We go into business to make money, so wouldn’t you want to know how much money you’re making? That’s why calculating net profit margin can be so useful. Net profit margin lets you see exactly how much money your business is making after all related expenses have been taken into account.

Overview: What is net profit margin?

The net profit margin ratio is an accounting ratio that is used to determine the percentage of profit that your company can generate from total revenue. The net profit margin formula is simple:

Net Profit ÷ Revenue x 100 = Net Profit Margin

Your net profit margin is the same as your net profit or net income that’s reported on your income statement, but the net profit margin is measured as a percentage.

Net profit margin is a more comprehensive measurement than gross profit margin, which measures profit after the cost of goods sold has been subtracted.

While gross margin is a good measurement of operational efficiency, gross profit margin concentrates solely on product-related costs, while net profit margin takes into account operational, overhead, and administrative expenses. This makes it a more reliable indicator of overall business profit than product profit.

If you’re using accounting software, you can directly obtain all of the figures needed to complete the net profit margin calculation from your financial statements.

If you’re using a manual accounting system, you’ll need to calculate a variety of totals for revenue, cost of goods sold, operating expenses, and returns and allowances before you can calculate net profit margin.

How to calculate net profit margin for your business

Before you calculate net profit margin, let’s go over a few accounting terms you’ll need to be familiar with.

• Cost of goods sold: These are the direct costs involved in producing the products and services you’re selling. Cost of goods sold includes direct labor and materials, as well as factory overhead.

• Revenue: Any payments you receive for the goods and services you sell are revenue.

• Net revenue: This is the revenue remaining after subtracting returns, allowances, and discounts.

• Gross profit margin: This is the amount of revenue that remains after deducting the cost of goods sold.

• Net profit: The amount of revenue that remains after deducting all expenses.

The easiest way to calculate your net profit margin is by using accounting software, but it can still be calculated if you’re using a manual accounting system.

Examples of net profit margin

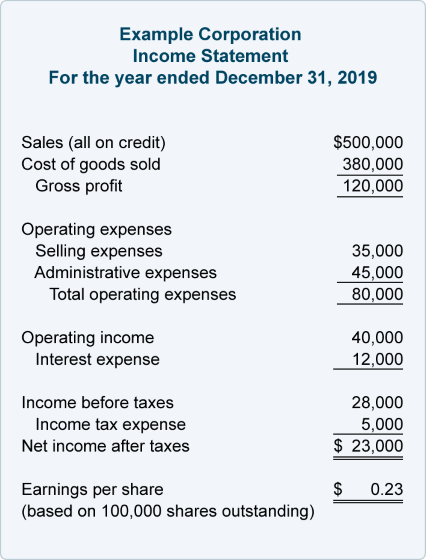

The information needed to calculate net profit margin can be obtained directly from your income statement. Let’s calculate net profit margin using the totals from the income statement below.

Example 1: Calculating net profit margin using accounting software

According to the income statement, your total sales were $500,000. If you had any returns or allowances, they would appear as a line item directly below your sales totals.

Next you’ll want to determine your total net income. On the income statement, this is already calculated for you, with expenses totaling $477,000 ($380,000 cost of goods sold + $80,000 operating expenses + $12,000 interest expense + $5,000 income tax expense).

Subtracting $477,000 in expenses from $500,000 in sales gives you a net income total of $23,000, which will be used to calculate your net profit margin:

$23,000 ÷ $500,000 x 100 = 4.6%

A net profit margin of 4.6% means that for every dollar of sales, you’re only earning around $0.05 in profit.

Example 2: Calculating net profit margin with a manual accounting system

Even if you’re not using accounting software, you can still calculate your net profit margin using the following steps.

• Calculate sales: You’ll need to total up the revenue for the time frame for which you’re calculating the net profit margin, subtracting any returns and allowances from revenue to reach the correct sales total. For this example, let’s say that you had $81,000 in sales and $1,700 in returns and allowances, making your net sales $79,300.

• Calculate cost of goods sold: Your cost of goods sold is an important component for calculating net profit margin. If you were calculating gross profit margin, you could stop at this step. Labor costs were $11,000, material costs were $14,500, and factory overhead was $1,100, making the total cost of goods sold $26,600.

• Calculate other operating and administrative costs: This includes operating expenses, administrative costs, taxes, and interest payments. Your administrative costs include $15,000 for payroll, $1,000 for rent, $400 for supplies, and taxes in the amount of $450, which total $16,850. Added to your cost of goods sold, total expenses are $43,450.

• Calculate net income: The final step is calculating your net income, which is $79,300 – $43,450 = $35,850.

Once you have this information, you can calculate your net profit margin.

$35,850 ÷ $79,300 x 100 = 44.61%

That makes your net profit margin 44.61%, meaning that for every dollar in revenue that your business earns, nearly $0.45 is earned in net profit. But is that good?

The answer depends on the industry you’re in, but generally speaking, a net profit margin of 10% is considered average, anything over 20% is considered good, and net profit margin of 5% or less is considered low. So, in the two examples above, the first has a low profit margin, while the second has a very high profit margin.

Net profit margin frequently asked questions

What is the difference between gross profit margin and net profit margin?

Gross profit margin, or gross margin, is the net sales minus the cost of goods sold. While gross margin gives you a good idea about the profitability of the goods and services you’re selling, it doesn’t factor in any other business expenses.

How should I interpret the results?

Though it can vary from industry to industry, generally speaking a net profit margin of 10% is considered average, anything above 20% is considered good, and anything below 5% is considered low.

How can I increase my net profit margin?

There are several things you can do to help increase net profit margin, including looking at your cost of goods sold. Are you paying too much for materials? Are there ways you can reduce labor costs, or make labor more efficient?

You may also want to look at operating costs to see if there are expenses you can cut. Finally, you can look to increase net profit revenue by adding another product or service, or increasing the selling price of your current products.

However, you’ll need to have sufficient justification to do so or your customers may take their business elsewhere.

Why it’s important to know your net profit margin

As an important accounting ratio for businesses of any size, net profit — and net profit margin in particular — plays an important role in the success of your small business. Knowing your net profit margin can help point out potential trouble spots or areas where your business is performing well.

If your profit margin is high, you may want to consider expanding your business or adding additional products and services, while a low profit margin can point out inefficiencies, allowing you to take corrective action before the issue threatens your business.

The post How to Calculate Net Profit Margin for Your Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint