If you’re in the import/export business or conduct business internationally, you need to know what cash against documents (CAD) financing is. We’ll explain exactly what CAD is, the advantages it offers, and best practices when using it in your business.

Overview: What is cash against documents financing?

Cash against documents or CAD financing is used for international transactions. The financial institution facilitating CAD financing works similarly to an escrow agent. This agent accepts the merchandise from the seller and holds it until the buyer examines and then pays for it.

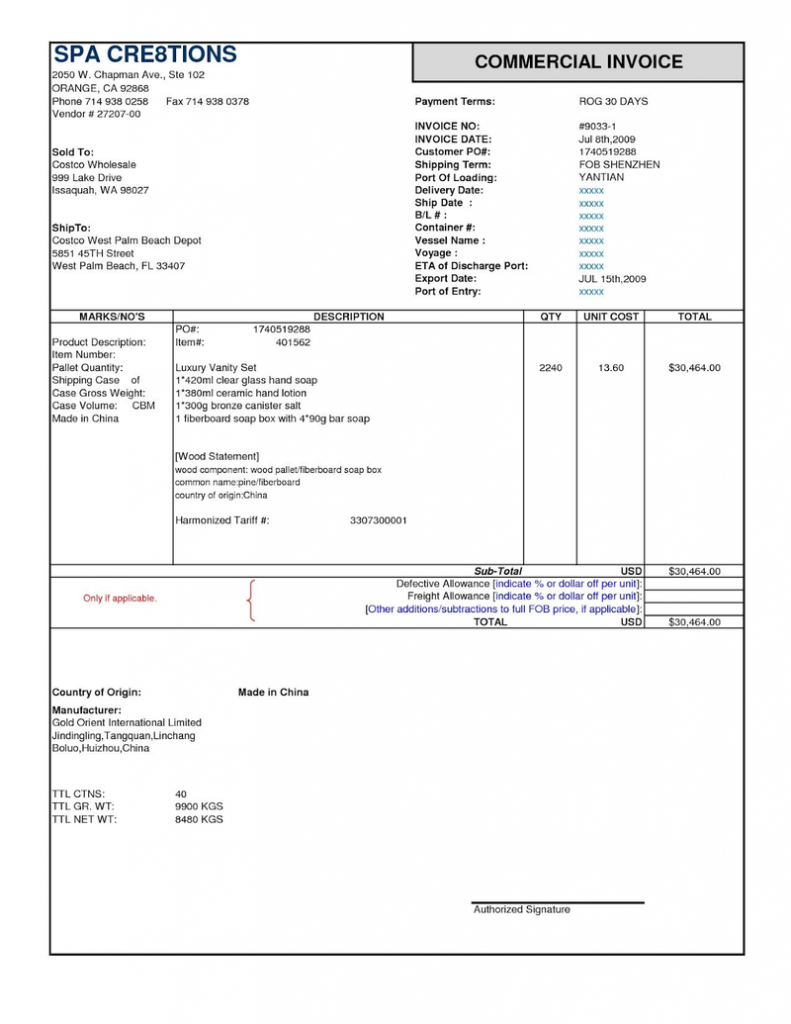

Once the seller receives the payment from the agent, the buyer then gains access to the merchandise, including all pertinent CAD documents included with the shipment.

In most cases, CAD financing is initiated by the seller, though the cost is usually shared between the buyer or importer and the seller or exporter.

Among the required documents in CAD financing are an Export Collection form as well as a Bill of Exchange. Like the product itself, all of these business documents are held until the buyer pays the amount owed to the financial institution holding the shipment.

Once the goods are paid for, the financial institution transfers the funds to the seller. When this is complete, and the buyer takes possession of the items, they are also provided with all of the documents that accompanied the shipment.

If you’re using small business accounting software, you’ll likely have to create many of these forms manually, though mid-size and enterprise resource planning (ERP) accounting systems often include the ability to automatically create many of the international CAD shipping documents when an international sale is processed.

Advantages of cash against documents financing

Whether you’re a buyer who sourced a product overseas or a seller looking to increase revenue by selling internationally, cash against documents financing can be beneficial.

Sellers are guaranteed payment

One of the reasons sellers may initiate CAD financing is that it helps to ensure that they’ll be paid for the goods shipped without the need to extend credit to an international buyer.

Buyers can inspect goods before making payment

Importing goods certainly has its risks. At the top of the list is receiving incorrect, incomplete, or low-quality items and orders. When using CAD financing, those risks drop considerably, as the buyer can usually inspect the goods before making the payment. This may not always be the case, so be sure that option is included before agreement to CAD financing.

Costs are typically shared between buyers and sellers

Because there are advantages to using CAD financing for both buyers and sellers, the cost of the transaction is typically shared between the two, even though the seller may be the initiator. Costs can vary depending on the financial institution used to facilitate the transaction and are usually little more than any other typical business expense.

The buyer does not need to obtain a letter of credit

Using CAD financing eliminates the need for a buyer to provide the seller with a letter of credit, which guarantees that the seller will receive payment on any goods they ship. A letter of credit is beneficial to a seller but has little benefit to the buyer.

For example, Jack imports 1,000 pairs of Italian leather shoes. The cost of the shoes is $10,000. Because Jack provided the seller with a letter of credit, the seller can demand payment from Jack’s bank, even if Jack finds the shoes unacceptable. And because the seller will receive the $10,000 because of the letter of credit, Jack’s available credit line is now diminished as well.

If Jack had used CAD financing, he would be able to examine the shipment prior to paying the seller, and his available line of credit would not be affected.

A third-party controls the shipment and payment process

Because the institution used in a CAD financing agreement is typically a disinterested third-party, neither the buyer nor the seller has a distinct advantage over the other.

Disadvantages of cash against documents financing

There are some disadvantages of using CAD financing, with the disadvantages impacting both buyers and sellers equally.

No guarantees buyer will take possession of goods

While CAD financing guarantees that the buyer will need to pay the amount due in order to take possession of the goods shipped and all necessary documents, with CAD financing, the buyer can simply refuse to pay, leaving the seller’s goods stranded in a foreign country.

The financial institution may release documents early

In some cases, there have been instances of financial institutions releasing documents to the buyer before payment is made. The process should always place documents against payments, with documents never released before payment has been made.

Excessive shipping costs

If a buyer does not pay for and take possession of the goods that have been shipped, the seller will be required to pay an additional cost for shipping the goods back to their country of origin.

Inability to examine shipment before payment

Depending on the agreement between the buyer, seller, and financial institution, the buyer may or may not be able to examine goods before making payment, leaving the buyer stuck with a product it did not order or one that has been damaged.

Payment is final

Once the buyer makes payment on a CAD financing shipment, it cannot cancel the sale or obtain its money back without the consent of the seller.

3 best practices when using CAD financing

If you decide to use cash against document financing, there are some best practices you can use to help the process go much smoother.

1. Give specific instructions

If you’re the exporter of goods, be sure to provide the CAD financing institution with specific instructions regarding the shipment, payment process, and the documents that are included in the shipment.

While most banks or other institutions should be familiar with the process, having the instructions included can help to reduce or eliminate the possibility of error. And when looking over the agreement, make sure that the CAD terms are accurate.

2. Choose the financial institution carefully

If you’re looking outside your bank for a CAD financing partner, be sure to investigate the funding services properly. Keep in mind that while banks may offer this service, they typically charge a higher fee than companies that specialize in CAD financing transactions.

3. Talk to each other

Buyers and sellers can have different expectations when it comes to conducting business overseas. Forging a good working relationship with your buyer or seller can help to ward off potential issues before they happen.

Cash against documents financing is usually worth the cost

Shipping overseas can be a risky venture for both buyers and sellers. Sellers have no guarantee that the buyer will approve and pay for the goods delivered, leaving them in the lurch for additional shipping costs that they may not be able to easily absorb.

Buyers, too, can lose out on CAD financing if they’re unable to examine the shipment before making payment.

But even with those distinct disadvantages, cash against documents financing offers a lot of benefits for both parties when done properly. These benefits include the opportunity for buyers to examine goods before paying for them as well as the ability for sellers to be paid before the goods are turned over to the buyer, with CAD payment terms always included in the agreement.

With the cost typically shared by both parties, using CAD financing is a small price to pay when international trade is part of your business.

The post Should You Use Cash Against Documents (CAD) Financing in Your Small Business? appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint