Tax liability is the amount of tax that you owe a particular tax authority. While the most common tax authority is the IRS, small businesses can also have a tax liability for other tax authorities including state and local jurisdictions.

Overview: What is tax liability?

Liabilities represent money that your business owes; therefore, your tax liability is the amount of money that your business owes various tax authorities. Tax liability should always be recorded in your general ledger as a current liability because in most cases, the liability will need to be paid within a year.

Your tax liability will vary depending on your business’ legal structure. For example, a self-employed individual who files a Schedule C at year’s end will pay taxes at a different rate than a C corporation.

While tax software does not manage or record your tax liabilities, it can be helpful when it’s time to pay quarterly taxes or file your yearly return.

Why do I need to know my tax liability for my business?

Tax liability is like any other liability. You need to know how much you will owe for the year to ensure that you have the means to pay it. For example, if your rent payment is $1,000 a month, you know that you have a rent liability of $12,000 for the year, even though you expense the rent monthly.

It’s important to calculate your tax liability for several reasons, but one of the main reasons is that it allows you to properly budget for the expense. Calculating your tax liability can also help you make more targeted business decisions or take a closer look at your expense deductions. Finally, knowing the tax liability for your business helps you have more accurate financial statements.

If you don’t estimate your tax liability properly throughout the year, your liabilities will be understated on your financial statements, rendering them useless. Even if your tax liability is zero, you need to know.

How to calculate your total business tax liability

Business tax liability is the amount of taxes owed based on the current income of your business. If your business is structured as a sole proprietorship, partnership, S corporation, or LLC, you’ll use pass-through taxation, which means that any profits that the business earns are taxed on your personal tax return.

If your business is a C corporation, you’ll be taxed at the normal federal corporate tax rate, which is 21%, as well as your state tax rate, which varies.

Unless you’re a C corporation, you should be calculating your business tax liability quarterly, based on your yearly taxable income. This allows you to make quarterly payments to the IRS based on those estimates, avoiding a big tax bill at the end of the fiscal year. If you’re not sure how to calculate tax liabilities, start with the following steps.

1. Estimate your business income for the year

The most accurate way to do this is to calculate your business income for the current quarter and then use that total as the basis for your yearly estimate. If you have a large influx of expenses or unexpected income in the following quarter, you can adjust your totals going forward.

2. Estimate deductible business expenses for the year

You would follow the same process for estimating expenses as you did for estimating income. For example, in the first quarter, let’s say your income was $14,000, while your qualified business deductions were $6,500, leaving you taxable income of $7,500 for the quarter.

You can multiply your quarterly estimates by 4 to arrive at your yearly estimate, or if you expect income or expenses to vary in the next quarter, you can include those variations in your estimate.

It’s important to calculate estimated tax liability by the year even though you’re required to pay estimated taxes quarterly because taxes are paid based on a graduated tax rate, which we’ll explain next.

3. Estimate taxable income

Now that you’ve estimated that your yearly pretax income is $56,000, and your deductible expenses total $26,000, your taxable income for the year is estimated at $30,000. Be sure to include any tax credits you may be eligible for when estimating your taxable income.

Because the IRS uses a graduated tax rate, you’ll be taxed at different rates based on income levels, which is why it’s important to calculate estimated taxes yearly.

For example, if you’re filing jointly with your spouse, you would calculate the tax on your $30,000 estimated taxable income as follows:

$19,750 taxed at 10% tax rate = $1,975

$10,250 taxed at 12% tax rate = $1,230

This means that your total tax liability for 2020 would be $3,205

4. Divide into quarterly payments

Now that you know that your yearly tax liability is estimated to be $3,205, you can divide that by four to make your estimated tax payments, which would come out to $801.25 for each quarter.

If your business operates close to margin, meaning your income and expenses are fairly even, you may end up with no tax liability at all.

Other types of tax liability

Business tax is just one of several tax liabilities your business may have. There are a few other tax liability examples you may need to consider.

Self-employment tax liability

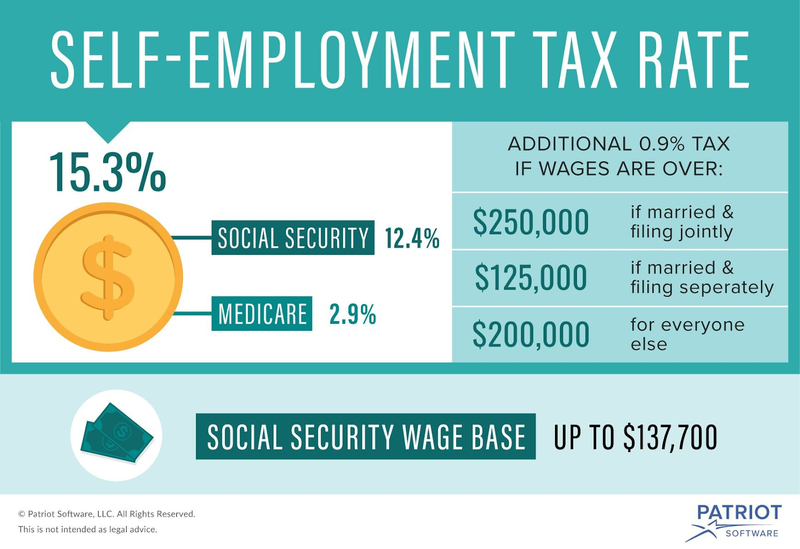

If you’re a sole proprietor that files Schedule C for your business, you will need to pay self-employment tax. Self-employment tax is usually calculated at the same time that your tax return is completed, but you can include it in your tax liability calculation by multiplying your estimated taxable income by 15.3%.

Keep in mind that half of your self-employment tax is considered a deductible expense. For example, if you were to calculate self-employment tax based on taxable income of $30,000 annually, your self-employment tax would be $4,590, although half of that or $2,295 would be fully deductible.

Sales tax liability

If you sell products in the jurisdiction where your business resides, you’re responsible for paying sales tax. Sales tax should be collected from customers at the time of the purchase, and much like employee income tax withholding, while it’s recorded as a liability, the amount is offset by the sales tax that you charge and collect from your customers.

Payroll tax liability

Payroll tax liability includes the income tax you withhold from staff paychecks as well as the employer portion of FICA, along with any state and federal unemployment taxes.

How to reduce your tax liability for your business

There are several ways you can reduce the amount of tax liability that your small business owes.

Track your business expenses properly

Be sure that you properly track your business expenses. Doing so may increase the number of legitimate tax deductions you can take for your business, which in turn, immediately reduces your taxable income and the amount of tax you’ll have to pay.

Always pay taxes on time

Penalties and interest can add up fast. Don’t make the mistake of paying your taxes late. I guarantee that the IRS or the state will notice and fine you accordingly, taking your previously affordable tax bill and turning it into one that you may not be able to pay.

Invest in your business

The cost of investing in your business, such as purchasing new equipment or furniture, or investing in the latest technology for your business are considered deductible expenses that can help reduce your tax liability.

Do you know what your tax liability is?

Part of being a responsible business owner is paying your bills on time, which includes taxes. Estimating, recording, and paying your taxes may not be fun, but it is necessary. Don’t let yourself be surprised by a huge tax bill at year’s end. Know what your tax liabilities are and make sure they’re paid when they’re due.

The post How to Calculate Tax Liability for Your Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint