It’s no secret that a sales team affects a company’s revenue and profitability. What’s not as well understood is that structured, streamlined procedures underpin a sales team’s success.

Sales representatives are often given murky, ill-defined workflows or procedures so burdensome that the reps spend more time on administrative tasks than on actually selling. Quote to cash (QTC), an essential component of the sales process, is one area ripe for these pitfalls.

Management consulting firm McKinsey & Company had a fintech client that implemented a QTC process so convoluted it took 200 emails for a sales rep to move from a customer price quote to providing an invoice.

The quote-to-cash process is the critical last mile to completing a sale. Avoid the problems McKinsey’s fintech client experienced by adopting a robust yet efficient QTC workflow. Here’s how.

Overview: What is quote to cash (QTC)?

Quote to cash describes the end-to-end process from a sales rep’s delivery of a quote to the customer’s purchase of the product or service being sold. It’s an indispensable component of a sales strategy.

Sales reps must undertake several steps, such as cold calling and working leads, before they reach the QTC stage. A customer’s request for proposal (RFP) is the demarcation point where the official QTC process kicks off.

Various teams participate in QTC. A sales manager signs off on any custom quotes. Accounting handles billing and payment collection. Account management may perform order fulfillment.

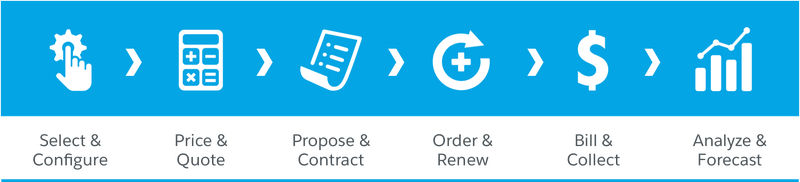

The 7 steps in the quote-to-cash (QTC) process

A discrete sequence of actions comprises the QTC process. In fact, the initial step of providing a quote is often broken down into three substeps called CPQ (configure, price, quote).

Let’s dig into each step in the QTC process.

1. Configure the quote

Sales reps who reach the RFP stage know they’re on the cusp of closing a sale. A prospective buyer who’s considering your offerings will invariably ask for a price quote.

This request for proposal kicks off QTC. Quote preparation begins with configuring a proposal including the products and services that meet the customer’s needs.

This configuration relies on a sales rep’s prior pitch to the client. The sales pitch generated the prospective customer’s interest in your company’s offerings, but it also served another purpose.

In that meeting, the rep probed the customer to understand their business needs. With this information, you can assemble a compelling quote order focused on the company’s products and services most applicable to the customer’s situation.

Some organizations establish standard quotes based on the basic or the most popular offerings. This accelerates quote delivery by making the CPQ phase akin to a restaurant menu.

Even then, sales reps usually have leeway to build a custom quote to fit the situation of a specific customer.

2. Pricing

Once you’ve configured the relevant products and services in the proposal, it’s time to price them.

Pricing is generally standardized or automated through software to ensure swift delivery, accuracy, and profitability. If that’s not the case with your business, a team outside of sales should provide pricing to avoid a conflict of interest.

Pricing can become quite complicated depending on your business model. I used to manage pricing software for small businesses in the travel industry, where a hotel room’s price can vary on considerations such as the size of the room and the view from its windows.

Factors affecting a price quote include discounts, special bundled pricing for multi-product purchases, and promotional pricing. Prices might fluctuate regularly, as was the case with my travel pricing software, which had to account for seasonality and competitive pressures.

This complexity can make generating a price quote a lengthy, difficult process. For these reasons, avoid asking sales reps to undergo a manual pricing process.

A manual process is asking for trouble. Not only does it take a lot of the rep’s precious time, but it can also lead to errors or a price that’s too low to be profitable, especially after considering costs such as the sales rep’s commission.

Implement a pricing structure that’s straightforward and easy to understand. This allows the sales rep to quickly add pricing to the proposal and explain the price quote to the customer.

Where a simple pricing structure isn’t possible, leverage software to streamline the effort.

Any custom quotes should require a manager’s approval. This makes sure the sales rep isn’t pushing for a low dollar amount just to close the sale. Every quote must meet a minimum pricing level to maintain profitability.

3. Complete the quote

With your product configuration and pricing worked out, it’s time to assemble a cohesive, easy-to-understand business proposal. The proposal summarizes which products and services the customer is buying and for what price.

Legal documentation outlining your agreement with the client is always part of the proposal as well. Your legal team works out this documentation in advance, and it serves as the contract between your business and the customer.

Sales teams should have a standard template to insert this information into. A template reduces errors, guarantees a professional look, and streamlines the CPQ steps. The proposal template should be short and to the point to accelerate closing the sale.

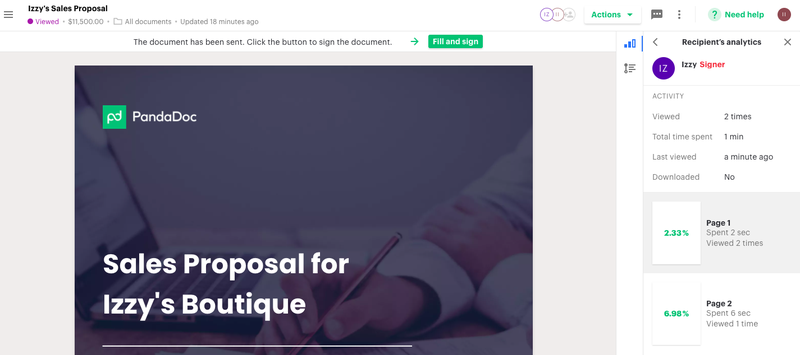

To facilitate the proposal creation and contract signing process, look to electronic signature software. E-signature software tracks who has signed the contract and makes managing many proposals easy and convenient.

The proposal and legal agreements go to the client as the official quote. But that’s just the start. The customer may respond with a counteroffer.

4. Negotiation and contract execution

A customer may have concerns or want to negotiate parts of the contract. A negotiation is particularly common for large purchases.

This part of the QTC process can involve a lot of contract changes. Establish a means of tracking these changes since the contract can undergo many iterations. Tracking allows your legal team to efficiently review changes.

Once negotiations successfully conclude, the contract is finally signed, and you’re ready to fulfill the order.

5. Order fulfillment

Fulfilling the terms of the contract is usually executed by a team other than sales. This necessitates a transition process from the sales rep to those fulfilling the order.

At this point, an account manager usually takes over ongoing oversight of the customer relationship, including order fulfillment, from the sales rep. In larger organizations, a separate order fulfillment team may exist.

This is a critical stage. Your company is now responsible for delivering on the terms of the contract, so your transition process must facilitate fast and orderly order fulfillment execution.

I’ve seen situations where a week goes by before order fulfillment begins due to manual steps. This frustrates the customer, who must follow up to see what’s taking so long.

You want the handoff from sales to order fulfillment to occur within a day. Automating the process is an ideal way to achieve this. After receiving a signed contract, an automated system can begin processing the order immediately.

After fulfilling the order, look for opportunities to upsell or cross-sell the customer into other offerings. But also focus on the customer’s satisfaction with their initial order to be sure they remain a customer when it’s time to renew their contract.

6. Billing and revenue recognition

The QTC cycle officially ends with payment collection. The accounts receivable team generates an invoice and sends it to the customer.

The contract stipulates quote payment terms. These terms affect revenue recognition in your company’s financial statements.

Like the order fulfillment stage, handoff to the accounting department must happen smoothly and in a timely manner. The accounting team must know payment processing requirements not only for proper billing but also to be sure the correct cash amounts are allocated for revenue recognition purposes.

The customer pays the invoice, the monies are then allocated, and the QTC process officially ends.

7. Post-QTC analysis

Payment processing may mark the official completion of the QTC process flow, but your organization’s success requires one final step.

Analyze every proposal, whether it led to a sale or not, to acquire valuable insights.

• How long is the end-to-end QTC workflow taking?

• Are parts of the QTC process taking too long or suffering from bottlenecks?

• Why were some proposals rejected? Was pricing the issue or did delays in the QTC workflow cause the customer to change their mind?

• How long is it taking to receive payment?

Use these insights to improve the QTC process and other areas of your operations, such as your revenue forecasts.

How technology can improve your quote-to-cash (QTC) process

Historically, QTC was a disjointed, inefficient manual undertaking. A sales team spent substantial small business resources assembling a quote and driving clients through the contract phases to the purchase point.

Businesses today can adopt a technology-driven QTC approach. Through software as a service (SaaS) tools, a business can efficiently pull together the disparate elements of the QTC workflow into a cohesive, seamless whole.

The best CRM software allows you to track customers through the entire sales cycle. It helps in other parts of the QTC process, such as using customer information to generate an invoice.

Accounting software enables quick, easy billing. Your company can automatically generate invoices and process payments, thereby reducing delays. The data is also centralized for easier financial management.

Create and manage proposals and contracts using an e-signature solution, such as PandaDoc. E-signature software helps through all phases of the document lifecycle, including tracking changes during negotiations.

SaaS solutions deliver flexibility to bring together the software that makes sense for your business needs. It also improves operational efficiency and customer satisfaction.

A last word about QTC

The QTC workflow alone adds many steps to the sales process. After investing so much labor to generate revenue, it’s vital to look beyond the sale to renewals.

Renewing existing customers is far less effort, cost, and time compared to acquiring new clients. Renewals go through the same QTC workflow, but they’re much faster to process than a new order since the customer is already familiar with your business and its offerings.

Improve the chances for renewal by implementing as much automation into the QTC workflow as possible through software. An efficient, effective QTC process delivers a better customer experience and maximizes its value to teams across your organization.

The post Quote to Cash (QTC): A Beginner’s Guide appeared first on The blueprint and is written by Robert Izquierdo

Original source: The blueprint