People are wishing they’d learned more about money in school — especially during the coronavirus pandemic.

Nearly half of respondents said that having more financial literacy education would have helped them manage their money better through the Covid outbreak, according to a study from D.A. Davidson. The study was done online and surveyed 1,047 U.S. adults March 29 to 30.

Respondents generally gave themselves low scores when it came to their own financial literacy — 36% of people rated themselves a “C” grade on financial knowledge, while 34% said a “B.” Only 16% said they’d merit an “A.”

“I was stunned at how honestly transparent these people were about this deficit in their knowledge,” said Andrew Crowell, vice chairman of wealth management and financial advisor at D.A. Davidson. “It was reality before the pandemic, but we think that the pandemic and the resulting financial strains and stresses it placed on households just amplified it in many people’s minds.”

Covid confusion

The coronavirus pandemic has had a big impact on personal finances. For many, it’s come with hardship — millions lost jobs or took pay cuts in the early days of the outbreak.https://products.gobankingrates.com/r/d9360ea31bf06ea8b9d0ef49288e28fb?subid=

On the other hand, many have gotten a break from student debt payments, and millions of Americans have now received three economic impact payments that have been used for boosting savings to paying down debt and more.

Still, even those who haven’t been slammed by the pandemic financially may be unsure of how to best manage their money to utilize stimulus payments and prepare for the future.

More from Invest in You:

Young adults feel their financial education in school was particularly lacking, the survey showed. More than 70% of Gen Z respondents said that having greater financial literacy would have helped them manage their finances better amid the coronavirus pandemic, compared to 47% among all respondents.

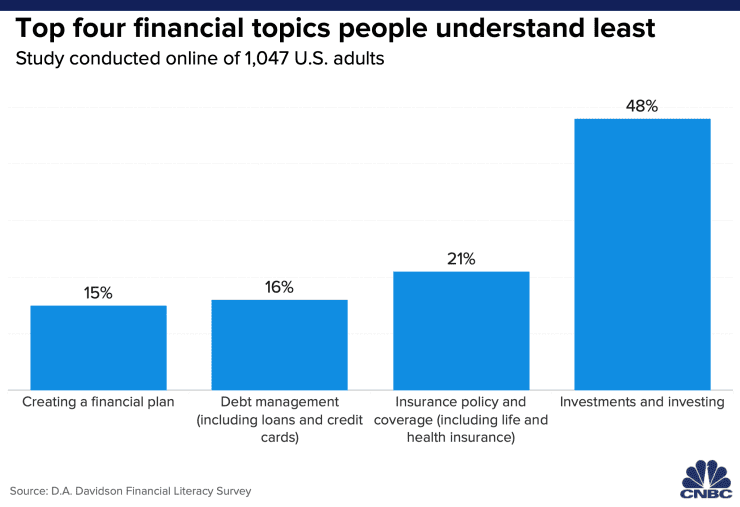

In addition, 30% of Gen Z said the financial subject they understood the least was debt management, falling behind investing, insurance policies and coverage and creating a financial plan.

“It’s terrible that financial literacy has been elbowed out of the curriculum at school,” said Crowell. “We’re just sending our children out into the world unprepared.”

Currently, only 21 states require that high-schoolers take a personal finance course, and for many it’s incorporated as part of another class. In 24 states, high schools must offer personal finance education but it is not mandatory for students to take it.

That’s not aligned with popular opinion, according to the study. Nearly 90% of respondents said that personal financial education should be a part of K-12 education, and 45% said children should start learning about money management between the ages of 11 and 15.

Meanwhile, 7% said that children under the age of 5 should be taught personal finance, and more than a quarter of respondents said that financial education should begin during the ages of 6 to 10.

Ability and capability

The coronavirus pandemic has also changed some aspects of personal finance education in schools, and has also meant that there’s many online resources and courses that students can take to boost their knowledge.

One is Next Gen Personal Finance, a nonprofit that curates the best content on the internet to help educators find resources to improve both financial literacy and capability, according to Yanely Espinal, its director of educational outreach.

The capability piece is important, according to Espinal. “Studies show that at the end of the day if your behavior isn’t changing then what’s the point of reading a million articles?” she said.

That includes tailoring education to the age of students and helping them learn to ask the right questions in situations that involve money, such as opening a bank account in person or online or buying a first car.

Espinal also said that part of the battle is getting students to talk to their parents at home about what they’re learning in school, money education included. Having children involved in small, age-appropriate activities that show how money works can be very helpful and as simple as having your child join you in creating a grocery list, budgeting and shopping.

The post More financial education would have helped people better manage their money in the pandemic appeared first on CNBC

Original source: CNBC