A few weeks ago, I wrote about capital budgeting and finished the article with a short discussion of economic value added (EVA).

EVA is a way to measure whether your business’ profits return more than the opportunity cost of the capital employed to earn them. It’s like doing a capital budget for your whole business.

Today, we’re going to look deeper at this concept. We will calculate economic profit by subtracting economic costs, such as opportunity cost, from net income.

It’s important for business owners to keep an eye on the economic profit of their businesses. You could be earning thousands each year in accounting profit but missing out on even more cash if you sold the business or changed your capital structure.

What is accounting profit?

Accounting profit is what you get with a traditional income statement. You start with revenue and then subtract all cash expenses from the year, plus some non-cash expenses such as depreciation and amortization.

Accounting profit is the number that you report to the IRS. It’s also the number that audited financials will show as net income. For most businesses, it’s the only bottom-line number that owners analyze.

How to calculate accounting profit

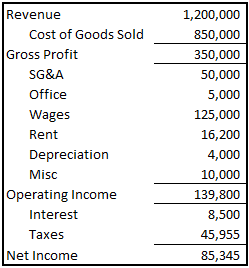

Accounting profit is what you get when you print out a P&L from your accounting software. Let’s take a look at an example.

Todd’s Tapers is a local tailoring business. The founder, Todd, has worked his way up to managing several locations and owns all but one of them.

Todd did pretty well last year. He generated $1,200,000 of revenue across his stores and turned that into $85,345 of accounting profits after all expenses.

The accounting profit formula

The formula used to find total accounting profit is:

Revenue – Cost of Goods Sold – Operating expenses +/- Other Income/Other Expenses

Here’s the calculation for Todd’s Tapers:

$1,200,000 – $850,000 – $210,200 – $54,455 = $85,345

What is economic profit?

Economic profit is accounting profit minus opportunity cost. One way to calculate economic profit is with EVA, which was discussed in the capital budgeting article linked above.

With EVA, opportunity cost is the rate charged on capital. Capital is made up of long-term liabilities and the equity account of the business. To calculate opportunity cost, you multiply the interest rate against long-term debt and add that to the required return of equity investors.

We’re going to calculate it a little differently for this article by looking at what Todd could earn if he sold the business.

How to calculate economic profit

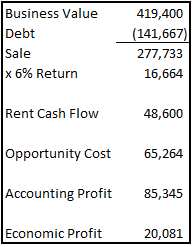

It’s undeniable that Todd has been successful in his career, and now he’s starting to think about retirement. To decide whether it’s still worth it to run the business, he wants to look at what his assets would generate in cash flow if he sold his business. Take a look at the following graphic and then we’ll go over each input.

Todd thinks he would be able to sell the business for 3x operating profit. Last year, the operating profit was $139,800, so the value of the business is $419,400.

He still has an open loan with a principal balance of $141,667 on one of the buildings that he would need to pay off. Taking the payoff of that debt into consideration, the value of the sale to Todd is $277,733.

Todd has a nephew-in-law who works as a financial advisor focusing on dividend stocks. He claims he can produce a steady 6% return if Todd rolls over the money from the sale into an account with him. That means the expected annual cash flow that Todd could achieve through the sale is $16,664.

Todd also needs to consider that the business currently occupies four buildings, owning three and renting one. The annual rent expense it pays for the one was $16,200 on the income statement.

To make it easy, we’ll assume that Todd will be able to rent the other three back to the buyer of the business for three times that amount, or $48,600 per year.

This puts the total opportunity cost of selling the business at $65,264 which is substantially less than the profit the business earned last year of $85,345. That means the current economic profit of the business is $20,081.

The economic profit formula

The economic profit formula is:

Accounting Profit – Opportunity Costs

For Todd, this formula is calculated as follows:

$93,845 – $16,200 – $48,600 = $28,581

Accounting profit vs. economic profit: What’s the difference?

Let’s look at three key differences between accounting and economic profit.

1. Implicit vs. explicit costs

Accounting profit subtracts only explicit costs from revenue. These are actual costs of the business, such as wages or cost of goods sold. Economic profit subtracts both explicit and implicit costs.

Examples of implicit costs for Todd’s Tapers were the annual cash flow from stocks if he sold the business and annual rent payments he would earn from the property. The key words for implicit costs are ‘if’ and ‘would’.

2. Reported to the IRS

It may be tempting to try to report economic profit to the IRS because it will always be lower than accounting profit, but only accounting profit is reported to the IRS. Other third parties like banks and insurance companies are also only interested in accounting profit.

Economic profit is an internal measure used by owners to make sure they are in a worthwhile investment.

3. Bookkeeping

You can’t bookkeep for implicit costs. There are no invoices to be entered for cash flow you could earn by making a different business decision.

Economic profit is a separate analysis that should be done at the end of the period. It is also entirely subjective. It is up to you to determine what rates of return you could earn on other investments and what other inputs may need to be applied to the formula.

4. Capital structure analysis

Capital structure is the debt and equity makeup for a business. Todd’s capital structure is mostly equity as he owns three locations and has debt on only one.

If Todd’s analysis showed that the business had negative economic profit, one way he may be able to take advantage of the opportunity cost, while keeping his business, would be by changing the capital structure.

Todd would refinance each of the buildings to take as much cash out as possible and then distribute the cash out of the business to be used on a different investment.

In this scenario, Todd exchanges part of his equity in the company for debt and reduces the business’s opportunity cost to whatever the interest rate on the debt is.

The business could now have an economic profit if the accounting profit was sufficient to make the interest payments. Todd can also invest the cash he receives in distributions into whatever opportunity he has that has more potential than the business.

Account for economic profit

Next time you’re reviewing quarterly financials, take a little extra time and calculate your economic profit.

It will help you to not only eventually make the decision to sell your business, but also know when it is smart to invest in big new projects or whether you should take advantage of more bank debt at low interest rates to fund your business while you diversify into some dividend stocks.

The post Should You Rely on Accounting Profit or Economic Profit? appeared first on The blueprint and is written by Mike Price

Original source: The blueprint