Check fraud affects everyone. It affects the retired couple down the street who mistakenly deposited a counterfeit check and are now out $500. It affects your neighborhood supermarket, which has had thousands of dollars of returned checks in recent months. It affects financial institutions that cash checks for customers who knowingly have no available funds in their account.

Check fraud can affect your small business as well. While many business owners have simply stopped using checks, many of those same customers continue to use checks to pay their business expenses.

So how do you protect yourself and your business from fraudulent checks? If ceasing to use or accept checks in your business is not an option, there are other ways to prevent check fraud from impacting your business.

Overview: What is check fraud?

Check fraud can take many forms, but in most cases, it involves the attempt to pay for goods using a stolen, altered, or counterfeit check. Other instances of fraud include writing a check to an individual or business with the knowledge that there isn’t enough money in the account to cover it.

Additional instances of check fraud can include using stolen checks to pay for goods, or creating and using counterfeit checks. And, with today’s technology, it can be difficult to tell whether a check is valid upon initial examination.

With many accounting software applications offering ACH electronic bill payment, you can eliminate the use of checks in your business. However, if this option isn’t feasible, be sure to spend some time educating yourself about check fraud and how to prevent it from causing problems at your business.

4 types of check fraud

Check fraud typically involves the illegal use of checks. While some forms of check fraud, such as floating, have become more difficult because of electronic check approvals, the use of counterfeit checks has increased due to the ability to reproduce checks that look like the real thing. The following list, though not exhaustive, highlights four of the most common types of check fraud.

1. Check floating

More common before debit cards came into existence, the act of check floating continues today, although on a smaller scale. For decades, people have used check floating as a form of a payday loan, writing a check for goods and services days prior to a deposit being made into their account.

In most cases, people who float checks aren’t looking to steal from others. They simply want to stretch their funds until payday. But whatever the motivation, the act can seriously harm small businesses.

2. Counterfeit checks

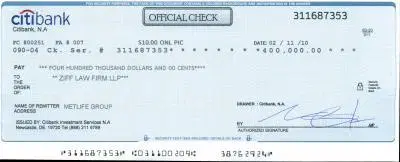

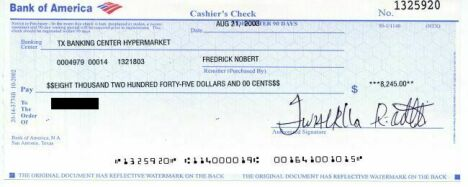

It used to be easy to spot counterfeit checks. Not anymore. Now you would be hard-pressed to tell the difference between a counterfeit check made using a desktop computer and a decent color printer and the ones used by your business.

Keep in mind that almost any kind of check can be counterfeit, so don’t be fooled into thinking that government-issued checks are always legitimate. Cashier’s checks can be counterfeit as well, so don’t assume that they don’t require the same amount of scrutiny.

Criminals use counterfeit checks in several different ways to steal funds from your account. In some cases, they use them to pay for merchandise, leaving business owners to foot the bill. In other cases, the scheme is more elaborate, involving overpayments and cashback requests that can leave business owners out thousands of dollars.

3. Stolen checks

Stolen checks, like counterfeit checks, can be used by criminals to pay for goods and services, or even deposited, with cashback provided. Once it’s discovered that the checks are stolen, the bank will reverse the deposit, once again leaving the owner in the lurch.

But if you use checks in your business, you run another risk, which is the threat of having unscrupulous employees steal checks. Also, a break-in at your business can result in massive check fraud should checks be stolen.

4. Check kiting

While check kiting mainly impacts banks and financial institutions, businesses can also be a victim of check kiting as well. Check kiting involves the perpetrator opening accounts at two banks and then floating checks between them, knowing there are insufficient funds at both banks.

Check kiting can impact your business if you allow cashback on a purchase. Another way check kiting can impact your business is if a customer purchases an item with a check and then returns the item for a cash refund. You end up providing the refund, and then the check is returned for non-payment.

More examples of check fraud

Diana needs groceries, but she only has $10 in her account and won’t be paid for two more days. On her way home from work, she stops at the grocery store and writes a check for $65 for her purchases. Because it’s Wednesday, she’s hoping the check she writes won’t clear her bank until Friday when her paycheck is deposited.

Unfortunately for Diana, the check is presented on Thursday and is returned for non-sufficient funds, making her responsible for the original amount, along with overdraft charges, while the grocery store is out $65.

Ed receives a refund check from the property management company that manages the apartment he was renting. A computer whiz, Ed looks at the check and sees how easy it would be to create a check that looks just like the one he received.

Later that afternoon, Ed has created a check that looks identical to the other one. He takes his newly created check to the bank and cashes it, and suddenly Ed has an extra $500, courtesy of his former property management company.

Meanwhile, the property management company has no idea that a counterfeit check has been cashed on its account since bank reconciliations haven’t been done in months. That makes it more difficult to collect the stolen funds from Ed or be reimbursed by the bank, which expects fraud occurrences to be brought to its attention within 30 days.

How your business can avoid check fraud scams

It’s currently estimated that losses from check fraud are in the billions in the U.S. alone and will likely continue to rise. But there are a few things you can do to prevent check fraud from affecting your business.

Always check ID when accepting a check

The first rule for accepting checks is to always check the ID of the customer writing the check. In every case, the ID should always match the name on the check. If it doesn’t, request an alternate payment method. There should be no exceptions to this rule, and make sure your employees — or anyone accepting a check on behalf of your business — abide by these rules.

Only accept checks from known customers

If you’ve always accepted checks from certain customers, the odds of them defrauding you are low. This might be the best way to continue accepting checks without increasing your risk of check fraud.

Start using other bill-paying methods

Start looking at other methods to pay your bills. Many businesses accept ACH payments or direct deposit for bill payment, which will eliminate the need for you to write business checks. It also eliminates the threat of stolen or misused checks.

Examine the check closely

When accepting a check, be sure to look at it closely. Does the coloring seem off? Do the numbers look legitimate? If a check looks suspicious, examine the routing number to see if it’s legitimate. Verify the legitimacy of the check with the bank that the check is written from.

If you’re unable to verify the information on the check, don’t accept it. Better to lose a customer than to be out thousands of dollars.

Be careful with cashier’s checks

It’s long been an assumption that cashier’s checks are legitimate. Unfortunately, cashier’s checks can also be reproduced to look authentic, with little recourse available to you if they’re returned for non-sufficient funds.

A genuine cashier’s check should always display a bank name at the top, with a phone number displayed as well. In all cases, the payee’s name should already be printed on the cashier’s check.

When in doubt, call the bank branch listed on the cashier’s check to verify its authenticity before accepting it.

Keep your checks locked up

Many check scams occur because checks are stolen and used fraudulently. With computer technology, they can also be easily reproduced and used by thieves.

If you need to use checks to pay bills, be sure they are only accessible to authorized employees, and that they are locked up in a secure location. You should also pay close attention to check numbers and immediately investigate any out-of-sequence checks since these can also indicate theft.

Reconcile bank statements promptly

The best way to spot-check fraud early is by completing your bank reconciliation process promptly. Finding a case of check fraud four months after it occurs will make it much more difficult to track down the perpetrator and less likely that the bank will reimburse the stolen funds.

There are ways to prevent check fraud

While the best way to prevent check fraud is to stop using and accepting checks, this may not be an option for your small business.

If using and accepting checks is a necessity for your business, be sure that you or your bookkeeper is following all the precautions, which include checking ID, examining and even verifying checks before accepting them, and keeping your check stock stored under lock and key.

Statistics aside, with some due diligence, you can eliminate check fraud in your business starting today.

The post Check Fraud: What It Is and How to Avoid It at Your Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint