Assets are anything of value that your business owns. Assets are always found on your balance sheet and should be categorized by type. Everything from your computer to your inventory is considered an asset and should be recorded as such.

The easiest, most accurate way to manage and record your assets is by using accounting software, but even if you’re using a manual accounting system, assets will still need to be managed properly.

Overview: What are assets?

In accounting, assets are things that your business owns. Assets can be tangible, such as your office furniture or company vehicle, or they can be intangible, such as patents, copyrights, and trademarks.

Assets can also be current or fixed. Cash accounts and accounts receivable balances are considered current assets, while a building would be considered a fixed asset. Although there are many different types of assets, the asset definition remains the same.

Assets can be classified in three different ways:

Convertibility:

Physical properties:

Operating and non-operating assets:

Let’s explore the various types of assets your company will need to record.

6 types of assets

Depending on how detailed your balance sheet is, there are up to six different types of assets for you to record. When recording an asset, you must categorize it properly. For example, you don’t want to record your accounts receivable as a long-term asset since they’ll be paid within a year’s time.

1. Current assets

Current assets are classified by how convertible they are, or how easily the asset can be converted into cash. Current assets can include:

• Cash accounts

• Cash equivalent accounts

• Accounts receivable

• Inventory

Most assets that can be converted into cash in less than a year are considered current assets.

2. Fixed assets or non-current assets

Fixed assets, sometimes called non-current assets, are also classified by how easily they can be converted into cash. Fixed assets are usually big-ticket items that are held for more than one year and can include any of the following.

• Buildings

• Vehicles

• Land

• Machinery

• Equipment

• Patents

• Copyrights

Anytime you have an asset that cannot be quickly converted into cash, it should be considered a fixed asset.

3. Tangible assets

If you track assets by physical existence, you can classify them as either tangible or intangible assets, depending on their properties. Tangible assets can include any of the following:

• Cash

• Inventory

• Marketable securities

• Machinery equipment

Anything that you own that has a physical presence can be considered a tangible asset.

4. Intangible assets

Unlike a tangible asset that has a physical property that you can touch, intangible assets have no physical presence. Intangible assets can include the following.

• Goodwill

• Copyrights

• Trademarks

• Licenses

• Patents

While intangible assets can hold significant value, they have no physical properties.

5. Operating assets

If you classify assets based on how they are used in your business, you can classify them as operating or non-operating assets. The following are a few examples of operating assets:

• Cash accounts

• Accounts receivable

• Inventory

• Patents

• Copyrights

When these assets are used in your business regularly, they are considered operating assets.

6. Non-operating assets

If you own assets that are not used in your business daily, they can be classified as non-operating assets. The following would be considered non-operating assets:

• Vacant land

• Marketable securities

• Short-term investments

While these assets still hold value, they are not used in the regular course of business, which is why they would be classified as non-operating assets.

How to record business assets

How you record an asset depends on the type of asset that you’re purchasing. Some assets, such as accounts receivable, are recorded every time you make a sale, while others, such as machinery or equipment, will need to be recorded differently.

For example, let’s say your customer pays you $1,450 on Monday, which you later take to the bank to deposit. Recording the deposit would increase your cash, which is an asset, and decrease your accounts receivable balance, which is also an asset.

| 1-11-2021 | Cash | $1,450 |

| 1-11-2021 | Accounts Receivable | $1,450 |

1. Identify the type of asset

In the journal entry above, the asset is a current asset since it’s affecting your cash account and your accounts receivable account. If you had purchased machinery for your factory for $5,000, the asset would be recorded as a fixed asset.

| 1-11-2021 | Cash | $5,000 |

| 1-11-2021 | Fixed Assets — Machinery | $5,000 |

2. Classify the asset properly

Depending on how your balance sheet is structured, the above journal entry could read Fixed Assets, Tangible Assets, or Operating Assets. Most small businesses use Current and Fixed Assets when classifying assets, although larger companies with multiple assets may use one of the other classifications instead.

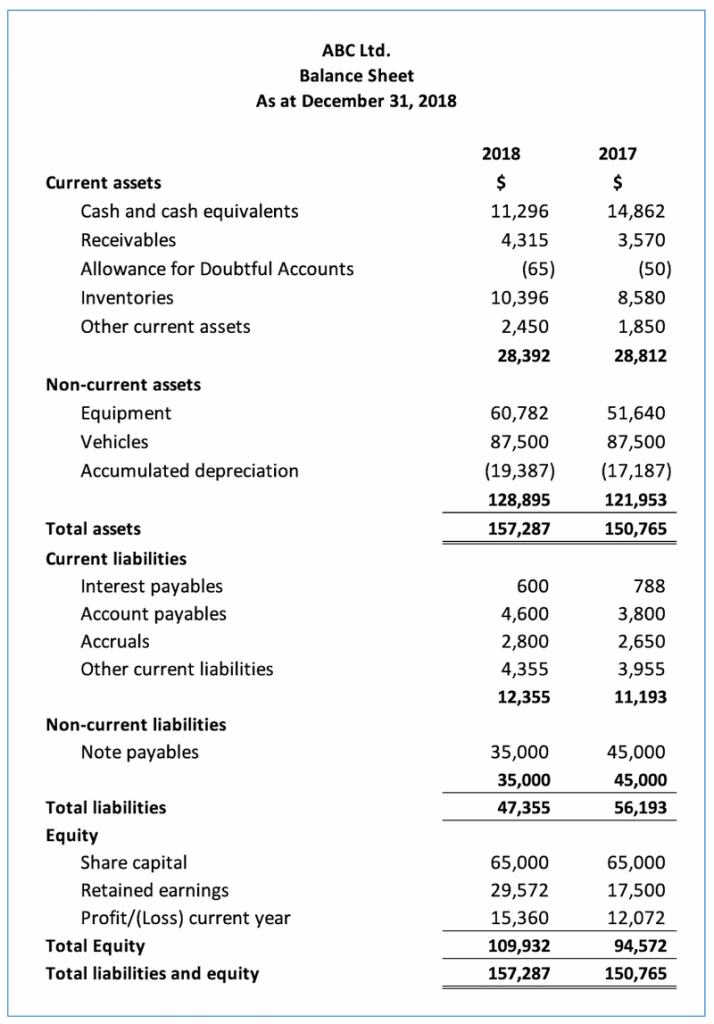

The balance sheet below displays the typical format.

3. Post the journal entry

Recording your asset using a journal entry is your final step. If you’re using a good accounting software application, much of this process will be completed for you. For example, when you sell a product or service, the recording of the sale will automatically increase your asset totals. If you’re selling products, your inventory asset total will also be updated.

Using accounting software, your asset balance will also be automatically updated when you purchase equipment, such as a new printer or copier, although you’ll also have to create a depreciation account for the newly added asset. If you’re not using software, you’ll need to record the purchase in a manual ledger and update your balance sheet.

Best practices when tallying assets

When it comes time to tally your assets, you’ll need to add all of the separate balances for each asset on your balance sheet as well as any additions or subtractions. Here are a few other best practices to consider using.

1. Make sure assets are not duplicated

Always make sure that your assets are properly categorized and are not duplicated. For example, if you record machinery under fixed assets, make sure that it’s not recorded under tangible assets or operating assets. This problem goes away with accounting software.

2. Include all of your assets in your total

When manually adding your assets, be sure to include assets in each category. To check your asset totals against your liabilities and equity, use this accounting equation formula:

Total Assets = Total Liabilities + Owners’/Stockholders’ Equity

For the assets on a balance sheet to be accurate, your total assets should always equal your total liabilities and equity combined.

3. Use accounting software

Concerns about duplicate entries and missing an asset while tallying disappear if you use accounting software.

During the setup process, you can choose the type of balance sheet classifications you wish to use, and anytime you sell a product, provide a service, receive a payment, or purchase equipment, inventory, or other assets, the information will be automatically posted to your balance sheet without any additional information needed from you.

Track your assets properly

Assets are an essential component of any business, so it’s vital that they’re managed and recorded properly. Of course, the best way to track assets is by using accounting software, but even if you’re recording transactions manually, it’s important that they’re managed properly.

Remember, without assets, you don’t have a business.

The post What Are Assets? A Primer for Small Business Owners appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint