The greatest difficulty in entrepreneurship in its early phases is the search for different ways to obtain money, financing, to be able to start your idea and get to overcome the so-called ” valley of death ” or initial phase of your project until you start to obtain positive results by covering your costs. In these early stages, the most common way to obtain financing is to resort to informal sources of financing, such as friends and acquaintances, to gradually turn to what are called business angel networks or private investors that can serve as a reference to obtain other investors later.

From these first phases, it is where you will already find yourself obtaining a positive return and you can use other forms of financing such as what are called financing rounds A, B, C, etc. or through venture capital companies . In the phases after death valley, your company already has the capacity to obtain financing from these professional investors with the normal purpose of expanding the markets that you serve from your startup.

Undoubtedly, the first years, before obtaining positive returns, are decisive for your entrepreneurship project; since, in them you will test and consolidate your product and the business idea. To give you an idea of the importance of particularly careful planning and execution, only 25% of startups exceed a year of life according to a study carried out by Forbes magazine.

The fundamental pillar to support your planning is a correct allocation of the resources that you have and the control of the available liquidity, as if it were the control panel of an airplane. To facilitate its control there are financial indicators that allow you to monitor such as months to runaway and burn rate , which serve to precisely control when you will run out of liquidity for your expenses or investments and when you should search for financing for your project

Normally, this search for financing must be carried out for a maximum period of 12 to 15 months during which you must test your hypotheses about your product or service and meet a series of milestones or milestones, such as registering your company in the commercial register, test a target market, implement new software or machinery that improves your production process.

In a country like Mexico, approximately 72% of companies are SMEs according to the Mexican Ministry of Economy and 35% are created by young entrepreneurs. Additionally, Mexico is a country with low banking penetration and therefore with a high volume of population outside the banking system. If we add to this the global pandemic due to COVID-19 that limits personal interaction, all this is limiting contact in a traditional way, in person, with clients and potential investors for new entrepreneurs. Therefore, planning liquidity needs and finding new investors is essential for the survival of your startup . The main effect of COVID that you should have for your company is the extension of the term for each between each search for financing by up to more than 30 months according to TechStars .

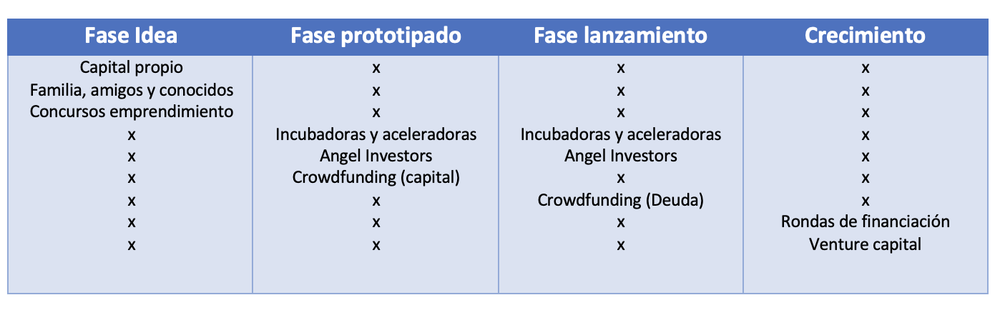

Funding sources according to the phase of your business project

To clarify the possible sources of financing for your company, below I present a table that can serve as a guide to solve this problem according to the phases in which your business project is:

But what do these concepts or agents mean and why does each have a certain phase?

Ideation

In the first phase of your project, the ideation phase, you are in a very initial phase of your product or service with just a beautiful business idea and eager to start working. In this phase you have a hypothesis that you think may be true and that is usually based on an unmet market need and that you have discovered from your previous experience. The main ways to start looking for financing are with your own money, from friends or acquaintances or through a public or private entrepreneurship contest that helps you start your idea. Before this phase you should start developing your business plan and clearly define what you intend to do and how you think it would be possible.

Additionally, you can opt for different prizes or contests. For which it will help you to have a business plan worked out and where the potential of your project is shown. According to the Ministry of Economy of Mexico, you can choose various options for SMEs and entrepreneurs.

Prototyping

In the prototyping phase, you have begun to test your product or service with a minimum viable product and you are in a phase of development and adaptation to the market, but you have already verified that you have a target group of customers who may be interested in acquiring it. In this phase you can go to:

Incubators or business accelerators that will help you improve your product or service, set up your company, prepare a business plan and test your product in a more agile way in the market, through a group of expert mentors who they will help in these different areas. The main difference arises from the fact that accelerators usually take a small part of capital; so that the entrepreneur has an injection of capital that he can use in his business project. To search for possible incubators or accelerators, the Ministry of Economy maintains an extensive list and additionally the largest ones are Angel Ventures , the one maintained by the Instituto Tecnológico de Monterrey and the Directorate of Incubation of Technology-Based Companies ( DIET ) belonging to the National Polytechnic Institute of Mexico (IPN). Recently, the call for the acceleration program for technological solutions around the future of work has also been opened under the name of Finance Forward Latin America 2021 convened byVillage Capital , with the support of the MetLife Foundation in Brazil and Mexico, and Moody’s.

Angel Investors or investor networks specialized in investing in business projects in these initial phases to be able to help them in exchange for a later profitability at the time of their exit through the sale of the company or its IPO. In Mexico you can find, for example, Angel Hub , Angel Nest and Angel Investment Network .

Crowdfunding through online platforms, such as Kickstarter or Republic can serve as a financing tool in exchange for a part of your capital in the company through just a detailed and attractive business plan. An example of this type of project can be found in Republic.io where some entrepreneurs with a real estate project in Tulum for its exploitation as short-stay accommodation have obtained more than 500 thousand dollars, the name of the project is Nectar Tulum .

Launching

In the launch phase you can use the same sources of financing, but with the main difference that, since your product or service is already developed, you should try to lose as little capital as possible. Motivated by this, if you use crowdfunding, it is advisable to choose instead of offering equity, offer debt or instruments convertible into equity. These derivative instruments are usually debt convertible into equity, but provided that the company reaches a certain value and value at the time of issuance of the debt. This possibility allows you to assign a small part of the capital since it is established based on that future value.

From this phase you enter the growth phase where you can choose financing rounds between professional investors or venture capital or venture capital firms. These investors base their forecasts on sales figures and a required return on their investment, which is typically between 20% and 30%.

In summary, there are different financing alternatives, although not all of them can fit into your business project depending on the phase you are in. Motivated by the global situation that we find ourselves in, the planning of these financing needs takes on greater importance as all the processes take longer and can determine the success or failure of your project.

The post How do I find money to start my business? appeared first on Entrepreneur

Original source: Entrepreneur