When we go into business, we expect to earn a profit. The key is to properly plan for how that profit will be earned. That’s where cost control comes in. Learn more about what cost control is, how it differs from cost management, and what measures you can take to better control costs and increase profits for your business.

Overview: What is cost control?

We all have baseline expenses that we’re responsible for controlling. Imagine trying to pay your rent or your mortgage if you didn’t plan for that monthly expense. The same theory applies to the business world. Cost control measures are designed to establish a baseline measurement that can be used to measure actual expenses against planned expenses.

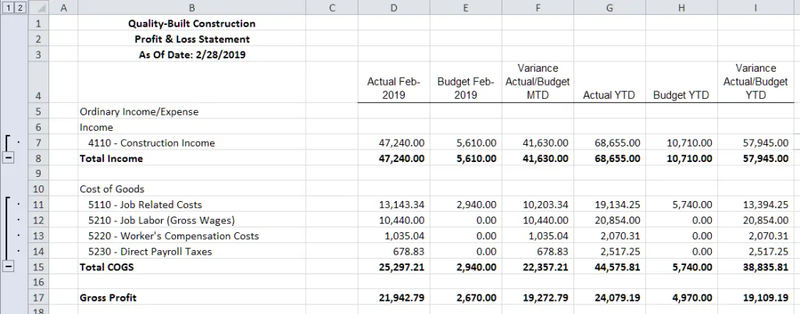

In business, when we budget expenses for product production, we estimate how much it will cost to produce and deliver that item to our customers. We then measure our actual costs against our budget to determine how close we are to the baseline and make adjustments accordingly.

When looking at these budget variances, we can see exactly where our estimates were accurate and where they’re off. It then becomes our job to look at these cost differences and figure out what cost control measures need to be put into place.

For example, let’s say you budgeted a profit of $4 for each product sold, but because your supplier expenses ran over budget due to an unexpected price increase, you only earned a $2 profit on each product sold.

Because you were able to pinpoint what caused your profit reduction, you can work on addressing the issue by changing suppliers, raising prices, or reducing other costs involved with production so you can get back to your original goal.

The easiest way to create a budget that can be tied back to your expenses is by using your accounting software application. If your software does not offer budgeting capability, you can use a spreadsheet application to create your budget, although updates will need to be entered manually. Either way, a budget is a necessity to better track and control expenses.

Cost management vs. cost control: What’s the difference?

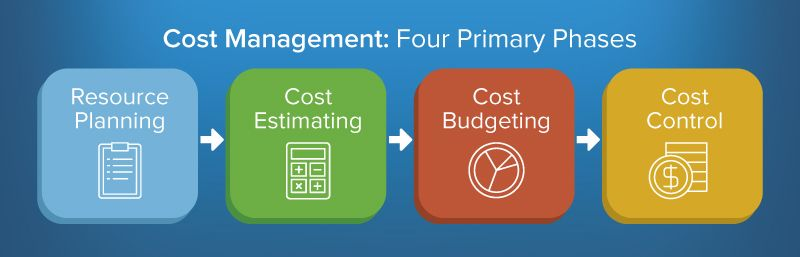

Cost management and cost control are often used interchangeably, even though they’re two different things. Cost management deals with planning and budgeting, while cost control deals with actual costs and the actions taken as a result of those costs.

For example, when creating a budget for the following year, you use cost management to prepare it. You start with the planning process, which includes products or services you want to offer and how you will be delivering them to your customers. The planning stage should also include initial financial projections, which will later be used in your budget.

Next, you’ll need to estimate the related costs of those processes and use those numbers to create a budget, or a baseline to measure against.

That’s where cost control comes in. Cost control measures actual expenses against estimated, or budgeted, expenses as a means to proactively address variances. Cost control is everything from addressing your budget variances directly to instituting corrective actions that will enable you to reduce unexpected costs.

But you’re not done yet. Even if corrective measures are taken, you’ll still need to track future expenditures to remain confident that the measures being implemented are effective.

5 ways to effectively cut and control costs in your small business

An effective cost control system starts with accurate budgeting, including a way to measure budget variances in real time. For example, if you’re managing a project, you’ll want to proactively measure your variances throughout the budget and quickly address variances such as overages to keep the project running smoothly.

This is also true when measuring company-wide variances. For example, if your manufacturing and production costs are way up, you don’t want to wait until the end of the year to address the issues behind the rise in production costs. That’s why examining your budget variances monthly can help ward off catastrophe by allowing you to make changes quickly.

Check out these other things you can do to help control costs in your business.

1. Drill down behind the numbers

When you run your financial statements at the end of the month, you notice that your net profit is much lower than expected. But to address the reason behind the unexpected dip in profits, you’ll need to know why they’re down.

Are your fixed costs higher than your original financial forecast? Did your supplier increase their pricing? Did you have to pay employees overtime to get products out on time? All of these can affect your profit, but you won’t be able to rectify the problem if you don’t know what caused it.

For example, if your costs increased due to a change in supplier pricing, you’ll need to address that issue with corrective measures, which may include negotiating a reduced rate or even changing suppliers. By pinpointing the issue, you regain more control over your costs and can begin working toward your goal of increasing profits.

2. Prepare budgets properly

The best way to implement both cost management and cost control procedures is to create a budget. Take the time to create a budget that isn’t just a rough estimate but uses historical figures as a basis. If that process doesn’t work for you, consider using a zero-based budget, which allows you to start from scratch, justifying each operating expense before placing it in your budget.

But creating a budget isn’t enough. You also need to regularly monitor that budget to stay on top of variances as they occur, not several months afterward when corrective action is no longer a viable option.

3. Manage your projects better

You’re about to host your first event of the year. What better way to make sure that projected costs stay on target than to manage various components of the event? While it can be useful to review costs after the event is over to see what went right and what didn’t, isn’t it better to monitor your project expenses in real time and take corrective action before your project exceeds its budget by thousands of dollars?

4. Keep an eye on your inventory

Your inventory levels can play a large part in whether profits are up, down, or stagnant. If you sell products, you need to learn to walk a fine line between having enough inventory in stock to fulfill orders on a timely basis and having excess inventory, which drives up costs and can end up as waste.

This is particularly important if your inventory has an expiration date. Manage your inventory properly and your costs will likely be reduced as well.

5. Reduce repairs

Better expense control often means being proactive rather than reactive. For example, using old or faulty equipment in your office or your production line can be disastrous, with an unexpected computer crash or faulty machinery costing you both time and money.

While you’ll spend money making sure your office and factory equipment is up to date, you’ll also eliminate the costly surprises that can pop up and wreak havoc with your budget and your costs.

Cost control is a necessity for a successful business

We all like to think that our business will make a profit. But there are things you can do to make that thought a reality, starting with implementing both cost management and cost control measures.

Keeping your costs under control starts with creating a budget that is used as an active tool and not just glanced at occasionally. Knowing your variances monthly can help you mitigate a crisis before it starts, allowing you to implement corrective measures — whether that’s looking for a new supplier, eliminating employee overtime, or adjusting production levels.

Controlling costs by implementing cost control measures puts you in charge of your business and its profits.

The post Why Cost Control Is Important for Your Small Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint