The fundamental accounting equation is the foundation of the double-entry accounting system. Designed to ensure your books remain balanced, learn more about how to use the accounting equation in your small business.

Overview: What is the accounting equation?

Created more than 500 years ago, the basic accounting equation continues to serve as the foundation of double-entry accounting. The double-entry system ensures that for every transaction recorded to an account as a debit, a corresponding entry must be entered to another account as a credit.

The accounting equation, also called the balance sheet equation, was built on the premise that for every asset that a business owns, there is a claim against that asset in the form of a liability or owner’s equity.

Before we talk about the accounting equation, let’s examine the three parts of the accounting equation: assets, liabilities and equity, and what they are.

• Assets: An asset is anything of value your business currently owns. Cash, cash equivalents, inventory, accounts receivable, land, vehicles, buildings, computers, and equipment are all considered assets.

• Liabilities: Liabilities are debts your business owes. Accounts payable, notes payable, mortgages, and bank loans are all types of liabilities.

• Equity: Equity can be called many things: owner’s equity, shareholder’s equity, or stockholder’s equity. Owners’ equity represents the funds, if any, that are available to the owners and shareholders. Retained earnings, which are earnings left over after dividends have been paid to shareholders, is also part of the equity section of the balance sheet.

As long as accounting transactions are recorded properly, either into an accounting software application or into a manual ledger or spreadsheet, your accounting equation will always be balanced.

Today’s accounting software applications have the accounting equation built into the application, rejecting any entries that do not balance. This can be useful for those new to accounting, since any entry into your general ledger will directly affect your accounting equation.

The accounting equation formula

The accounting equation is simple:

Assets = Liabilities + Owners’ Equity

The accounting equation doesn’t consider the type of assets and liabilities on your balance sheet. It simply takes the total of each category to complete the equation.

How to calculate the accounting equation

The accounting equation is calculated using numbers from your balance sheet. If you’re keeping your books manually, you will need to create a balance sheet by adding your assets, liabilities, and equity totals.

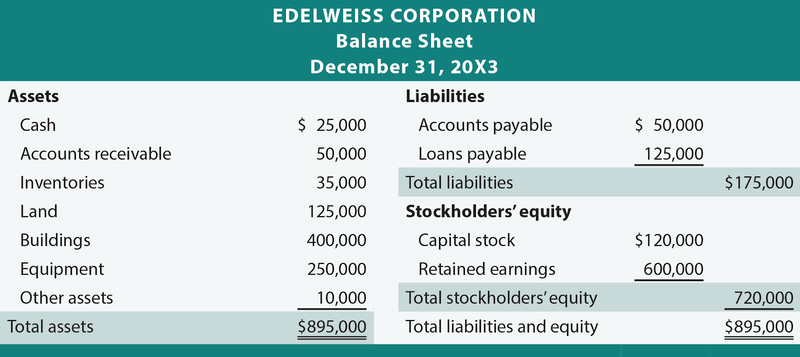

For example, if you look at the Edelweiss Corporation balance sheet, you’ll see that the total assets for the corporation are $895,000, where liabilities total $175,000 and stockholders’ equity totals $720,000.

$895,000 = $175,000 + $720,000

Using the numbers from the Edelweiss Corporation’s balance sheet, we can see the accounting equation has been properly used, with assets equal to total liabilities plus equity.

How to use the accounting equation

Making the jump to double-entry accounting can be a scary prospect for business owners with no accounting experience, but the end result is worth the extra time it may take to get the concept down properly.

The accounting equation is used to ensure your balance sheet remains in balance. For example, Sally’s Art Supplies is a brand new business. In preparation for opening the business, Sally did the following:

• Contributed $15,000 of her own money to the business

• Purchased $4,000 worth of inventory for the business on credit

• Purchased shelving for $2,500 on credit

Sally’s Art Supplies

12-31-2019

Balance Sheet

| Assets | |

| Current Assets | |

| Cash | $15,000 |

| Inventory | $ 4,000 |

| Total Current Assets | $19,000 |

| Fixed Assets | |

| Furniture and Fixtures | $ 2,500 |

| Total Fixed Assets | $ 2,500 |

| Total Assets | $21,500 |

| Liabilities and Equity | |

| Current Liabilities | |

| Accounts Payable | $ 6,500 |

| Total Current Liabilities | $ 6,500 |

| Total Liabilities | $ 6,500 |

| Equity | |

| Owners’ Deposits | $15,000 |

| Total Equity | $15,000 |

| Total Liabilities and Equity | $21,500 |

Here’s how each transaction Sally made affected her balance sheet using the accounting equation:

Sally’s first transaction was a contribution of $15,000 of her own money to start her art supply business. This transaction affected two accounts: the cash account in assets and the owner’s deposits accounts in equity. Using the accounting equation, here’s how this transaction would look:

$15,000 (cash) = $ (liabilities) + $15,000 (owners’ deposits)

Sally’s deposit increased her cash account and also increased her equity account, keeping the accounting equation in balance.

Next, Sally purchased $4,000 worth of inventory to stock her store. The inventory purchase affected the inventory account under assets and the accounts payable account under liabilities.

$4,000 (inventory) = $4,000 (accounts payable) + $0 (equity)

Sally’s purchase increased her inventory account while also increasing her accounts payable account, keeping her accounting equation in balance.

Sally’s final transaction was to purchase shelving for her store. Her transaction affected her balance sheet as follows:

$2,500 (furniture and fixtures) = $2,500 (accounts payable) + $0 (equity)

Sally’s final transaction is in balance as well.

Using the accounting equation, we were able to record each of Sally’s transactions using double-entry accounting, which used one debit and one credit in each transaction, ensuring that the accounting equation was used properly in the transactions.

Accounting Equation Frequently Asked Questions

What is the difference between single-entry and double-entry accounting?

Single-entry accounting is similar to checkbook accounting, where you simply record transactions as they occur. Double-entry accounting requires that every transaction recorded as a debit has a separate but equal transaction recorded as a credit. The result is the accounting equation.

If I’m using accounting software, do I have to worry about the accounting equation?

While it’s important that you understand the accounting equation and its impact on your financial statements, accounting software today has the fundamental accounting equation built into the application, rejecting any entry that does not follow the principles of the equation.

What are the main components of the accounting equation?

The equation’s main components are assets, liabilities, and equity. Assets are anything of value owned by your business, liabilities are debts owed by your business, and equity represents the level of ownership in the business after subtracting liabilities.

The accounting equation formula is assets = liabilities + owners’ equity.

Why does the accounting equation matter?

Very small businesses can usually use single-entry accounting with no repercussions, but if you want to get a better picture of your business finances, are looking for outside investors, or wish to apply for a loan, consider making the move to double-entry accounting, which is built on the accounting equation.

The accounting equation ensures for every debit entry made, there is a corresponding credit entry made. This ensures your balance sheet will remain in balance.

While double-entry accounting is more complicated than single-entry accounting, the end result is more accurate financial statements and books always in balance, both worth a few extra minutes of work.

The post The Accounting Equation: How to Use It in Your Small Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint