Like making money, managing expenses is part of being in business. In most cases, managing your expenses is a simple process since the majority of expenses incurred by small businesses usually consist of overhead expenses such as rent, office supplies, postage, and salaries.

But as your business grows and you look toward the future, you may decide it’s time to invest some of your earnings into long-term assets that are designed to last for more than one year. These capital expenditures need to be handled differently than your everyday expenses.

Overview: What are capital expenditures (capex)?

Capital expenditures, or capex, are the funds used by business owners to purchase physical assets designed to increase the value of their business. Capital expenditures can also be used in order to maintain or improve a current asset.

These capitalized costs are considered an investment in the future growth of the business and are not recorded as an expense.

Because fixed assets do not expire within a year, you’ll need to expense them over time. This is done by calculating depreciation over the useful life of the asset and then posting a depreciation journal entry to your general ledger using the appropriate schedule.

Most capital expenditures are depreciated between 3 and 7 years, but fixed assets such as buildings may be depreciated up to 20 years or more.

Any time a fixed asset is purchased by your business, it’s considered a capital expenditure.

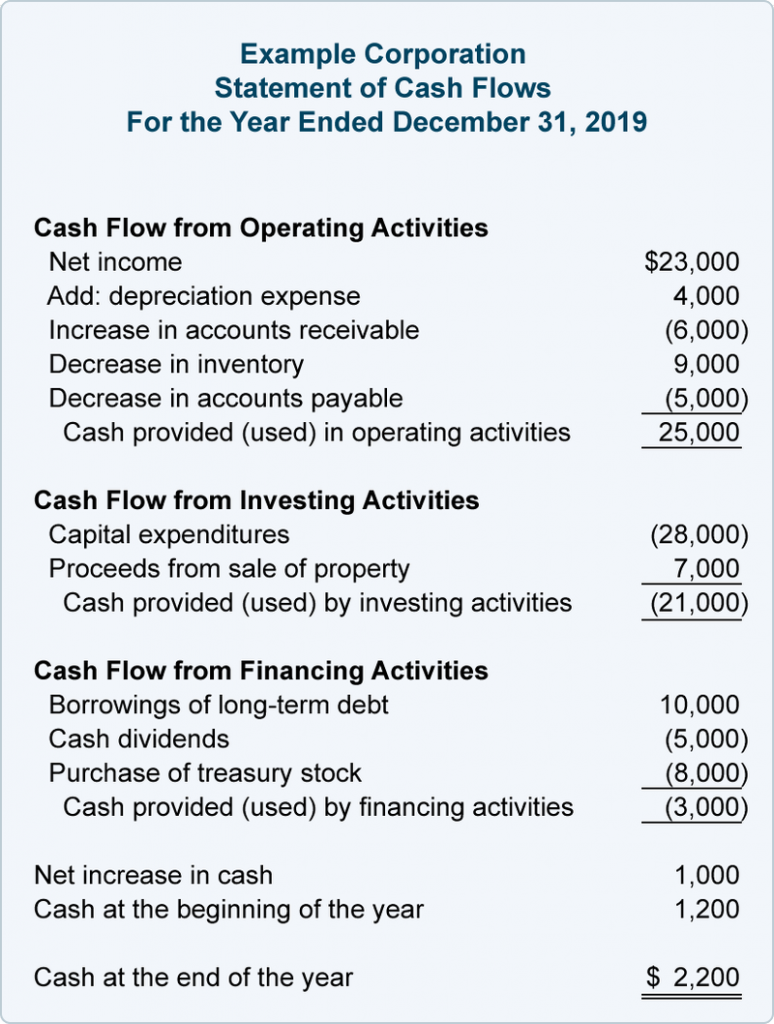

Unlike operating expenses, which are recorded on your income statement, capital expenditures are always recorded as an investment on your balance sheet and will also appear on your cash flow statement under the investing activities section.

Capital expenditures vs. operating expenses: What’s the difference?

While both technically are expenses, capital expenditures are items that are designed to be used across multiple years. Capital expenditures can include the purchase of a new building, machinery for your factory, or a new truck for transporting equipment. Other capital expenditures include:

• Renovations and remodeling

• Equipment

• Software

• Technology

In addition to purchasing new items, capex can also be used to improve assets you already own such as a new roof for an industrial plant or the installation of central air conditioning in an existing building.

On the other hand, operating expenses, sometimes referred to as Opex, reflect the everyday costs of doing business. These expenses are used short-term without any expected future gain attached to their purchase. Operating expenses can include:

• Rent

• Salaries and salary-related expenses

• Utilities

• Advertising

• Travel

• Property taxes

Operating expenses are typically the majority of the costs that your business will incur and will always appear on your income statement because the expenses are recognized in the period in which they occur.

Small businesses may struggle with determining what qualifies as capex and what is an ordinary expense. This can be particularly challenging when businesses purchase items which are designed to last long-term such as inexpensive furniture or even computer keyboards.

To make this decision easier, business owners can establish a minimum on capital expenditures in order to eliminate the need to depreciate inexpensive items.

For example, if your business sets a $5,000 minimum on capital expenditures, that means that any item you purchase for less than $5,000 will be expensed in the period in which it was purchased, while any purchases for more than $5,000 will be capitalized or depreciated.

Another issue that small business owners may run into are cash flow considerations. Because capital expenditures are usually paid for up front, small businesses may find that they are unable to purchase a more expensive asset.

If that’s the case, leasing the asset instead of purchasing it outright may be more cost-effective with the expense completely tax-deductible.

How to calculate capital expenditures

The formula to calculate capex is straightforward, with the most important component the accessibility of accurate financial statements.

The formula simply adds your net increase in property, plant, and equipment (PP&E) to your depreciation expense for the year, with the total indicating how much you’ve spent on capital expenditures for the year.

The easiest way to create accurate financial statements is by using accounting software to manage all of your company’s financial transactions. It will do much of the capex calculation for you and will be found on your cash flow statement.

If you’re using manual accounting ledgers, you’ll need access to a beginning and an ending balance sheet for the period for which you’re calculating capex, as well as a year-end income statement.

The balance sheet is where you’ll find the property, plant, and equipment (PP&E) balance for the year, while the income statement will provide you with a total of accumulated depreciation for the year in question.

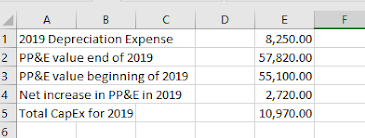

If you need to manually calculate capex, you can do so in four steps:

PP&E (current period) – PP&E (prior period) + Depreciation = Capex

Using the numbers from the spreadsheet above, the calculation would be:

$57,820 – $55,100 + $8,250 = $10,970

The result means that in 2019 your business invested $10,970 in property, plant, and equipment.

How to use capital expenditures

Capital expenditures can be used in various ways, including acquiring new physical assets or upgrading existing fixed assets, which can include property, buildings, equipment and machinery, technology, furniture, or an industrial plant.

Capital expenditures are seen as an investment in the future of your company, rather than a one-time expense.

For example, if you own a small printing company and invest in a new printing press, the purchase would be considered a capital expenditure because the additional equipment is considered an investment that will add value to your business for many years.

Calculating capital costs also helps business owners be aware of how much they have invested in their company, while investors look to capex to see how much a business has invested in their future growth.

As your business grows, so does capex

With business expansion, it becomes more likely you will use capex to invest in long-term assets.

Whether the fixed assets are in the form of a new building to manufacture your products, state-of-the-art machinery for more efficient product production, or new technology that will streamline operations, if you envision your business growing, capital expenditures will be a necessity.

Make sure they’re accounted for properly.

The post What Is Capex and How Do You Calculate It? appeared first on the blueprint and is written by Mary Girsch-Bock

Original source: the blueprint