track expenses, you’ll need to create a template or log sheet that your employees can use to record expenses. You may want to create two templates — one for travel-related expenses and one for miscellaneous expenses.

While it’s up to you what you want to include on the business expense log, make sure that you have a space for everything you require.

3. Have a place for receipts

As unwieldy as they are, receipts are a necessity for properly documenting expenses. Having your employees take a copy of their receipts can help reduce the stack. If that’s not feasible, ask them to tape all relevant receipts to another piece of paper that should be included with their expense report.

Of course, having them snap a photo of a receipt and submit it using expense management software is the best way to handle receipts. That allows you to have a permanent record of the receipts without having to find a place to store them.

4. Double-check expenses

When receiving an expense report from your employees, be sure to give it more than a cursory glance. Mistakes happen, but they won’t be caught and addressed if you aren’t paying attention.

Checking expenses also gives you a much clearer picture of what your employees are spending money on when they travel, allowing you to decide if there is a clear return on investment or if travel is costing your business more than it’s worth.

5. Add up expenses and receipts

This is an easy but important step. The total of the expenses submitted should equal the total of the receipts submitted. If they don’t, you need to determine which receipts are missing and have your employee track them down.

This is particularly important if your employees are using a company credit card while traveling. Any expense on that card should have a corresponding receipt, or there should be a good reason why it’s missing.

6. Approve reports and process reimbursements promptly

Once a report is approved, be sure and promptly process any employee reimbursements. If it’s a small amount, it can probably be paid with their next paycheck or sent through accounts payable to be paid in the next week or so. But if an employee has spent a significant amount of money that needs to be reimbursed, consider using direct deposit or ACH to reimburse them for the funds expended.

An easy way to avoid numerous reimbursements is to provide a credit card or spending card to your employees. Spending cards can have limits set, allowing employees access to funds up to a certain amount. That can be great for unplanned expenses while eliminating potential overspending.

5 expense reporting best practices for your business

1. Automate the process

If you make the switch to expense management software, much of the above goes away. Completed reports would be automatically routed to the correct approver(s), receipts would be automatically matched with corresponding expenses, any policy violations would be flagged by the software, and the report or the expense would be returned to the submitter for correction.

Even with expense management software, you still have to review submitted reports and expenses, but it takes a fraction of the time compared to an expense report submitted the traditional way.

If you only have a few employees who seldom travel, you can likely get away with manual expense processing, but if your employees need to travel for business, or even need to regularly purchase items for work, expense management software is worth the investment.

2. Create a policy that’s easy to follow

Make it easy for yourself and your employees by creating an expense report policy that they can easily follow. Set some basic rules and some spending limits, and make a list of what’s reimbursable and what’s off-limits. A clear, simple policy is more likely to be followed by your employees and makes the approval process much easier for you.

3. Process reimbursements promptly

There’s no reason to make your employees wait for weeks to be reimbursed for out-of-pocket expenses. Create a reimbursement process that is simple for you and gets money back to your employees sooner rather than later.

4. Pay attention to the expenses you’re approving

Pay attention to the expenses that come across your desk. Even if they fall within your written policy, it’s important to note who is racking up the most expenses and what those expenses are for.

For example, is one department responsible for the majority of expenses? Does one employee in particular spend more money than your other four employees combined? Is one expense category bombarded with expenses regularly? Chances are that all of those expenses are justified, but you won’t know that if you don’t pay attention.

5. Enforce your policy

As important as it is to create an expense management policy, it’s equally important to enforce that policy. Rules are built into expense management software and violations are flagged immediately, but if your employees are submitting reports to you manually, it’s up to you to find any violations and flag them accordingly.

Expense reporting doesn’t have to be difficult

Using expense management software can make expense report preparation and approval easy. Even if you choose to forego an expense reporting system right now, creating an easy-to-follow expense management policy can make the entire process less confusing for your employees and less work for you.

The post How to Process Expense Reports for Your Small Business? appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint