Business partnerships are often compared to marriages, and with good reason.

When you enter one, you’re signing up to mingle your finances. If the business is sued because of something your business partner does, you both have to answer. And if you’re not careful, creditors and courts can reach into your personal assets to settle up.

There are four types of partnerships, some of which can lessen these risks. Some types are only available in certain states, and some are limited to specific types of businesses.

Before you jump in, it pays to know your options and how to form the kind of partnership that suits your needs.

Overview: What is a partnership?

A partnership is a business shared by multiple owners. It’s not a legal business entity, and it doesn’t have to be registered with the state. Basically, if you decide to go into business with another person without filing any state paperwork, you’re automatically in a partnership.

Some types of partnerships are legal business entities registered with the state. These entities may provide limited liability protection to shield your personal assets.

How are partnerships different from other business entities?

A partnership, like a sole proprietorship, is legally and financially inseparable from its owners. Profits and losses may be passed through to the owners’ personal income for tax purposes. Debts and liabilities pass through as well.

Partnerships are generally easier and less costly to create than corporations.

All partnerships provide the advantage of pass-through taxation, which generally results in lower taxes than other business structures such as corporations.

Types of partnerships

These are the four types of partnerships.

1. General partnership

A general partnership is the most basic form of partnership. It does not require forming a business entity with the state. In most cases, partners form their business by signing a partnership agreement.

Ownership and profits are usually split evenly among the partners, although they may establish different terms in the partnership agreement.

In a general partnership, all partners have independent power to bind the business to contracts and loans. Each partner also has total liability, meaning they are personally responsible for all of the business’s debts and legal obligations.

That’s a lot of power and a lot of mutual responsibility. For example, say a general partnership has three partners. One of the partners takes out a loan that the business cannot repay. All partners may now be personally liable for the debt.

General partnerships are easy to form and dissolve. In most cases, the partnership dissolves automatically if any partner dies or goes bankrupt.

2. Limited partnership

Limited partnerships (LPs) are formal business entities authorized by the state. They have at least one general partner who is fully responsible for the business and one or more limited partners who provide money but do not actively manage the business.

Limited partners invest in the business for financial returns and are not responsible for its debts and liabilities.

This silent partner limited liability means limited partners can share in the profits, but they cannot lose more than they’ve invested. In some states, limited partners may not qualify for pass-through taxation.

If they begin actively managing the business, they may lose their status as a limited partner, along with its protections.

Some LPs appoint a limited liability company (LLC) as the general partner so no one has to bear unlimited personal liability for the business. That option may not be available in all states, and it’s much more complicated than an LP.

3. Limited liability partnership

A limited liability partnership (LLP) operates like a general partnership, with all partners actively managing the business, but it limits their liability for one another’s actions.

The partners still bear full responsibility for the debts and legal liabilities of the business, but they’re not responsible for errors and omissions of their fellow partners.

LLPs are not permitted in all states and are often limited to certain professions such as doctors, lawyers, and accountants.

4. Limited liability limited partnership

A limited liability limited partnership (LLLP) is a newer type of partnership available in some states. It operates like an LP, with at least one general partner who manages the business, but the LLLP limits the general partner’s liability so all partners have liability protection.

LLLPs are currently authorized in Alabama, Arizona, Arkansas, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Iowa, Kentucky, Maryland, Minnesota, Missouri, Montana, Nevada, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Dakota, Texas, Virginia, Washington, and Wyoming.

California doesn’t authorize LLLPs, but it will recognize LLLPs formed in other states.

Because they aren’t recognized in all states, LLLPs are not a good choice if your business works in multiple states. In addition, their liability protections haven’t been tested thoroughly in the courts.

How to legally form a partnership

When forming a partnership, follow these steps.

Step 1: Choose a structure

The first step is to find the best partnership for your situation through these steps:

• Research permitted partnerships: Check your secretary of state’s website to determine the types of partnerships available in your state and which ones are permitted for your business type.

• Discuss your vision and goals: What do you expect to contribute to the business, and what do you want to get out of it? Are you looking for steady income, a tax shelter, or the chance to pursue a dream? Do you have spouses or family members who might play a role in the business? How will you handle structuring money and partnership accounting?

• Choose a structure: Based on all of those factors, choose the structure that best fits your business. This is a good time to consult your attorney and a tax advisor.

Step 2: Draft a partnership agreement

While partnerships have been founded on a handshake, most are created with a formal partnership agreement.

A partnership agreement is like a corporation’s articles of incorporation. It establishes how your business will be run, how profits and losses will be shared, and how you’ll manage changes such as the departure or death of a partner.

Your partnership agreement should be signed by all parties and kept on file permanently.

Your agreement should cover the following items:

• Who are the partners and what is their contact information?

• How will ownership be divided among the partners?

• Who will manage the business? Will more than one partner share the responsibility?

• Do you have limited partners? If so, what will they contribute?

• How will disputes be resolved? Will one manager have a final say? What happens if you have an irreconcilable difference?

• What process will you follow if a partner decides to leave? How will that person’s financial stake in the business be valued and resolved?

• How will profits and losses be distributed? On a set schedule? At the partners’ discretion?

• Will family members participate in the partnership? Will they have any special powers, privileges, or limitations?

SCORE provides excellent resources for drafting your partnership agreement, including mentors to help you through the process.

Step 3: Name your business

Before filling out any state paperwork, you need to find an available, permissible name through these steps:

• Consult partner name regulations: Each state has its own rules for including partner names in your business name, and they can be very particular. For example, in Massachusetts, the name of an LP “may not contain the name of a limited partner unless it is also the name of a general partner or the corporate name of a corporate general partner or the business has been carried on under that name before the admission of the limited partner.” Comb through the fine print to make sure you’re following your state’s rules.

• Check corporate designator rules: States have unique requirements for including corporate designators — words or suffixes such as “LP” that reflect your business type — in your business name. This is to ensure that people dealing with you can readily understand the nature of your business. In Massachusetts, for example, LPs must spell out the words “limited partnership” in their names. In other states, you may be able to use “LP” instead.

• Check availability: Once you have a street-legal name, you need to make sure it’s not already taken. Most secretary of state websites include an online search feature that will give you an answer immediately.

Step 4: Register your partnership

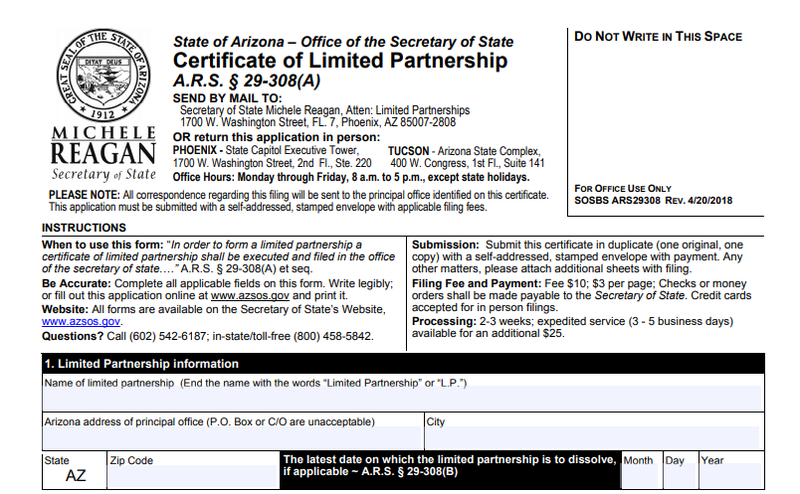

If you’re forming an LP, LLP, or LLLP, you must register your business with the state through these steps:

• Choose a home state: If your business is dispersed among multiple states, you will need to choose a state of formation. Generally, the state where you conduct the bulk of your business is the best state for this.

• Check licensing requirements: Determine what licenses you will need to conduct your business and apply for them as required.

• Apply: Complete the relevant certificate of partnership for your chosen structure and submit it to your secretary of state or corporations division. The application generally includes the names and contact information for all partners, their roles, the purpose of the business, and an expiration date for the partnership.

• Appoint a registered agent: You must name someone who is available in a physical office location during business hours to accept delivery of notices of lawsuits (service of process) and other business documents. There are professional services you can use to manage this for you.

• Submit your application: Submit the prescribed number of copies (usually two) of your certificate with the required fee to the secretary of state or corporations bureau. You can usually submit your application online.

• Keep your documents: Once your application is approved, store the documents in your permanent business archive.

Step 5: Submit annual reports

If your partnership is registered as an LP, LLP, or LLLP, you’ll likely need to submit annual reports to keep the secretary of state up to date on basic information about your business. In most states, these are due annually or biennially with a fee based on your entity type.

Be sure to check these requirements, and schedule automatic notifications to ensure that you don’t miss a state deadline.

Build a lasting, successful partnership

There are times in business when it pays to be that wildly optimistic, starry-eyed dreamer. Launching a partnership calls for more of a skeptical approach.

The more you question your motives, check your answers, and prepare for the worst up front, the better your chances of a happily ever after.

The post 4 Types of Business Partnerships: Which Is Best for You? appeared first on the blueprint and is written by Elizabeth Gonzalez

Original source: the blueprint