Return on investment (ROI) is a financial ratio that calculates the level of income generated by a specific investment. Learn more about ROI, how to calculate it in your business, and why it’s so important to understand the results of your calculation.

Overview: What is return on investment (ROI)?

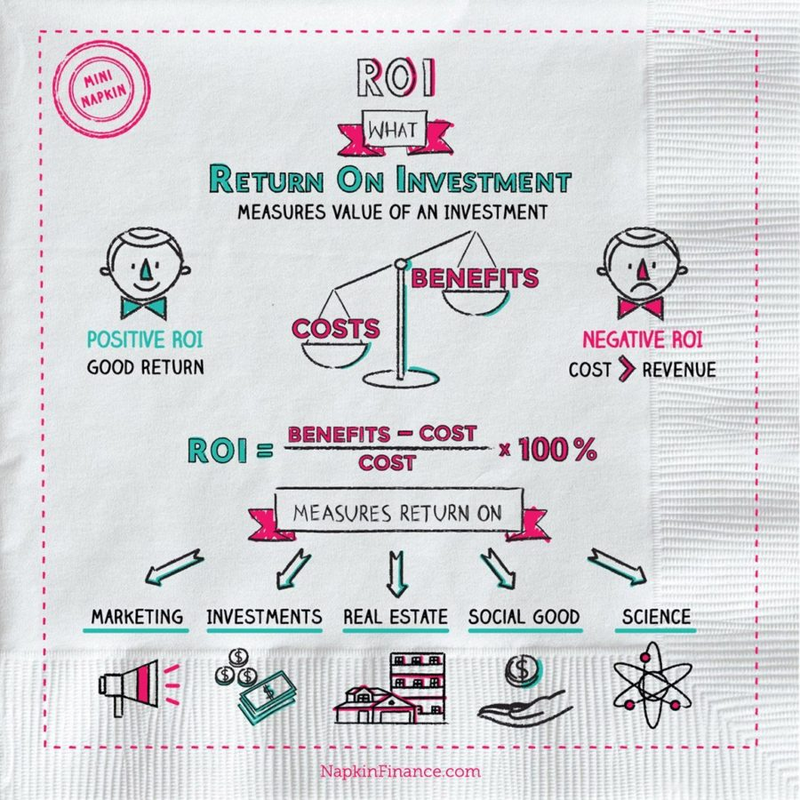

ROI is a financial ratio that uses net profit and the initial cost of the investment to determine how profitable your investment is. Return on investment can sometimes be confused with rate of return (ROR), but the two should not be used interchangeably, as calculating rate of return includes a specific period, while return on investment does not, considering only the initial investment and the amount earned.

To calculate ROI, you’ll need information such as the initial investment amount and access to an income statement or other documentation that provides the total amount received from the investment.

For example, your friend Gina asks you to invest in her dog obedience training business. You know a lot of dogs that need obedience training and expect Gina’s business to succeed, so you give her $5,000.

However, Gina encounters many issues with her business, and at the end of the year, you receive only $2,500 from your $5,000 investment that Gina had promised to double. How do you calculate your ROI for the investment in Gina’s business?

Start by using the ROI formula, which is:

Returns ÷ Investment = ROI

To calculate your ROI for investing in Gina’s business, you would use the following calculation:

($2,500 – $5,000) ÷ $5,000 = -0.5 or -50%

This means that your initial return on investment in Gina’s company is a negative 50% since you lost $2,500 on your initial investment.

How to calculate return on investment (ROI) for your business

Calculating ROI can become a complicated process for large corporations. However, for small business owners, the process is simple.

For example, to calculate ROI for your initial business investment, you’ll need to know how much your initial investment was and current long-term debt totals, if any. You’ll also need to know what your after-tax income was for the year. All of this information is available from your accounting software application, from your spreadsheet, or your accounting journals.

Let’s say your long-term debt is $15,000 while your owner’s equity is $45,000. Together, they equal $60,000. Meanwhile, the total after-tax net income for your business in its first year of operation is $135,000. To calculate your return on investment for your first year, do the following calculation:

$135,000 ÷ $60,000 = 2.25 or 225% ROI

This is high. This will change from year to year, particularly as more long-term debt is added to the business or you invest more money into it.

An example of the return on investment (ROI)

To reach more customers, you invest $20,000 in a marketing campaign aimed at attracting new customers. At the end of the year, you have a total revenue of $150,000, with $75,000 determined to result directly from the campaign.

($75,000 – $20,000) ÷ $20,000 = 2.75 or 275%

This means you have an ROI of 275% for your marketing campaign.

How should you interpret your return on investment (ROI)?

ROI analysis is important, and luckily, interpreting your ROI is fairly straightforward. The higher the ROI, the more efficiently you’re using your investment to generate revenue. In the example above, we calculated ROI for the first year of business and the initial investment. Continuing to calculate ROI regularly will provide you with a much clearer picture of how your investments are performing.

Because ROI can vary widely depending on the investment type and the industry you’re in, there is no average ROI to compare your results to. Instead, compare your results to other small businesses in their first year of operations to see how your ROI compares. If you do calculate a comparison, be sure to compare your business performance against that of a similar business to get the most value from the ROI results.

3 advantages of using ROI

Calculating ROI for your business offers many advantages. Let’s look at a few.

1. Easy to calculate

Learning how to calculate return on investment is easy, with just a couple of business metrics such as net profit and investment amount needed, giving you quick insight into your initial investment.

2. Results are easy to understand

The results of your ROI are simple to interpret. A positive number means you have a positive return whereas a negative number means you’ve lost money on this investment. ROI is easily understood, even by non-accountants, making the calculation results a valuable metric to use when approaching investors or loan officers.

3. Offers flexibility

ROI can be calculated for a variety of investments, or it can be calculated for your business as a whole. This allows you to see areas of your business that have benefited from a specific investment, such as an advertising campaign that increased revenue or a second location that increased sales volume.

3 disadvantages of using ROI

Although calculating ROI offers many advantages, take into consideration a few of its disadvantages.

1. Doesn’t answer all the questions

What is a good return on investment? Is it 10%, 25%, 100%, or even more? It depends on the initial investment, what kind of return you’re expecting, and how similar businesses in your industry are performing. If you use ROI to give you information on how an investment is performing, great. But don’t expect it to tell you everything you need to know about your business or even that investment.

2. Time is irrelevant

When comparing the ROI for two investments your business has made, look behind the scenes at additional information not considered when calculating ROI. One consideration is time.

For example, you have two investments that both have a 25% ROI. One investment was a one-year marketing campaign, while the other was a two-year investment in upgraded equipment. That can make a major difference when analyzing ROI results since the marketing campaign yielded a 25% ROI after one year, while the equipment upgrade produced a 25% ROI after two years.

3. Lack of accuracy

It’s difficult to calculate the ROI on a social media campaign when you’re not able to tie results directly to the campaign. The same goes for businesses that start a blog or create a new website. While these tasks can pay dividends for a business, it may be hard to directly tie them to an increased ROI.

Why is ROI important for your business?

Any time you invest money, whether it’s in a new business, updated equipment, or a targeted marketing campaign, you want to see how well that investment has performed.

Calculating ROI allows you to do just that. Not only does ROI give you information on your investments, but it can also guide you in deciding about other business investments.

While it’s important to consider additional information when calculating ROI, such as the time factor and how your ROI stacks up against other similar businesses, ROI can immediately show you how your investment has performed.

The post Return on Investment (ROI) and What It Means For Your Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint