Rising earnings. Economic growth. Bargains. A lot of the stuff investors were thought to cherish has been in short supply in the rally that has swept markets since March.

Also: share repurchases, all but gutted as the coronavirus lockdown put a premium on conserving cash. A measure of equity demand that tallies announced buybacks and takeovers fell to $12 billion last month, the second-lowest level in the past decade, data compiled by TrimTabs Investment Research show. Meanwhile, stock offerings exploded, pushing the total to a record $94 billion.

It’s another example of how the market’s monomaniacal focus on reopening and central bank stimulus is blotting out every other consideration guiding equities. From a supply-demand perspective, companies have turned against bulls after spending years as their biggest ally. The revolt did little to discourage investors from chasing momentum in a market where $9 trillion was added to equity values in 10 weeks. The Nasdaq 100 has surged 38% since its March low and briefly eclipsed its all-time closing high on Wednesday.

“All those things are telling you everything is not OK, and then you look at the S&P 500 — it keeps going up,” said Jerry Braakman, chief investment officer of First American Trust in Santa Ana, California. “The market doesn’t care about valuations. With the Fed continuing to step in, the right bet has been to bet with the Fed. The trends are your friends right now, just keep riding it higher and it’s almost a little bit like, stick your head in the sand.”

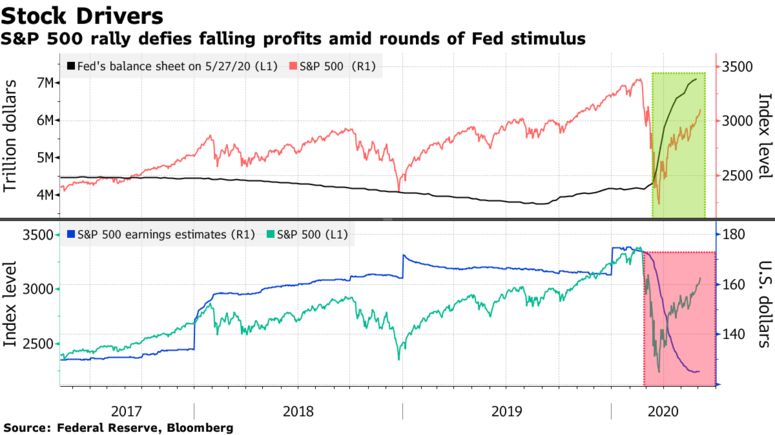

The S&P 500’s unrelenting rally from its March low has defied many business fundamentals. The economy is heading for the worst recession in decades with factories and stores forced to shutter due to the coronavirus pandemic. In a quarter where corporate profits are expected to plunge 44%, the benchmark measure has climbed 21%, on course for its best return since 1975.

In response to business woes, about one-fifth of S&P 500 companies have suspended their buyback programs this year, an amount equal to more than 40% of the total executed for all of 2019, data compiled by Goldman Sachs show.

Cash-strapped firms from airlines to cruise lines rushed to sell shares to shore up their balance sheets. Companies including Warner Music Group and ZoomInfo Technologies flocked to initial public offerings, seeking to raise money and take advantage of a market multiple that’s expanded to a 20-year high. As a result, equity sales in May more than tripled the 12-month average, according to TrimTabs.

“The staggering volume of new offerings should be of concern to market participants,” said Winston Chua, an analyst with TrimTabs. “The more shares in the marketplace, the harder it is for existing shares to move higher, all else being equal.”

Worrisome as the trends are, bulls are unbowed. After the March selloff, investors quickly embraced the stay-at-home trade of tech megacaps and drugmakers following the Federal Reserve’s emergency measures. As reopening came into focus in recent weeks, traders branched out buying to include riskier stocks, snapping up banks and small caps, companies seen benefiting most from an economic rebound.

Along the way, hedge funds and retail investors emerged as steadfast buyers. Trading activity among individuals have almost tripled this year, according to data from retail brokerages compiled by Goldman. Among the firm’s hedge fund clients, net leverage, a measure of the industry’s equity exposure, has risen to the 92nd percentile in the past 10 years.

A looming danger, however, is these investors reversing their stance to join corporations in unloading stocks, according to Goldman strategists led by David Kostin. Now that corporate America has ceased its role as a crucial source of price support, the market is vulnerable to shocks, they argue. In the past, companies have helped keep equity losses from snowballing. The market’s bottom in February 2018 came in a week when Goldman Sachs’s corporate-trading desk saw the busiest buyback orders ever.

“In addition to the elevated positions of hedge funds and retail investors, the sharp ongoing reduction in buybacks poses a risk to the balance of U.S. equity supply and demand,” Kostin wrote in a note. “Consequences of the sharp reduction in corporate repurchases include lower EPS growth, higher share-price volatility, and lower equity valuations.”

For now, the spike in corporate selling is not a problem with investors fearing missing out on the rally. Citigroup’s sentiment model, which tracks factors such as fund flows and options trading, is pointing to a state of euphoria among investors.

“The talks from Federal Reserve officials and other government officials that basically they’re willing to take whatever it takes to make sure the economy can get back on track gives investors the feeling that there is really no significant risk in stocks,” said Michael Ball, managing director of Denver-based Weatherstone Capital Management. “Things like fundamentals and buybacks don’t matter until they matter, and people over-correct for that.”

The post The Things That Used to Matter to Stock Investors Don’t Anymore appeared first on Bloomberg and is written by Lu Wang

Original source: Bloomberg