The Annual Percentage Rate (APR) is a measure of how much it will cost you to borrow money. APR is used for credit cards and loans of all kinds, and it combines the interest you will pay throughout the year plus any fees, expressed as a percentage of your principal loan amount. APRs are useful when it comes to comparing offers from different lenders.

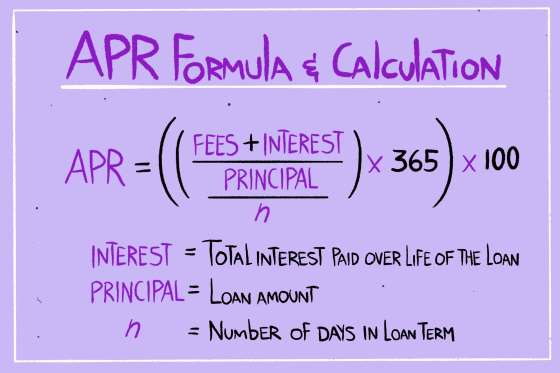

The annual percentage rate or APR is a standardized measure of how much interest you will pay throughout the year (365 days) for the principal loan amount you’ve borrowed. This total also encompasses any applicable loan fees. In short, the APR is the full price you pay to borrow money.

“APR, at least with closed-end loans like mortgages, student loans, and personal loans, is designed to help you understand the impact of fees on your cost environment,” explains Matt Carter, a personal finance expert with Credible, an online loan marketplace.

Many factors affect the APR you’re likely to get. A big one is your credit score. Consumers with the best credit will have the lowest interest rates. Your credit score gives lenders an idea of how likely you are to make your payments on time, so they will be more comfortable charging less interest and fewer fees to a customer with a very good or exceptional score.

This is why it’s so important to monitor your credit report, especially when you’re planning to borrow money. Knowing where you stand can help you determine if a lender is overcharging you or offering you a good deal. You should also keep in mind that the APRs advertised by banks are usually the ones you would qualify for if you had a Very Good (740+) credit score. The best way to compare APRs is to review offers from several lenders.

Another factor that impacts the APR a lender will offer you is the loan term. Say you’re thinking about taking out a mortgage. On a 30 year loan, there is a greater chance that interest rates will rise, making the loan less valuable to the bank. there is also a greater chance you will default (all other things being equal).

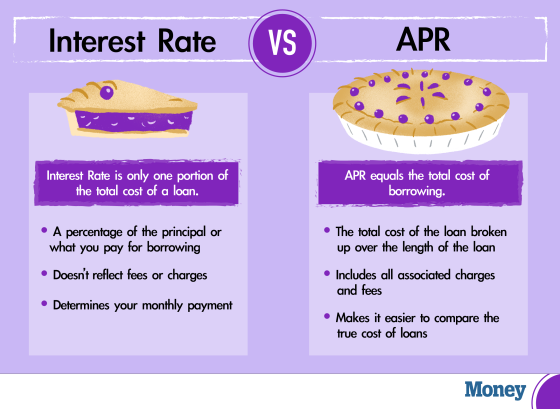

One important thing to note is that, while the terms “APR” and “interest rate” are often used interchangeably, they are not the same thing. As we mentioned earlier, the annual percentage rate includes the interest rate and the fees you have to pay the bank to borrow the money. So, all APRs include the interest rate, but not all interest rates are APRs.

APRs for Mortgages and Other Loans

When you take out a loan —whether it’s an auto loan, a personal loan, or a mortgage— you are responsible for paying several fees to the bank. Some of these fees you pay upfront when you take out the loan; others are included in your APR and you pay them over the years along with interest.

Some fees that may be included in the calculation of your loan’s APR are:

- Origination fees. The cost charged by the bank for processing your loan application. They may also include underwriting and administration fees and are detailed in your loan estimate as part of your closing costs.

- “Discount points.” These are not part of the origination fees but deserve a special mention. When an origination fee equals 1% of the loan amount, that’s 1 “point.” On a $100,000 mortgage, 1 point would equal $1,000. Some banks will offer to reduce your APR by a certain percentage if you pay points in advance instead of absorbing the cost into your APR.

- Mortgage broker fees. If you hired the services of a mortgage broker, your APR may include their fees. Broker fees are usually 1% to 2% of your loan amount, and you can choose to pay this cost upfront instead of including it in your APR

- Private mortgage insurance (PMI). You will be required to pay insurance if you have a conventional mortgage and made a down payment of less than 20%. This cost may also be reflected in your APR.

When it comes to mortgages, Carter says that only comparing APRs between loan offers may not paint the whole financial picture, as the average homeowner will sell their home after eight years and the APR spreads the total cost of borrowing over the entire length of the loan. If you plan to sell within five years, for example, review the loan closing costs and calculate how much it will cost you over those first five years.

“With mortgages, the loan with the lowest APR is not always the best deal. If you pay a lender thousands of dollars in ‘points’ in return for a lower interest rate, you may not reap the benefits of that lower rate until you’ve made many years of payments. A loan with lower fees but a higher interest rate might have a higher APR, but a lower five-year cost of borrowing.”

Credit Card APR

If you look at your credit card terms, you’ll see a table — called a Schumer box — listing all the APRs and fees associated with your card. The typical credit card user won’t come across most of them, but it’s still a good idea to become familiar with them so you know what to expect if and when they apply to you. Some of the different APRs you may see are:

- Purchase APR. The interest rate applied to the charges you put on your card. It doesn’t include any fees, as fees aren’t usually charged when you make purchases with your credit card. It can be fixed or variable, meaning it changes depending on the federal prime interest rate.

- Introductory APR. A promotional purchase APR offered temporarily. The introductory period usually lasts between six and 18 months, after which you’ll be subject to the regular purchase APR.

- Cash Advance APR. Applied to any money you withdraw as cash from your credit line. It’s usually higher than the purchase APR and is also subject to additional fees that will be added to your bill total.

- Balance Transfer APR. Applied to the balance you move from one credit card to another. It also tends to be higher than the purchase APR, though some cards offer a lower introductory balance transfer APR that can be as low as 0% for an initial period. You may also be subject to an additional fee.

- Penalty APR. Applied to your balance if you fail to make a timely payment, if a payment bounces, or if you exceed your credit limit. According to the CARD Act of 2009, the rate for your existing balance must go down if you pay your bill on time for at least 6 months, but the credit card company could apply a higher rate to any new charges.

For Howard Dvorkin, CPA and chairman of Debt.com, the best way to avoid all these credit card APRs is simple: “Don’t run a balance.”

“I’m being straight up,” says Dvorkin. “The only person you’re hurting is yourself by running a balance, and the only people you’re enriching are at the bank.”

If not running a balance isn’t a possibility for you or if you’re already in credit card debt, there are ways to improve your situation. “Try transferring your debt… to a credit card that has a deal where you can transfer the balance [for a low APR]… and always try to triple the minimum payments.”

Your APR by the Numbers:

Let’s compare two mortgage offers for a house valued at $160,000. We’re including the five-year cost of borrowing as an example for those who plan to sell their home before the end of their term. According to the Consumer Financial Protection Bureau, the majority of borrowers keep a mortgage for an average of five years before refinancing or selling.

The five-year cost of borrowing can be calculated by subtracting the principal loan amount from the total (including fees and other costs) you’d pay over the first five years of the mortgage.

Mortgage Loan Offer 1

Home Price: $

160,000Term:

30-year fixedAPR:

3.1%Monthly payment:

$683.23Total paid at the end of the term:

$245,960.53Five-year cost of borrowing: $23,132.93

Mortgage Loan Offer 2

Term:

15-year fixedAPR:

2.8%Monthly payment:

$1,089.6Total paid at the end of the term:

$196,128.84Five-year cost of borrowing: $19,036.02

Say you go with mortgage 2 since it’s the best deal overall. If your credit score isn’t high enough to get you the 2.8% APR, you might have to settle for a 3.5% APR. In that case, you will have paid a total of $205,886.24 at the end of 15 years, with a five-year cost of borrowing of $23,958.91. Following this example, the first mortgage offer would be a better deal if you were planning to sell within five years.

Now, let’s compare two credit cards with a balance of $10,000.

Credit Card 1

APR:

14%Monthly payment:

$450Time to pay off balance:

43 months or 3 ½ yearsTotal interest paid: $4,106

Credit Card 2

APR:

25%Monthly payment:

$450Time to pay off balance:

58 months or just under 5 yearsTotal interest paid: $10,876

As you can see, a higher credit card APR adds up, especially if it takes you longer to pay off the card completely.

The post What is an APR? appeared first on Money and is written by Mayra Paris

Original source: Money