Being a business owner carries its share of risks and rewards. One of the more prominent risks is running low on cash. Luckily, managing your cash flow properly can help mitigate that risk.

That’s why cash flow projections are so important. Completing a cash flow projection for your business allows you to make more informed decisions. For example, if you expect your expenses to be higher in the next month, you can cut down on unnecessary expenditures. Likewise, if you know that cash flow is expected to be higher next month, you may want to purchase a new laptop to replace the aging one that you’ve been using.

In this article, we’ll explain a cash flow projection and its benefits and give you step-by-step instructions on how to create a cash flow projection for your business.

Overview: What is a cash flow projection?

A cash flow projection estimates the amount of cash that you expect to come into and flow out of your business. Also known as a cash flow forecast, a cash flow projection can be created for any period, with some small businesses even creating a weekly cash flow projection. Twelve-month projections are also fairly common, though they will need to be adjusted throughout the year as revenues and expenses change.

A properly prepared cash flow projection provides business owners with a view of all expected funds that will be coming in and going out of the business. Knowing your projected cash flow can provide a solid basis for making business decisions and lets you know if a potential cash shortfall is on the horizon.

There are numerous benefits to creating a cash flow projection, with little in the way of downsides. Even prep time is minimal, with a basic cash flow projection often taking less than an hour to prepare once you get the hang of it.

Many small business accounting software applications can prepare a basic cash flow statement, which can be helpful, but that only provides historic information and doesn’t cover expected cash flow for future periods.

If you’re still unconvinced on the merits of creating a cash flow projection, check out some of the benefits.

4 benefits of creating a cash flow projection

Creating a cash flow projection can help business owners better plan for the future and make more informed business decisions. Here are a few more reasons why creating a cash flow projection can benefit your business.

1. Improves decision-making

Creating a cash flow projection provides business owners and managers with the financial data they need to make more informed business decisions. These decisions can include reducing expenses when a cash shortfall is expected or investing more in the business when cash is expected to increase.

2. Helps control spending

Spending money is part of owning a business. But there’s an optimal time to spend money and a time when you should keep your expenses to a minimum. A cash flow projection done right can pinpoint both of those times.

3. Points out potential problem areas

Creating a cash flow projection can show you exactly how much cash is not flowing into your business. It can show you months or categories where expenses may be higher than you expected. Having this information available in an easy-to-understand format helps pinpoint potential trouble spots before they become an issue. A cash flow projection also serves as a good basis for calculating the cash coverage ratio, if you typically calculate cash ratios, and free cash flow totals for your business.

4. Predicts cash shortages

On some level, you may know that sales are down, but looking at that number on a spreadsheet makes it much more real. Many small businesses can be caught off guard by an unexpected cash shortage. While you may not be able to prevent the shortage, knowing that it’s coming can help you manage it better.

How to create a cash flow projection

Creating a cash flow projection is very simple; a projection for the upcoming month can be completed in less than an hour, though quarterly or yearly projections can take a little longer. Use cash flow assumptions, which are the total incoming and outgoing cash transactions you assume will occur, and follow the steps detailed below.

1. Bring your ending cash total forward

If you’re creating a cash flow projection for the first time, you’ll want to use your reconciled cash balance. If you’ve already created a cash flow projection for the previous month, your beginning balance for the upcoming month will be the ending cash balance from the previous month.

For example, after you reconcile your bank statement, your ending cash balance is $2,000. That will be placed at the top of the cash flow projection.

2. Estimate sales

Next, you’ll want to estimate sales that you expect to be paid in the upcoming month. For example, if you have $10,000 in invoices due the following month, and you expect 80% of those invoices will be paid, you’ll put $8,000 in income for sales paid.

3. Estimate other revenue

If your only revenue source is sales, you can move to the next step. But if you have other sources of revenue, such as rental income or interest income, you can place it below the sales revenue. For example, if you currently rent office space that brings in $1,000, you’ll place that amount under rental income, making your total incoming cash for the following month $9,000.

4. Estimate regular expenses

The next step is to estimate your regular expenses for the month. Be sure to include all of your regular expenses. In this example, your monthly expenses would include rent of $1,100, utilities that average $250 a month, a part-time employee, whose salary is $2,000 monthly, and insurance of $150 a month.

5. Estimate seasonal or one-time expenses

If you have a one-time expense upcoming, you can include it in a separate line item. Just be sure not to include that expense each month. For example, you have a subscription to a professional newsletter that you pay $90 for quarterly. You would only include that expense in the months when it’s paid.

6. Subtract expenses from income

After all cash in and cash out has been estimated, you can subtract your total expenses from your total income to see your cash flow for the month. This number is important since it displays whether you had more incoming cash than expenses.

