A post-closing trial balance is the final trial balance prepared before the new accounting period begins. Used to make sure that beginning balances are correct, the post-closing trial balance is also used to ensure that debits and credits remain in balance after closing entries have been completed.

Overview: What is a post-closing trial balance?

A post-closing trial balance is a report that is run to verify that all temporary accounts have been closed and their beginning balance reset to zero.

If you’re using an accounting software application, much of this work is completed automatically, but if you’re using manual ledgers or spreadsheets to record accounting transactions, you’ll need to make sure that your temporary account balances are reset to zero to begin the new accounting period.

If you’re not using accounting software, consider using a trial balance worksheet, which can be used to calculate account totals. That makes it much easier to create accurate financial statements.

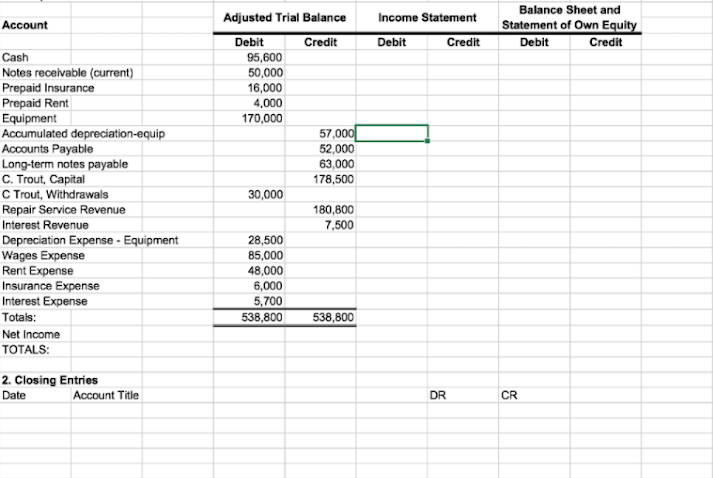

The trial balance worksheet contains columns for both income statement and balance sheet entries, allowing you to easily combine multiple entries into a single amount. This makes sure that your beginning balances for the next accounting cycle are accurate.

Types of trial balance

There are three main types of trial balance reports that you can run, with each trial balance run during a specific part of the accounting cycle.

For example, an unadjusted trial balance is always run before recording any month-end adjustments. Once the adjustments have been posted, you would then run an adjusted trial balance.

Finally, when the new accounting period is about to begin, you would run the post-closing trial balance, which reflects your totals going forward into the new accounting period. All trial balance reports are run to make sure that debits and credits remain in balance.

1. Unadjusted trial balance

The unadjusted trial balance is the first trial balance that you’ll prepare, and it should be completed after all entries for the accounting period have been completed.

The unadjusted trial balance is your first look at your debit and credit balances. Ideally, your debits and credits should match. If not, you’ll have to do some research to locate and correct any errors.

2. Adjusted trial balance

All businesses have adjusting entries that they’ll need to make before closing the accounting period. These adjusting entries include depreciation expenses, prepaid expenses, insurance expenses, and accumulated depreciation. Once your adjusting entries have been made, you’re ready to run your adjusted trial balance.

3. Post-closing trial balance

Once your adjusted trial balance has been completed, you’re ready to record post-closing entries for the month.

The purpose of closing entries is to close all temporary accounts and adjust the balances of real accounts such as owner’s capital. Like all of your trial balances, the post-closing balance of debits and credits must match.

An example of a post-closing trial balance

Before you can run a post-closing trial balance, you’ll have to make sure that all of your adjusting journal entries have been entered.

The adjusted trial balance for ABC Business is shown below. While all of the adjusting entries for ABC Business are reflected in the adjusted trial balance, we still need to do some closing entries before running the post-closing trial balance.

ABC Business

Adjusted Trial Balance

August 31, 2020

| Cash | $ 16,625 | |

| Accounts Receivable | 2,700 | |

| Office Supplies | 700 | |

| Furniture & Fixtures | 4,000 | |

| Accumulated Depreciation | 550 | |

| Accounts Payable | 7,100 | |

| Owner’s Capital | 10,500 | |

| Sales Revenue | 11,750 | |

| Rent Expense | 1.100 | |

| Salaries Expense | 4,000 | |

| Utility Expense | 350 | |

| Supplies Expense | 200 | |

| Depreciation Expense | 225 | |

| Totals | $ 29,900 | $ 29,900 |

Now that your adjusting entries have been completed and your adjusted trial balance debits and credits balance, you’re ready to make some closing entries in preparation for completing the post-closing trial balance.

Closing temporary accounts is an important step in the accounting cycle, and running the post-closing trial balance helps to make sure that the process has been completed accurately.

| 8-31-2020 | Sales Revenue | $ 11,750 |

| 8-31-2020 | Income Summary | 11,750 |

| 8-31-2020 | Income Summary | 5,875 |

| 8-31-2020 | Rent Expense | 1,100 |

| 8-31-2020 | Salaries | 4,000 |

| 8-31-2020 | Utility Expense | 350 |

| 8-31-2020 | Supplies Expense | 200 |

| 8-31-2020 | Depreciation Expense | 225 |

| 8-31-2020 | Income Summary | 5,875 |

| 8-31-2020 | Capital | 5,875 |

Now that your income and expenses have been posted to your income summary account, you’re ready to prepare your post-closing trial balance dated 9-1-2020.

ABC Business

Adjusted Trial Balance

August 31, 2020

| Cash | $ 16,625 | |

| Accounts Receivable | 2,700 | |

| Office Supplies | 700 | |

| Furniture & Fixtures | 4,000 | |

| Accumulated Depreciation | 550 | |

| Accounts Payable | 7,100 | |

| Owner’s Capital | 16.375 | |

| Totals | $ 24,025 | $ 24,025 |

Because you made closing entries for revenue and expenses, those accounts do not appear on the post-closing trial balance. You’ll also notice that the owner’s capital account has a new balance based on the closing entries you made earlier.

Post-closing trial balance frequently asked questions

Do I need to run three trial balance reports?

Yes, to complete the accounting cycle, you’ll need to run three trial balance reports.

Why don’t my debits and credits match?

There can be several reasons why your debits and credits don’t match. The most common reason is a simple addition error.

However, if that’s not the case, look at your subsidiary ledgers to make sure that all of your transactions have been properly posted. You may also want to see if any numbers have been transposed or entered in the wrong column, such as a debit entry inadvertently posted as a credit.

What does the general ledger have to do with a trial balance?

A trial balance is a report that lists the ending account balances in your general ledger. A repository for all of your accounts, every transaction recorded either in your accounting software or in your manual ledgers directly impacts the general ledger.

It’s important that your trial balance and all debit balances and all credit balances in your general ledger are the same. If they’re not, you’ll have to do some research to locate the errors.

The post-closing trial balance is the final step in the accounting cycle

Running a trial balance is a must for anyone manually recording financial transactions since it helps to make sure that debits and credits are in balance — which is the core principle of double-entry accounting.

The post-closing trial balance, the last step in the accounting cycle, helps prepare your general ledger for the new accounting period. It closes out balances in both expense and revenue accounts, which allows you to start tracking these totals again in the new accounting period.

Even if you’re using accounting software, running a trial balance can be important because it allows you to review account balances for accuracy. Make sure you don’t overlook this important step.

The post Why the Post-Closing Trial Balance Is so Important for Your Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint