It’s probably the only bonus that makes you scratch your head before taking it. The next time you make a fixed asset purchase, consider claiming bonus depreciation on your business tax return.

Overview: What is bonus depreciation?

Before we discuss bonus depreciation, let’s define depreciation.

You usually can’t report the entire expense of a fixed asset in the year of purchase. It’s customary to break up the expense over a period of years. You depreciate an asset over its useful life, reflecting the time you expect the asset to generate revenue and be of use to the business.

For example, say a coffee shop purchased an espresso machine for $10,000. Instead of reporting the entire $10,000 expense on its income statement and business tax return in year one, the shop would report $1,000 in depreciation annually for 10 years, the machine’s useful life.

Bonus depreciation is a tax incentive that allows business owners to report a larger chunk of depreciation in the year the asset was purchased and placed in service. As the law stands, you can deduct up to 100% of an asset’s cost in the year of purchase on your business taxes. Not all assets are eligible, and there are restrictions.

Let’s stop here to acknowledge that bonus depreciation — under current tax law — allows you to expense the entire cost of most fixed asset purchases in the year purchased and placed in service, just like you do most other business expenses.

With bonus depreciation, you can deduct the cost of both your staplers and heavy machinery in the year purchased and put to work. The processes to deduct both expenses vary, but the bottom-line impact is the same.

The Tax Cuts and Jobs Act of 2017 (TCJA) increased the deductible amount from 50% to 100% of an eligible asset’s cost. After 2022, that 100% decreases by 20 percentage points until it reaches 0% in 2027.

That’s the plan, unless Congress extends the bonus depreciation rate. Assets purchased before September 27, 2017 are subject to previous tax law for bonus depreciation.

In short: Bonus depreciation is an accelerated depreciation business tax deduction that lowers your small business tax bill. Through 2022, you can depreciate 100% of most fixed asset purchases.

How bonus depreciation works

Claim bonus depreciation by following these five steps.

1. Buy a qualified business asset

Most asset purchases your business plans to depreciate are eligible for bonus depreciation in the year purchased and placed in service. The two major exceptions are buildings and intangible assets.

The tax law allows bonus depreciation for tangible assets with an IRS-dictated useful life of 20 years or less. Machinery, equipment, computers, appliances, and furniture fall under this category.

Intangible assets, like email lists and patents acquired from third parties, aren’t eligible for bonus depreciation. Buildings get depreciated over 27.5 years under the modified accelerated cost recovery system (MACRS), the IRS’s proprietary depreciation method, and are also ineligible.

If their gross vehicle weight rating (GVWR) exceeds 6,000 pounds, large SUVs and pick-up trucks are eligible for bonus depreciation because the IRS considers them transportation equipment. You can expense your smaller vehicles by deducting the IRS mileage rate — $0.575 in 2020 — for every mile driven for business.

The way you acquired the asset also matters. You can’t take bonus depreciation if you purchased the asset from a related party, such as a family member. Check the IRS release on bonus depreciation for more restrictions.

2. Place the asset in service

To take bonus depreciation — or any depreciation — you need to be using the asset. The depreciation clock starts not when you purchase the asset but when you place it in service. So plug in that espresso machine and keep the cappuccinos coming all year long.

3. Calculate bonus depreciation

The bonus depreciation calculation will depend on the year you placed the asset in service. As of 2020, the bonus depreciation rates are as follows.

| 2020 | 100% |

| 2021 | 100% |

| 2022 | 100% |

| 2023 | 80% |

| 2024 | 60% |

| 2025 | 40% |

| 2026 | 20% |

| 2027 | 0% |

Say it’s 2020, and you just opened an online t-shirt shop that required the purchase of a $10,000 screen printing machine. You can deduct the entire purchase with bonus depreciation.

If we’re in 2024, you can depreciate $6,000 ($10,000 purchase x 0.6 bonus depreciation rate). The remaining $4,000 will be depreciated in future years according to MACRS.

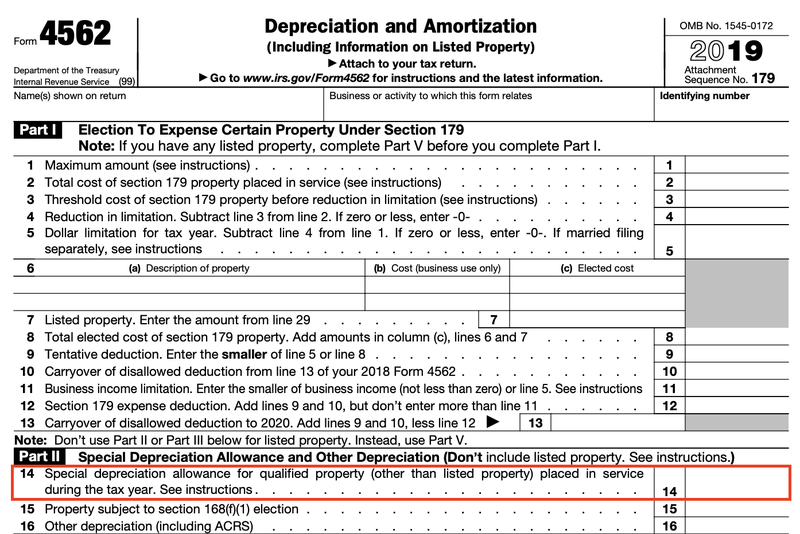

4. Report bonus depreciation on Form 4562

The IRS formally calls bonus depreciation a “special depreciation allowance.” You report bonus depreciation on IRS Form 4562, where businesses report depreciation and amortization.

You report bonus depreciation on Line 14 on Form 4562. If you’re reporting bonus depreciation for multiple assets, report the total cost.

5. File your business tax return

You can use tax software to help you file your business tax return. Depreciation can get complicated, so you should also talk to a tax professional before filing.

Bonus depreciation frequently asked questions

What’s the bonus depreciation limit?

In 2020, there are no bonus depreciation limits. There’s currently 100% bonus depreciation for fixed assets purchased and placed in service during the year, no matter their cost. Starting in 2023, the limit creeps down by 20 percentage points annually, to 0% in 2027.

Is bonus depreciation the same as Section 179?

Bonus depreciation and the Section 179 deduction are tax deductions that allow business owners to expense most or all of their fixed asset purchases in their first year. Though they share many similarities, they are two separate deductions.

The Section 179 deduction offers more flexibility but comes with an annual deduction limit.

The Section 179 deduction limit is set at $1,040,000 for 2020, where bonus depreciation has no such limit. Your Section 179 deduction also cannot create a net loss for your portion of business income. For example, if you have $5,000 in business income and want to expense all $10,000 of your shiny new asset, it’s a no-go. You can only deduct $5,000.

There’s no business income limitation for bonus depreciation. If you have $5,000 of business income and want to deduct all $10,000 of a new asset, use bonus depreciation. That’d leave you with a business loss of $5,000.

The list of assets subject to the Section 179 deduction is similar to those for bonus depreciation, but you can only deduct qualified improvement property under Section 179. So if your business renovates its building, you can only use Section 179 to deduct the cost.

You can take advantage of one, both, or neither of the depreciation plans. Consult with a tax professional to determine which strategy produces the lowest tax liability.

Do I have to take bonus depreciation? Should I?

Bonus depreciation is not mandatory. For eligible assets you’d prefer to expense using the MACRS depreciation method, you can elect not to take bonus depreciation.

Consider the impact of bonus depreciation. If you take a 100% bonus depreciation deduction, you lose the opportunity to depreciate an asset over its useful life. Growing businesses with low net income might prefer to spread out the cost of their assets over their useful lives.

Also, electing bonus depreciation applies to all assets in the same class. For example, if you purchase 10 computers for your business, you can’t take bonus depreciation for just one or two. It’s all or nothing.

Again, talk to a tax professional before deciding to take bonus depreciation.

Can I record bonus depreciation on my financial statements?

Bonus depreciation is a tax incentive that cannot be reflected in your financial statements. Regardless of how you depreciate your assets for tax purposes, follow generally accepted accounting principles (GAAP) when creating your financial statements.

Your tax and book depreciation schedules are mutually exclusive. Most small businesses use the straight line depreciation method for their financial statements, expensing a uniform amount for each year of the asset’s useful life. Under this method, your depreciation journal entry, made up of depreciation expense and accumulated depreciation, will look the same every year.

Bonus depreciation isn’t always the best choice

Depreciation is a concept new small business owners likely haven’t encountered before, and it can get complicated fast. Bonus depreciation can lower your tax bill now, but talk to a tax professional before committing to it.

The post A Small Business Guide to Bonus Depreciation appeared first on The blueprint and is written by Ryan Lasker

Original source: The blueprint