Outside of selling their products and services, one of the most important things a small business owner can do is reconcile their accounts. Account reconciliation is simply the act of reconciling one set of transactions with another set to ensure both sets match.

Learn which general ledger accounts should be reconciled regularly, and key things to look for during the account reconciliation process.

Overview: What is reconciliation?

If you’ve ever been billed for an item you didn’t buy or found yourself with a larger bank balance than you know you should have, you understand the importance of account reconciliation.

While it may be tempting to fly to Vegas with those extra funds, the bank will likely find the error when they’re reconciling their accounts, leaving you stuck in the desert with an empty wallet.

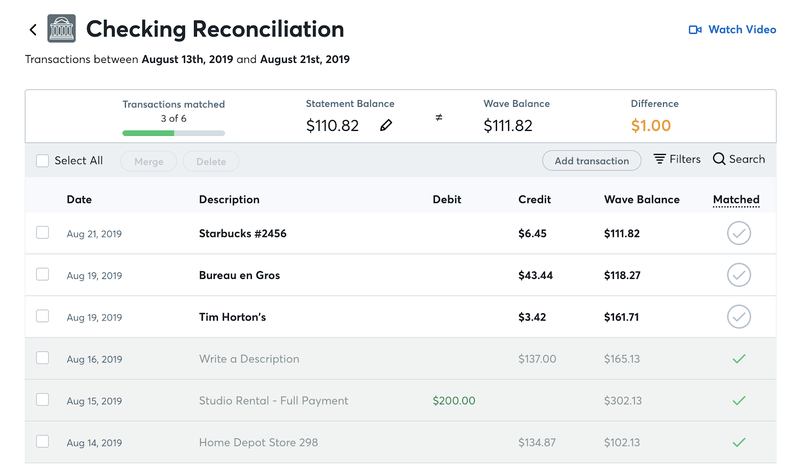

While much of the account reconciliation process is handled by accounting software, it still needs to be done. If you’re a software holdout and still record transactions manually, it’s even more important your accounts be reconciled regularly.

Why is account reconciliation important for businesses?

If you use double-entry accounting in your business, you need to do account reconciliations monthly. The most important account reconciliation your business can perform is the bank reconciliation.

The bank reconciliation ensures your bank account ending balance matches the balance reflected in your general ledger. While that seems simple enough, don’t confuse simplicity with importance.

Letting the bank reconciliation process slide can result in out-of-balance books, missing payments, unauthorized charges never being discovered, and missing deposits. And that’s just the beginning.

Fresh out of school, I was hired as an accounting assistant. I was excited until I realized my primary job was to reconcile five bank accounts, none of which had been reconciled for over a year.

Take my word for it, you don’t want to skip this process, even for a single month. And remember, it’s not just the bank reconciliation you need to complete. Other accounts need to be reconciled as well.

How to reconcile your accounts for your business

The reconciliation process includes reconciling your bank account statements, but it also includes a review of other accounts and transactions that need to be completed regularly. Follow the steps below to ensure nothing is overlooked.

1. Complete your bank reconciliation first

One of the most important things you can do to keep your general ledger accurate is to perform a bank reconciliation monthly. Do this for all bank accounts with activity during the month.

Most accounting software applications offer automatic bank reconciliation, which reduces the work. However, if some of your bank accounts aren’t connected to your software, you’ll have to reconcile those manually.

If you’re not using accounting software, you’ll have to prepare a reconciliation form, which can be as simple or detailed as you like. The form needs to provide you with enough space to add any outstanding items that will resolve any discrepancies between the two balances.

7-31-2020 Bank Reconciliation

| BANK | GENERAL LEDGER | |

|---|---|---|

| Ending Balance as of 7-31-2020 | $15,750 | $11,990 |

| Bank fees | $ (50) | |

| Check # 777 | ($ 1,365) | |

| Check # 779 | ($ 2,025) | |

| Check recorded twice in error | $ 420 | |

| $12,360 | $12,360 |

Adding the two columns, the bank reconciliation form now displays your reconciled balance of $12,360.

2. Complete journal entries

After completing the reconciliation form, you’ll need to review the entries made on the form and determine if you need to complete a journal entry. The bank reconciliation reflects the following transactions:

• Bank fees of $50 were recorded by the bank but not accounted for in the general ledger.

• An outstanding check for $1,365 which has been posted in the general ledger, but has not been cashed by the recipient.

• An outstanding check for $2,025 which has been posted in the general ledger, but has not been cashed by the recipient.

• A correction for a check written to the electrician that was recorded in the general ledger twice in error. You will have to credit back the expense to the utility account where both checks were originally recorded.

The two outstanding checks will not have to be recorded as a journal entry, since the adjustment is on the bank’s side. However, any adjustments on the general ledger side will have to be entered.

| DATE | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 7-31-2020 | Bank Fees | $50 | |

| 7-31-2020 | Cash Account | $50 | |

| 7-31-2020 | Cash Account | $420 | |

| 7-31-2020 | Utility Expense | $420 |

Once these adjustments are made to the general ledger, your bank account will now be reconciled with your general ledger account.

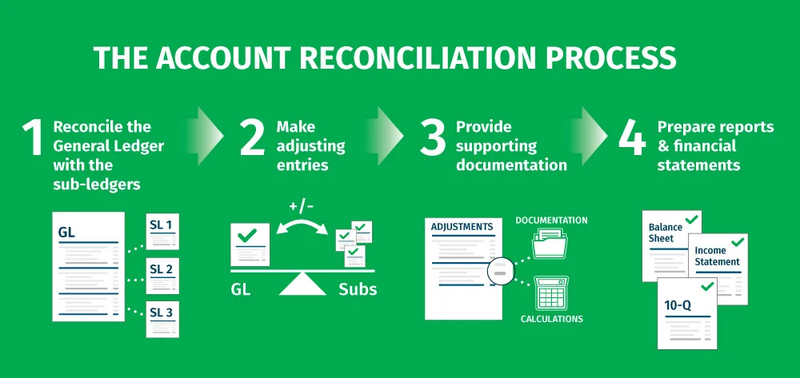

3. Reconcile general ledger to sub-ledger accounts

If you use accounting software you can skip this step, as it’s completed automatically. However, if you’re managing your accounts manually, you’ll need to reconcile your general ledger balance to your sub-ledger balance.

This ensures both balances match. Some of the sub-ledgers you may be using include fixed assets, payroll, accounts payable, and accounts receivable.

The reconciliation process is necessary if you use manual ledger accounting to ensure that general ledger balances are accurate. The easiest way to begin this process is to have your sub-ledgers handy along with your general ledger.

This way you can check off all the matching items, making note of any missing transactions, which will need to be recorded using a journal entry, which will put your general ledger and sub-ledgers in balance.

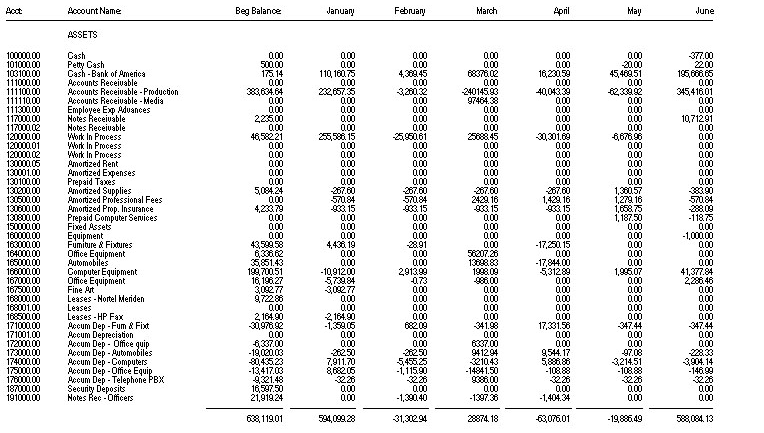

4. Review historical trends

This step may not be necessary for smaller businesses with limited activity. But if you’re processing a lot of transactions, it can be an eye-opening experience to review a comparative trial balance.

A trial balance can tell you a lot about your business in a single glance. For example, when reviewing your trial balance for the current year, you notice that your travel expenses have been averaging $1,500 a month, but in July, travel expenses jumped to $5,000.

The first item of business should be to see what expenses make up that $5,000. Did something get posted into the account in error? Did someone turn in old travel expenses? There could be a variety of issues that caused the expenses to jump so dramatically.

Maybe you don’t have a utility expense in July because you never received a bill. Maybe you had a large mailing that caused the postage account to jump.

Anytime something appears out of the ordinary, you’ll want to review the originating documents such as invoices entered to determine if they were posted properly and whether any adjustments need to be made. Reviewing your comparative trial balance is one of the most important things you can do for your business.

5. Run an updated trial balance

This one doesn’t have to be a comparative trial balance, because you’re only interested in checking the new balances after all your journal entries have been completed. Be sure recurring journal entries and reversing entries have been completed.

Once the trial balance looks accurate, you can rest assured your accounts have been reconciled properly.

Frequently asked questions about account reconciliation

Do I still have to reconcile my accounts if I use accounting software?

Yes. Though the process is much easier if you use accounting software, and you can skip the sub-ledger reconciliation process, your bank accounts will still need to be reconciled and any unexplained discrepancies investigated.

Should a business owner handle the reconciliation process?

If you have a staff bookkeeper or accountant, they can certainly handle the reconciliation process, but as the business owner, it’s your responsibility to oversee what they’re doing.

Remember, it’s your name on the bank account, and if there’s an error, it’s ultimately your responsibility to resolve it promptly.

If I don’t have any transactions for the month, can I skip the reconciliation process?

Just because you don’t have any transactions in your general ledger doesn’t mean that something isn’t going on with your bank accounts. Don’t assume that the statement is correct.

Banks make mistakes too, and if they mistakenly take money from your account and you don’t find out until three months after the mistake was made, it becomes much more difficult to resolve.

Account reconciliations should be completed monthly

I know you’d rather be selling your products or providing services to your clients than being stuck in the office doing account reconciliations. But the good news is, if they’re done on a timely basis, they become much easier.

And for those of you still handling your accounting manually, making the move to accounting software will eliminate much of the work you’re doing using manual ledgers. Either way, monthly reconciliations are a must.

The post What Is Account Reconciliation and Why Is It Important for Your Business? appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint