Whether you run an online marketplace, a brick-and-mortar store, or both, your top priority is pleasing customers and making sales. Without a seamless checkout experience, you’ll likely push customers away or, at the very least, slow business down.

We’ll go through what a payment gateway is, how it serves your business, what to look for when choosing a solution, and five of the best payment gateways for secure transactions.

Overview: What is a payment gateway?

Payment gateways allow businesses to collect online payments. They securely transfer money from your customers’ accounts to your payment portal. Your payment gateway ensures secure transactions by encrypting data, such as card and bank details, that your customers have provided.

Payment gateways are also used in physical stores in conjunction with point-of-sale (POS) systems, POS terminals, and other POS hardware.

Payment gateway vs. payment processor: What’s the difference?

Payment gateways and payment processors are both necessary for online transactions. While payment processors execute payment transactions, payment gateways approve or decline transactions made between your online business and your customers.

In short, payment gateways are virtual POS software solutions for your e-commerce store, while payment processors act as an intermediary between your payment gateway and the merchant bank.

What to consider before choosing a payment gateway

Before you decide on your secure payment gateway of choice, you need to consider some key components. While it’s all too easy to choose the cheapest option available, this can lead to selecting a tool that’s not the right fit for your business.

Associated costs

There are multiple costs to bear in mind when selecting a payment gateway:

• Payment gateway setup fees

• Monthly gateway fees

• Gateway processing charges

• PCI compliance fees

Not all payment gateway providers charge for all of the above fees. For example, some merchant account providers include the setup fees if you get your gateway through them. Take into account the size of your business and customer base before choosing your payment gateway.

User experience

There’s nothing more off-putting to customers than a frustrating checkout experience. The right payment gateway will provide a good experience as well as secure payment options, meaning your customers are more likely to make repeat purchases.

Always ask vendors for a demo or walkthrough of how their payment gateway works before you make a definitive choice.

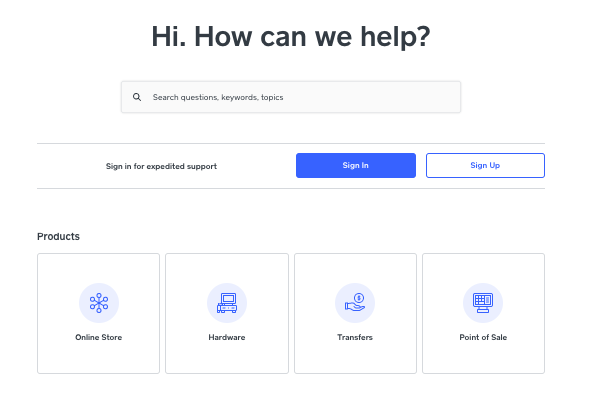

Customer support

Look closely at each payment gateway’s customer support options. Are there multiple customer service routes available (phone, email, support ticket, knowledge base)? Is customer phone support offered on a 24/7 basis? Consider your business model and customers and work out exactly what kind of customer service options you require.

Payment gateway setups

The payment gateway you choose will largely depend on whether you’ve already selected a merchant account and, if so, the options that are compatible with it.

Generally, there are three payment gateway setup options:

• Selecting a merchant account provider that offers its own proprietary payment gateway

• Using a payment service provider that comes with a built-in payment gateway

• Choosing a merchant account provider that doesn’t come with a payment gateway and choosing a standalone gateway

The top 5 payment gateways for secure transactions

While most payment gateways offer similar core features, they offer different pricing structures, contracts, and customer support options.

Let’s take a look at five of the best payment gateways we’ve identified.

1. PayPal

PayPal is one of the most well-known and trusted payment platforms in the business. PayPal offers its Payflow payment gateway to process payments, which is automatically included in its online processing tools. It’s also offered as a standalone payment gateway to businesses that already have a credit card processing provider.

To use Payflow, users don’t need to sign a contract. Plus, Payflow integrates with the major shopping carts and works with almost every payment processor.

If you sell to customers overseas, you can also accept payments in 25 different currencies. The payment gateway is also completely PCI-compliant.

However, Payflow locks in your customers’ payment information, meaning that if you choose to switch gateway providers, you can’t migrate your customer data over to the new gateway. This could be a concern if you operate a subscription-based business since you wouldn’t be able to bill your subscribers without re-requesting their details.

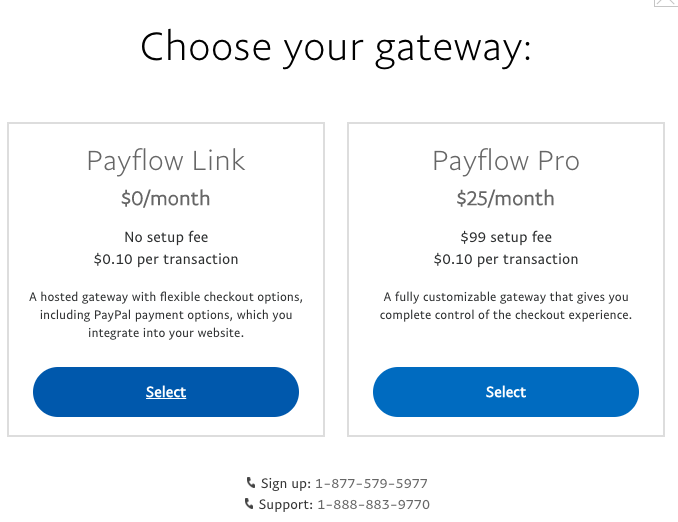

PayFlow is available under two pricing plans:

• Payflow Link: No gateway setup or monthly fees. Users are charged $0.10 per transaction. Users have access to a hosted gateway with flexible checkout options.

- Payflow Pro: Charges a $99 setup fee, a $25 monthly gateway fee, and a $0.10 per transaction fee. Users have access to a fully customizable payment gateway.

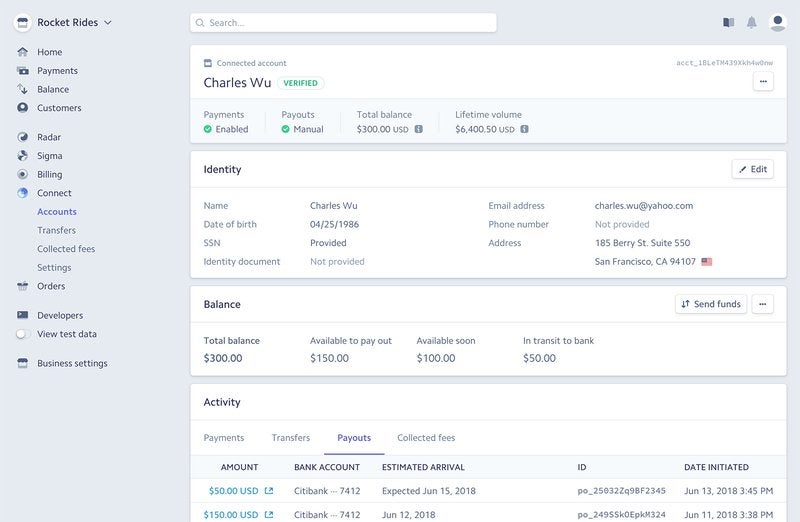

2. Stripe

Stripe offers its own payment gateway called Stripe Connect. The core Stripe product is aimed at businesses that have a developer, or a team of developers, and it’s a much more complex system than your average payment platform.

Stripe Connect is built into Stripe’s original payment platform. This means that there are no additional gateway setup fees, monthly gateway fees, or transaction processing fees.

Stripe’s credit card transactions costs are 2.9% + $0.30 per transaction.

Along with accepting all major credit cards and ACH payments, Stripe also accepts a large number of other payment methods, including:

• Apple Pay

• Google Pay

• Klarna

- Bacs Direct Debit

3. Square

Square is a free POS system and payment gateway. It also offers a free online store powered by Weebly that automatically connects to Square payments, but Square itself is not offered on a standalone payment gateway basis.

Square’s online transaction fees cost a flat rate of 2.9% + $0.30 per transaction, and it does not charge setup, monthly, or PCI-compliance fees.

However, Square does not accept ACH payments, and its customer support options could be improved. Currently, Square’s live customer service is only available from 6 a.m. to 6 p.m. PT, Monday through Friday. This is a big disadvantage for businesses if they run into problems during the weekend or outside of those hours.

4. Authorize.net

Authorize.net is a payment gateway that’s been around for some time — since 1996, in fact. It’s a reliable and popular solution that comes with few downsides. The one major flaw is that, like PayPal’s Payflow, Authorize.net also locks in your customers’ payment information, which will leave you unable to migrate your customer data to a new gateway if you choose to switch providers.

Authorize.net is not a merchant account provider; it’s purely a payment gateway provider. All major credit and debit cards, ACH payments, and most digital payment methods are accepted. Its Advanced Fraud Detection Suite also prevents your business from card-not-present fraud.

If you have a lot of international customers, Authorize.net is a great solution. The gateway accepts transactions from almost every country, provided your business is based in the U.S., the U.K., Canada, Europe, or Australia.

Authorize.net is a well-rounded solution, bringing with it plenty of gateway experience. However, it sits on the costlier side of payment gateways.

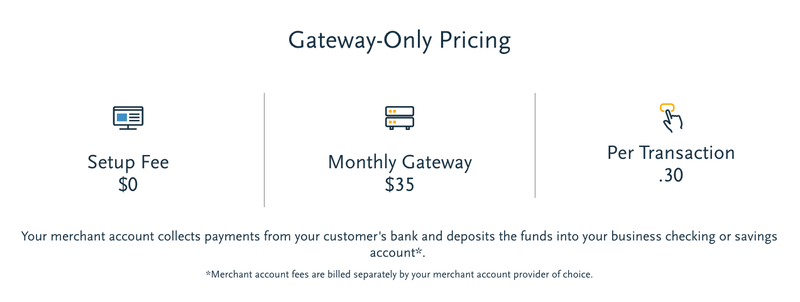

Here’s a quick rundown of fees:

• When signing up directly with Authorize.net, users are charged a $49 setup fee and a $25 monthly gateway fee.

• If you’re already using a merchant account, you’ll pay an extra $0.10 per transaction (Authorize.net can set you up with a third-party merchant account).

• Gateway-only pricing costs $35/month and $0.30 per transaction.

5. Braintree

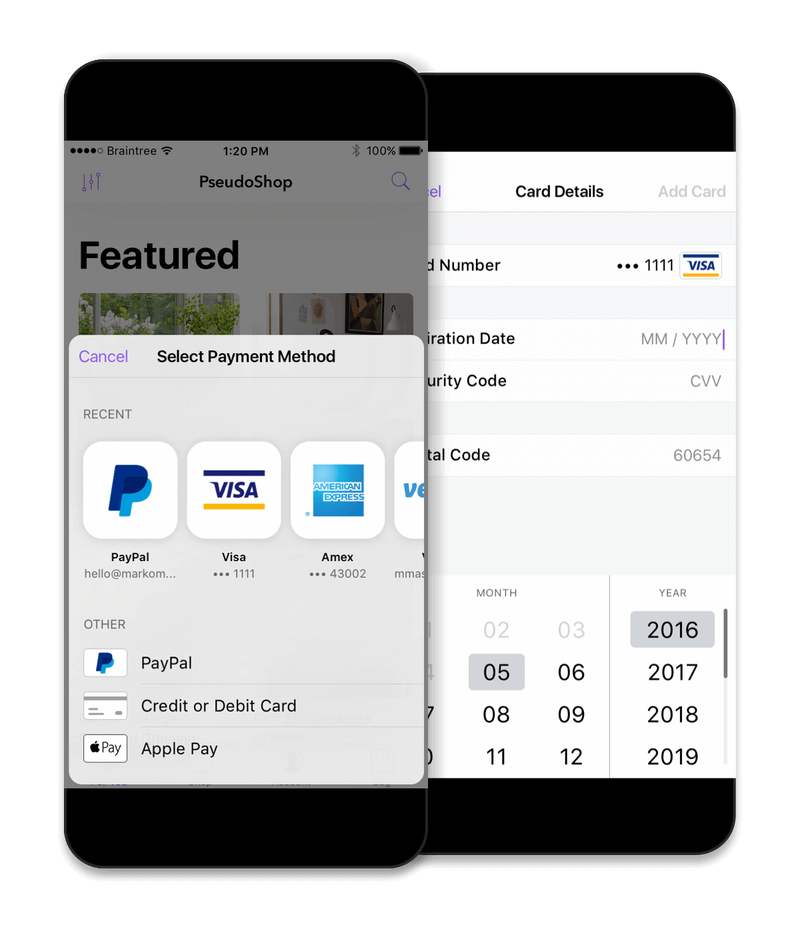

Braintree is a payment gateway that specializes in the e-commerce industry. When you sign up for a Braintree account, you receive both a payment gateway and a merchant account. The solution was acquired by PayPal back in 2013, putting it in very good company.

Like other payment gateways, Braintree accepts all major credit cards, multiple digital payment methods, and ACH payments. It also supports recurring billing for subscription-based businesses.

The only fees Braintree charges are its per-transaction fees, which are 2.9% + $0.30 per transaction. Other than that, it doesn’t charge setup, monthly, PCI-compliance, or gateway fees. You also won’t be locked into a contract.

Braintree also offers a sandbox account to allow potential users the chance to explore the product before applying for a merchant account.

Delight online customers at checkout

There are a lot of payment gateway options available to businesses these days, which makes it all the more important to do your research before diving into the deep end. Consider your business model, whether you only sell online or also in a physical store, and whether the gateway can support all of the operations you need it to.

Product demos are a business’s best friend, and it’s even better if you can access a sandbox account to experience the product for yourself before putting your money on the table.

The post The 5 Best Payment Gateways for Secure Transactions appeared first on The blueprint and is written by Rhiân Davies

Original source: The blueprint