I keep a framed Coco Chanel quote on my desk. It reads, “The best things in life are free. The second best are very, very expensive.” Running a small business falls squarely in the latter category, most of us can agree.

Cash is the lifeblood of any small business, so it’s critical to monitor your company’s cash position and predict how it’ll change in the near future.

Overview: What is a cash budget?

A cash budget, also called a combined cash budget, is a financial planning tool that predicts when cash will come into and leave your business, usually on a monthly or quarterly basis.

The budget highlights areas where your business might not have enough money to cover essential payments, such as employee wages, debt payments, and emergencies. It can also identify times when you might have too much cash, a good problem to have.

All cash budgets follow the same formula:

Opening Cash Balance + Cash Inflow – Cash Outflow = Closing Cash Balance

Tracking your company’s near future cash position can keep your business from temporarily running out of cash. For example, a cash budget can flag a potential cash shortfall months away that you can remedy now by securing a line of credit. You can’t get approved for a loan overnight, so planning can buy your business longevity.

Cash budgets reflect the collections and payments based on your company’s master budget, a high-level expectation of future revenue and expenses.

Example of a cash budget

A cash budget is an income statement, bank statement, and cash flow statement all in one.

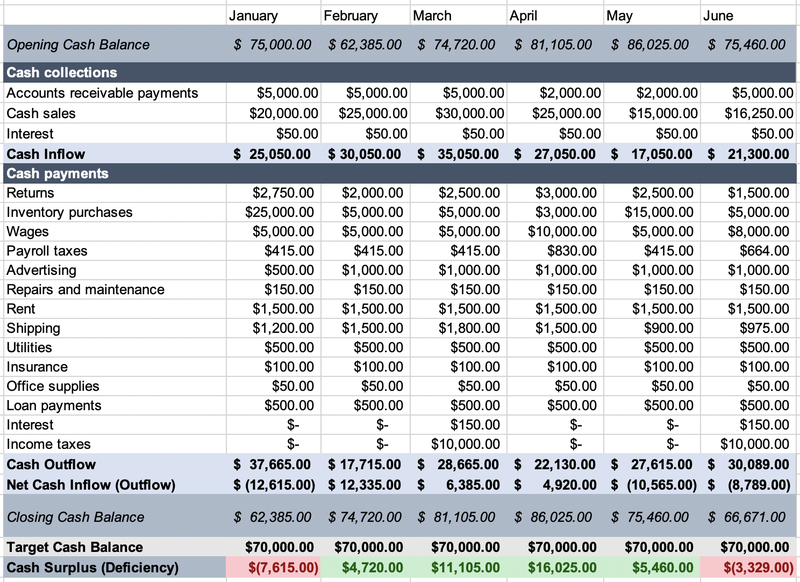

Take a gander at the six-month cash budget example below. It starts by giving the projected opening cash balance, which is the same as the previous month’s closing cash balance.

In between, there’s space for every type of cash collection, such as cash sales and customer payments on credit sales, and cash payments for expenses and loan payments. I took a flexible budget approach, estimating shipping costs as a percentage of the company’s cash sales for the month.

The cash budget ends with a cash deficiency or surplus based on the company’s target cash balance, the minimum amount of money the company is willing to have at the end of the month.

The company predicts cash inflows — to bring in more than it spends — in February, March, and April. Cash is rolling in, and expenses are relatively low. Life is good.

However, they’re planning for net cash outflows in January, May, and June, where the company expects to spend more than it takes in. It shouldn’t be a problem in May, since the cash balance ends above the targeted $70,000. However, the company needs to consider how it will make do with thousands less than they would like to keep for emergencies in January and June.

How to prepare a cash budget for your business

Preparing a cash budget requires looking into the future. You’ll need your accounting software, most recent bank statement, and a crystal ball to get through all six steps.

1. Create a cash budget template

The best place to make a cash budget is in Microsoft Excel. A powerful tool for small business accounting, Excel gives you the reins to customize your cash budget. Copy the format above; I’ll be honored.

Some accounting software packages have budgeting features, so you can go that route if it’s available to you.

2. Determine the time frame

Think about how far out you’d like to project your company’s cash flow. A cash budget’s time horizon shouldn’t exceed one year; it’s unlikely you’ll be able to make a realistic projection that far in the future.

In this planning step, consider whether you’d like to estimate your cash ingoings and outgoings on a monthly or quarterly basis. You should only prepare a quarterly cash budget when your business has hoarded enough cash to cover expenses for the full quarter.

You might get even more specific than monthly, but that’d be more work than it’s worth. Businesses often have the leverage to delay cash payments within a 30-day period to avoid temporary cash shortfalls.

3. Identify a target cash balance

Just like individuals, businesses should have an emergency cash fund if times get tough. Safeguard at least three months’ expenses in cash, and promise yourself not to spend it unless you’re in dire circumstances.

Solopreneurs with no employees can dual-purpose their personal emergency savings.

4. Enter your company’s current cash balance

Your business’s current cash balance might be the only certain number in the entire budget. Include your company’s current cash balance, including savings and petty cash.

Sole proprietors with no separate business bank account might not have a starting balance per se. Enter the amount you have set aside to fund future business expenses.

5. Prepare and analyze your business’s cash flow statement

To predict the future, look back at how your company’s cash flows. Open a month-by-month cash flow statement in your accounting software, and examine how your business spends and collects money.

The cash flow statement should also be the basis for all the categories on the cash budget. As shown in the example above, each collection or payment line represents a line on the cash flow statement.

6. Project your company’s cash flow

Here’s the most challenging part. Forecast your company’s cash flow by entering the business’s estimated cash collections and payments. Follow our guide to financial projections.

Start by estimating your company’s estimated cash receipts, also called cash inflows. Collections on accounts receivable, cash sales, and income interest are the most common cash inflows.

Next, estimate cash payments, or cash outflows. Consider operating expenses, such as rent and utilities, inventory purchases, and looming debt and tax payments. Manufacturers also incorporate expected raw material purchases outlined in their production budgets.

You should have a full-fledged cash budget by now. Have a colleague look it over to make sure you didn’t miss any loan or tax payments.

3 best practices when preparing a cash budget

Take these tips into account as you predict your business’s future cash position.

1. Take advantage of technology

Artificial intelligence (AI) is not here to take your bookkeeper’s job — yet. However, AI accounting can help you develop your cash budget.

Accounting software such as Intuit QuickBooks Online and Xero automatically creates short-term cash flow projections based on your company’s recent spending patterns. Bank of America business accounts do the same.

While you might know more about upcoming debt and tax payments than your software, take a peek at what they’re expecting down the pike.

2. Compare budgeted vs. actual cash flow

Enhance future cash budgets’ precision by overlaying your actual and budgeted cash flow and analyzing the variances.

Comparing budgeted and actual numbers might reveal collection and payment patterns you hadn’t initially recognized. Your future cash budgets will be better for it.

3. Have a plan for cash surpluses and deficiencies

Devise a plan to secure cash to keep your business afloat during cash droughts.

Many small businesses establish revolving lines of credit, a type of loan, to smooth potential cash flow issues. When your business needs cash, it can pull on its credit line. When the debt is repaid, you’re immediately eligible to take out more money, up to your credit limit.

Likewise, too much cash in the bank means you might be missing an opportunity to invest in growing your business. Create a growth strategy to execute during prosperous times.

Budgets aren’t written in concrete

Cash budgets are an essential part of a small business’s financial planning. While expenses occasionally come out of nowhere and threaten to tank your business, having a cash budget can help you see around corners with enough time to react.

The post How to Build a Small Business Cash Budget appeared first on The blueprint and is written by Ryan Lasker

Original source: The blueprint