Have you had a business idea bubbling for a while? You’re not alone. Turning the spark of a potential business idea into something real is a dream for many.

However, before you jump in and go for it, you have a lot to consider. Ask any fellow small business owner for tips, and they’ll tell you that growing a small business depends on getting a handle on everything from your finances to your target market — and having a plan helps.

Making a business plan can help you determine if your business idea is viable. Going through the business planning process can help you figure out if your idea can turn into something more and understand some of the challenges you might face along the way. Another added benefit: if you’re interested in getting outside financing, having a business plan can speed up the process.

To get started, check out our guide to writing a business plan.

Overview: What is a small business plan?

Before you can call yourself a small business owner and promote your services on Small Business Saturday, you need to make sure your idea can turn into something. A small business plan helps you do that. A plan helps you consider all sorts of details, from how you’ll approach marketing to the best way to set up your legal structure to pay taxes for your small business, and everything in between.

Your business plan outline acts as a guide. Think of it as a road map for your company over the next three to five years. Having a plan in place before you get started helps you think through your business goals and the best ways to achieve them.

Diving into the planning process gives you a better understanding of your financial needs too. That’s crucial if you decide to apply for loans or grants in the future. Plus, knowing your business inside and out means you can create better proposals for your products or services to close more deals.

What should you include in a small business plan?

Are you concerned you’ll need to be an expert in business or accounting to start? Don’t worry. Anyone can create a business plan. In general, most people use a pretty standard business plan template to begin.

You’ll want to include these components in your business plan

1. Executive summary

The executive summary is the first page of your small business plan document. It gives an overview of your business, including your mission statement, the products or services you offer, the company’s ownership structure, and a general summary of your business plans.

2. Company description

Next comes your company description. Here, you’ll list your company’s legal name and structure, ownership, and its address.

3. Business overview

This section is a summary of your industry and how your product or service fits. You can look at current market trends as well as projections for the future.

4. Market analysis

Here, you’ll give a full overview of the target market where you plan to sell your product or service. Be specific, especially when thinking about your competitors’ strengths and weaknesses and how your product or service will fill a need.

5. Operational plan

Your operational plan will provide a business model showing how your company will operate. It should include the ownership structure and the roles of the management team and expected employees, if any. Be sure to include outside resources you might need, for example, an accountant for your small business, lawyers, etc.

In this section, you’ll also want to include any real estate and logistics needs for office space or production and any special equipment or supplies to get your product manufactured.

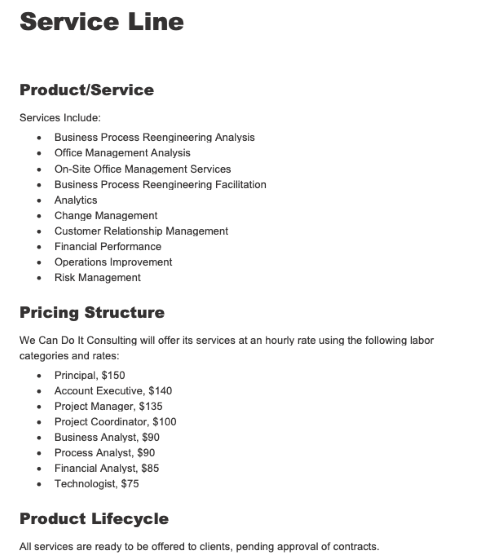

6. Sales and marketing plan

Your sales and marketing plan could have a couple of sections. First, you want to cover the products and services you will offer in detail. Include your pricing models, the costs to make your products, and how you plan to sell and distribute your goods.

Get detailed on the marketing side here. Today, digital marketing plays a crucial role in growth. Many solopreneurs and mom and pop shops rely on social media and their business website to sell goods. Consider that and other methods you plan to use to promote your brand.

7. Financial plan

If you plan to seek funding, in the form of investors, a bank loan, or grant, for example, this section of your business plan is very important. Highlight here how your business can become profitable and grow over time.

Include estimates of your cash flow, income statements, and balance sheet. From there, you’ll be able to estimate your finances over the next three to five years.

8. Appendix

As you get started, your appendix might be a little thin. Once you’ve determined your idea can become a viable business and you’ve gotten started, use this section as a place to keep essential documents.

These documents can include:

• Your credit report

• Financial statements

• Articles of incorporation

• Marketing materials

• Tax information

If you decide to apply for business funding, you’ll need to have these documents handy and included in your business plan. Make sure you have a system for record-keeping to keep everything straight.

How to write a small business plan

Now that you know what goes into your small business plan, you can start filling in your template with real information. Here’s how.

1. Do your research

The most time-intensive part of getting your business plan set is the research phase, and the more research you do, the better.

You’ll need to compile research on your industry, as well as your direct competitors and the audience you’ll target.

Go deep in researching your industry and competitors — it can have many benefits. A deep understanding of the industry matters, especially if you need to set up manufacturing and distribution channels.

And it never hurts to learn more about your competition, including their strengths and weaknesses. That can help highlight opportunities for your brand.

2. Gather your financial information

Financial data plays a huge role in getting your business plan up and running, so don’t cut corners here.

Remember, as you start to run and grow a business, money matters. So, you need to find a way to keep track of it all. Accounting software, such as QuickBooks, can help you monitor everything from the expected billable hours you’ll have to pay accountants or contractors, such as freelance web designers for your site or writers for your marketing, to invoices and inventory.

Once you have a full and realistic picture of your finances, you can start planning your projections.

3. Follow the outline structure

With your research and data in hand, you can start writing your business plan, section by section. Something to remember as you write: keep it concise.

Most business plans end up being around 7 to 20 pages, depending on the type of business. For something relatively simple, such as a solo consulting firm, you don’t need to worry about manufacturing and logistics in your operational plan section, for instance.

4. Write your executive summary

While this is the first part of your business plan, it’s generally the last thing written so that you can sum up everything in a few concise paragraphs.

Business plan example

To help you get started with your business plan, here’s an example. This plan is an example template from the Small Business Administration (SBA).

You’ll start with the executive summary. You can see that this one gives a quick overview of the company, product, and customers.

Next is the company description page. The company has noted its primary members and its legal structure for tax purposes.

In the market research or market analysis section, the plan details more than you see in the executive summary. You’ll find more in-depth descriptions of the industry as a whole and the target market. The plan also outlines its competitive advantages over similar brands in the industry.

The operational planning section is pretty simple too. Since the business is a consulting firm, all product lines are services, with no assembly required. So there’s no need to list manufacturing, shipping, or logistical needs or concerns. It’s just a description of services with pricing.

Since this is a small, service-based business, the marketing and sales plan is quite simple. It lays out a simple strategy for growth as well as some marketing channels the company plans to use and the person in charge of most of the selling.

SCORE, which offers a network of free business mentors nationwide, has more detailed instructions on what you can include in your financial plan.

You’ve got the roadmap — now follow it

Creating a business plan is a great way to stay focused and on course. Starting a business is an exciting time, but it’s also easy to get distracted. With a business plan, you have a roadmap that can help guide you through the ups and downs of getting your business up and running.

The post How to Write a Small Business Plan appeared first on The blueprint and is written by Liz Froment

Original source: The blueprint