Business owners are often on the lookout for investors. From small and agile startups to more mature cash cows, most businesses can take advantage of new money from smart investors.

The most popular sources of investment funds are from private equity and venture capital firms. Let’s take a look at the two fund types and how they differ.

What is private equity?

Private equity (PE) is the finance term for a large variety of investment pools that invest in private companies. The funds take an equity stake, usually at least 50%, in a private business. Sometimes, private equity investing will involve purchasing a large stake in a public company and taking it private so it no longer trades on the stock market.

How does private equity work?

Private equity funds are generally structured with a limited partnership agreement. The general partner is the PE firm, and the limited partners are the investors. The funds search for private businesses, often struggling ones, to sink investment capital into.

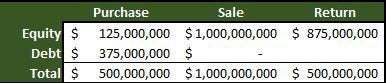

PE funds can produce massive returns through leverage. Often, PE funds will use a leveraged buyout, where the fund purchases 100% of a business while putting in only 25% of that money as equity. Let’s take a look at how that process works in the below table.

The fund puts 25% down on a $500 million leveraged buyout. While the private investors own the company, usually for 5-10 years, the business cash flows make the debt payments. This example is admittedly showing a perfect situation. The business can pay off the $375 million in debt completely, and its sale price is double the purchase price. So on an initial investment of $125 million, the fund returns $875 million to its limited partners.

PE funds typically target one of two types of businesses: either an undervalued, mature business that throws off a lot of cash to make debt payments or a struggling business that the fund can hire consultants to quickly turn around.

What is venture capital?

Venture capital (VC) is a subset of private equity. Venture capital funds take stakes in fast-growing startup businesses, planning to exit the investment in either an initial public offering (IPO) or merger at a price many multiples of their investment.

How does venture capital work?

Start-ups will select a lead investor, typically a fund specialized in the industry or a person with experience founding businesses in their area. They typically raise capital in multiple rounds as they hit various benchmarks.

The lead investor negotiates term sheets with the business for each round of investment and often recruits other investors.

A subset of venture capital (would that make it a sub subset of private equity?) is corporate venture capital where a large corporation participates in venture capital to further its own growth.

Private equity vs. venture capital: What’s the difference?

The world of private equity and venture capital is wide and for each difference, you could probably find a fund in either classification that goes against the grain. We’ll be talking about the generalities of how these funds work.

1. Business stage

The key difference is the stage in the business lifecycle that the funds target. VCs look for fast-growing startups with plenty of room to run. PEs looks for more mature businesses that are either struggling or have plenty of cash flow to make massive debt payments.

2. Investment

VCs will look to get as much of the business as they can, but good founders are dead set against giving up equity. You’ll rarely see a VC investment in more than 50% of the business.

PE funds will make investments that take a stake in the business, but their goal is usually to take over the entire company. This is so they can control their involvement in the business.

3. Involvement

While VC funds will angle to get someone on the board and hook the founders up with some rad mentors, PE funds often get far more involved in the business. They will appoint their own executives, manage the capital structure however they see fit, and bring consultants in, either from outside the business or in-house professionals who work for the PE firm.

Many private equity funds take a more passive stance on interacting with the business. But the traditional picture you get of PE funds is that they are the natural evolution of 1980’s style corporate raiders, buying a company, cleaning all the rot out, and then selling it for a profit.

4. Business size

This difference varies the most. I had a meeting with a local PE fund in college that doesn’t do investments over $1 million; meanwhile, some VCs can pull off investments in unicorns (private companies valued at over $1 billion).

Generally, PE funds you see on the news are trying to leverage their way to buying large-cap companies, while the VCs are investing in companies that may not even have revenue yet.

5. Investment source

VCs will almost always directly invest the cash of the limited partners. PE funds also invest their own cash, but they will often strengthen that position with bonds, bank debt, or even stock options and warrants.

Bonus section: Permanent capital

The newest fund type to enter the fray doesn’t fit neatly into either of the two classifications we’ve discussed so far. Many investors have become frustrated with private equity funds that buy companies just to load them up with debt, lay off a ton of employees, and distribute all excess cash, putting the business at risk .

This new solution is to raise a private equity-like fund that doesn’t focus on exits. Permanent capital funds have fund terms of twenty or more years. This locks up investor capital for long enough that the fund can focus on finding high quality businesses that will continue to produce plenty of cash flow to reinvest in other businesses or return to investors.

PE or VC? Depends on your POV

If you’re looking for investors in your business, this article should help you figure out where to get started. If your business has been steadily growing for a while, and you want to be totally out of the picture, look at PE funds. If you don’t want to be out of the picture, but do want a payout, research permanent capital. And if you run a super exciting startup, VC is the way to go.

The post Private Equity vs. Venture Capital: Which Should Your Business Target? appeared first on The blueprint and is written by Mike Price

Original source: The blueprint