Some investors see recent volatility as a way to get rich quick. Trying to outsmart the market can end very badly.

Last week, 20-year-old trader Alexander Kearns using the Robinhood platform committed suicide after a series of risky options trades left him deep in the red. In the note to his family, he said he had “no clue” what he was doing.

“Financial access without knowledge can destroy lives and, as seen here in its most extreme form, can tragically end them,” said Douglas Boneparth, a certified financial planner and president of Bone Fide Wealth.

Still, the number of young investors trying their hand at trading through Robinhood — and other major on line brokers — has spiked during the Covid-19 market sell-off and rebound. A spokesperson for Robinhood said they “are deeply saddened to hear this terrible news and we reached out to share our condolences with the family,” in an earlier statement to CNBC.

Options trading, bankrupt companies

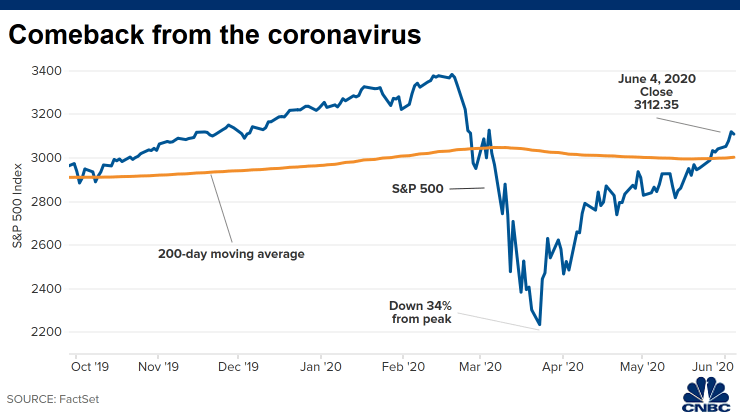

Considered a “generational-buying moment,” young and inexperienced investors view the coronavirus-sparked recession as an entry point into the world of investing. Investor newbies are even piling into the beaten down airlines and cruise lines, as well as speculative stocks like Hertz.

The recent tragedy underscores the risk that comes with complicated financial instruments like options trading, which gives a trader the right — but not the obligation — to buy or sell an asset at a specific price, on or before a certain date. Traders use it to hedge risk, or speculate.

“These are extraordinary complex securities and trading strategies and yet they are readily available to anyone who chooses to open up an account, it’s as if we are handing out firearms to children,” said Ric Edelman, the chairman and CEO of Edelman Financial Services.

As with commodities and other futures investments, “you not only have to be right, you have to be right at the right time,” Edelman said.

Commission-free trading coupled with a lack of sports betting and other forms of gambling have all helped drive interest in such speculation by retail investors, who are favoring riskier plays in smaller dollar amounts.

That is also what has propelled trading in the stocks of bankrupt companies like Hertz. In that case, shares of the car rental company rallied even after the company announced it had suspended its plan to sell up to $500 million in stock amid Chapter 11 bankruptcy proceedings.

“The problem with Hertz, specifically, is that the economic value of the shares is zero,” said Michael Crook, head of Americas investment strategy at UBS Global Wealth Management.

“There’s a very high probability that someone purchasing shares would lose all of their money.”

“The overall theme here is mistaking hoopla for investing,” Boneparth said.

A better solution is to stay focused on an investment plan rather stock picking, he advised.

Stick with a diversified mix of stocks and stock funds to protect against losses and limit the downfall from some high-risk investments, he said. “There’s no single asset category that is going to solve all of your problems.”

Further, keep your long-term goals in mind. “If you are saving for a home, are you really going to take all, or a big portion, of your home savings and throw it into an investment that could be cut in half?” Boneparth asked.

If there are specific shares you want to own, set aside a portion of your portfolio for those positions, Boneparth said, and research the financial health and well-being of those companies as well as the executive team and future outlook.

“I have plenty of clients that manage a small portfolio of stocks on their own,” Boneparth said.

“If with 5% to 10% of your investable assets, you went out and bought 10 companies, it won’t be all that bad if you get a couple wrong and couple right,” he said. For instance, “if you were wrong about Hertz and right about Tesla.”

“If you want to own Hertz, make it half a percent of your net worth, for example,” added Crook. “If it’s right, and you make 10,000%, you don’t need a large position.”

REITs, commodities

The same goes for keeping small positions in other tricky investment plays, including oil futures contracts and real estate investment trusts, or REITS, Crook said.

“Almost anything can fit into a portfolio at the right allocation,” he said.

Those who are very near retirement or who have short-term goals should still keep a chunk of their savings in cash, certificates of deposit and high-quality short-term bond funds to further shore up their financial profile.

And finally, consider talking to a financial advisor who can work with you as you review your goals, reassess your risk and come up with an investment strategy that pays.

The post Don’t let the recession tempt you into these risky investments appeared first on CNBC news and is written by Jessica Dickler

Original source: CNBC news