7. Add beginning balance to estimated cash flow

Once you have your total cash flow for the month, you can add your beginning balance to your current cash flow to arrive at your ending cash balance for the month. This is the balance that you’ll use as your beginning cash balance for the following month.

| Beginning Cash | $2,000 |

| Sales at 80% | $8,000 |

| Rental income | $1,000 |

| Total incoming cash | $9,000 |

| Outgoing Cash | |

| Rent | $1,100 |

| Utilities | $ 250 |

| Wages | $2,000 |

| Insurance | $ 150 |

| Subscription | $ 90 |

| Total Outgoing Cash | $3,590 |

| Cash Flow for January | $5,410 |

| Ending Cash Balance | $7,410 |

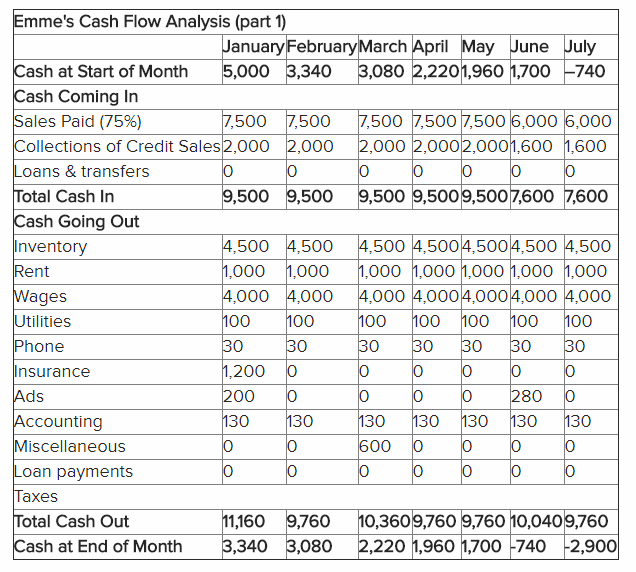

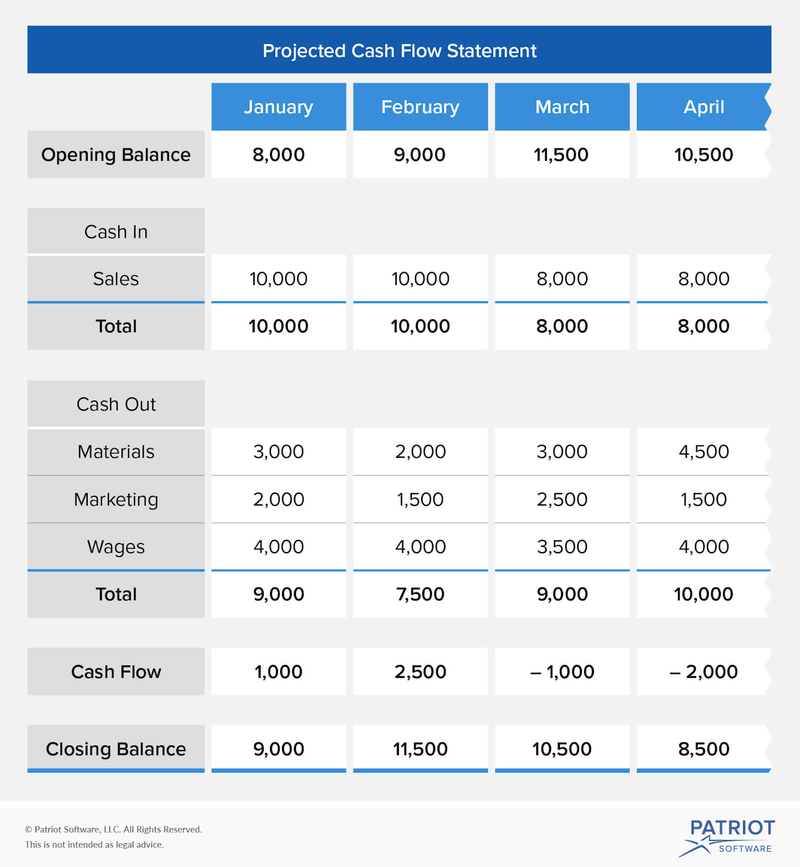

A cash flow projection example

The basic cash flow projection example below shows your beginning cash balance each month, with the prior month’s ending balance carried over as the beginning balance the following month. On this statement, cash in is limited to sales, with cash out split into three categories. Once those totals are in place, you can come up with your cash flow total for the month, as well as your ending balance.

Cash flow projections can be summarized like the one below, or you can choose to make the cash flow projection as detailed as you would like.

Though in some cases you may be able to create a projected cash flow statement like the one above in your accounting software application, you’ll want to use a spreadsheet to create a more detailed cash flow projection.

3 best practices when forecasting cash flow

Remember that a cash flow projection is just a projection, and things can change quickly. Your customer’s check may be eaten by your dog, a flaming meteor may put a hole in your roof, or your personal assistant might win the lottery and quit. But for the most part, you should be able to predict your cash flow fairly accurately by following these guidelines.

1. Be conservative

When estimating your operating cash flow, always be conservative. While we like to think that all of our customers will pay us on time, the reality is usually different. Your projections will likely be more accurate if you don’t assume that all outstanding invoices will be paid when they’re supposed to be paid.

2. Update regularly

If you only do a cash flow projection for the upcoming month, you won’t have to update much. But if you take on a quarterly or yearly projection, chances are that things will change during that time. You’ll add customers, lose customers, take on more employees, and add more monthly expenses, so be sure that those changes are added to your projection.

3. Include seasonal or variable expenses

Some industries are busier at certain times. If you’re in retail, chances are your busier months are November and December, while a gardening store will likely be busier in the spring. Make sure that those fluctuations are included in your projections.

Cash flow projections are important for all businesses

Whether you’re a sole proprietor offering IT services or a small manufacturer selling hockey pucks, a cash flow projection can help you better manage your business, plan for expected cash shortfalls, and eliminate unnecessary expenses when cash is low. Isn’t it time to use a cash flow projection in your business?

The post How to Create a Cash Flow Projection appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint