Startup business owners can be a lot of things — an accountant, an attorney, a designer, a chef, a baker, or a skilled woodworker. What they usually aren’t is an experienced bookkeeper or accountant. But properly tracking your financial transactions is part of being a business owner, whether you’re a startup or an established business owner.

Startup business accounting can be particularly important since it’s likely that you’re operating your new business on a tight budget. But even if you’re lucky enough to have millions backing your business, your investors are going to want to know what you’re spending their money on.

Why is accounting important for startups?

Congratulations on starting your own business. As a business owner, your main objective is to sell your goods and services. But how will you know when your customers pay you if you don’t record their payment?

How can you take tax deductions at year-end if you aren’t keeping track of your expenses? Will a call from the bank be the first indication that your account is overdrawn? That’s why bookkeeping and accounting are so important, particularly for startups.

Before you begin, there are a few things you need to do:

• Determine your business structure

• Open a separate bank account for your business

• Find an accounting software application that you’re comfortable with

• Establish a bookkeeping system for your business

Once these items are completed, you’re ready to start managing financial transactions for your small business.

10 accounting basics every startup needs to track

While it is possible to manage your business accounting in a manual accounting system, you’d be much better served using an accounting software application.

Most entry-level applications on the market today are designed for people just like you: business owners with limited knowledge of bookkeeping and accounting basics. They’re also designed to make tracking financial transactions easy, and most are affordably priced for even the tiniest budget.

If you’re not sure whether something needs to be tracked, err on the side of caution and assume that it does. In all cases, the following financial items need to be properly managed.

1. Bank statements

With the advent of online banking, bulky bank statements are a thing of the past. However, reconciling your bank account is still important. Reconciling your statements each month allows you to balance your general ledger balance to your bank balance, account for any bank fees, and find any possible banking errors that may go unnoticed if the statements are not reconciled monthly.

2. Credit card statements

It’s just as important to reconcile your credit card statements as it is your bank statement. Credit card fraud is a real thing and can sneak up on you with a lot of small charges put through to see if you’re paying attention. Be sure you have a backup for every charge on your credit card statement. This is particularly important if you have a company credit card that is used by multiple employees.

3. Payroll

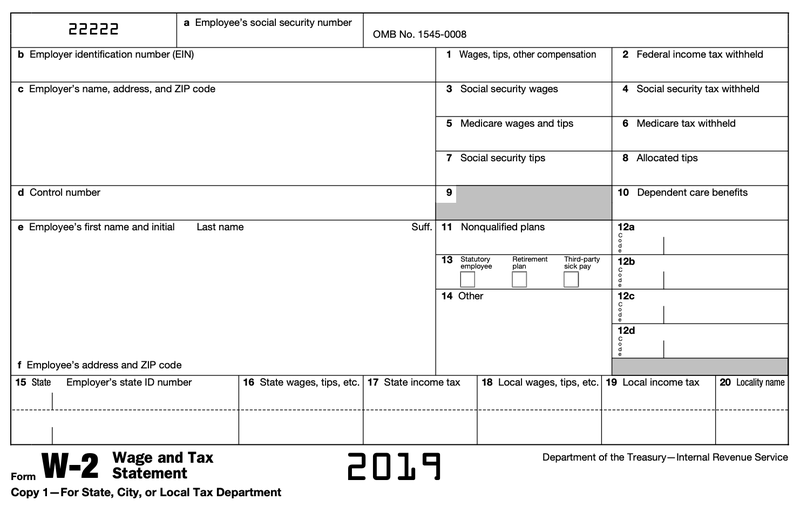

If you don’t have any employees yet, you don’t have to worry about payroll. However, if you have even one employee, you’ll need to properly track payroll. This includes everything from managing employee personnel records to retaining employee time records. This also means you need to manage all related payroll forms including 941s as well as W-2s and 1099s.

The best way to manage payroll is to subscribe to a payroll service that does most of the work for you. But even if you do it yourself, you’re still responsible for maintaining payroll records properly.

4. Invoices

One of the first things you should learn how to do is create an invoice. After all, how long will you stay in business if your customers aren’t invoiced for the products and services that you provide?

Again, any accounting software application you purchase will have an invoicing component included, which means accounts receivable tracking as well. If you want to get paid, be sure that you’re regularly invoicing and following up on those invoices.

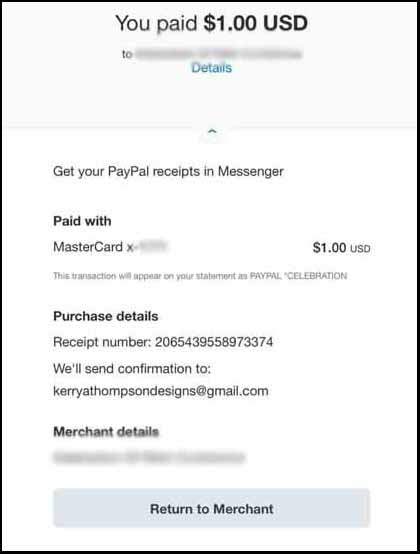

5. Proof of payment

Your supplier calls to let you know that they won’t be shipping any products until you pay your bill. The problem is you mailed them a check three weeks ago. While you may not keep physical checks anymore, be sure that you keep your bank statements handy so you can determine if a check has cleared and, if so, request a copy of the check to give your supplier.

If you’re not using checks, keep proof of your payment together with the bill if the payment goes missing.

6. Startup costs

If your business is brand-new, make sure to track all of your startup expenses because, according to the IRS, you may be able to deduct up to $5,000 in startup and organizational costs in the year that your business becomes operational. Any costs exceeding the deduction will need to be amortized.

7. Payments received

Anytime a customer pays you is a reason to celebrate. Make sure that payments received from your customers are adequately tracked, whether they pay by check, cash, credit card, PayPal, or via ACH transfer. Whenever a customer pays, a record of that payment should be attached to their invoice and filed. If you’re ahead of the curve and using a paperless office, just save a record of the payment to their file.

8. Bills

As a new business, you must establish good credit with your vendors from the start. That means paying your bills when they’re due. But be sure to examine each bill that comes in to make sure that it’s accurate. It’s easier than you may think to pay an incorrect bill, so don’t let that happen.

After entering your bills in accounts payable, track them weekly to make sure that they’re paid on time. If they’re not, you’ll likely have to pay late fees, interest charges, or both.

You’ll also want to keep track of those smaller expenses such as parking fees, postage, printing, and mileage. Tracking business expenses properly will make sure that your year-end deductions are accurate and that you have the documentation to prove it.

9. Tax returns

If you’re a brand-new business, chances are you don’t have any tax returns yet. However, once you do, those returns must be filed away and kept for at least three years, although it may be a good idea to keep them longer.

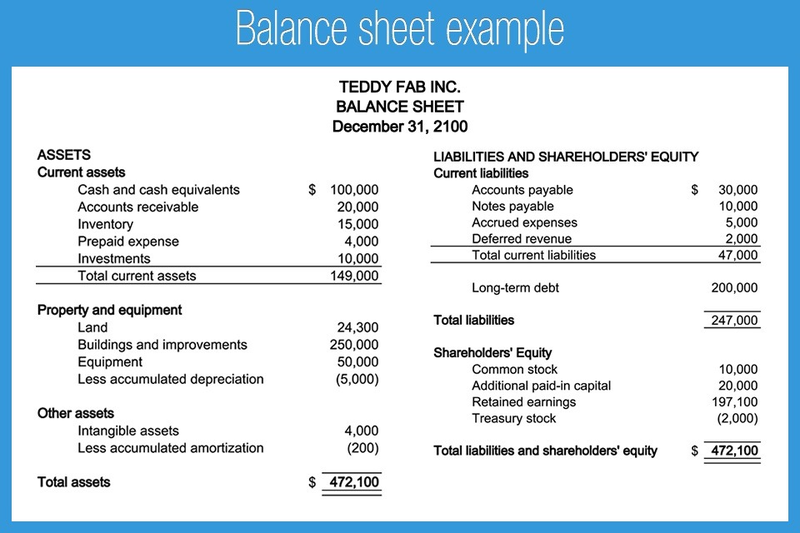

10. Financial statements

You should be printing a set of financial statements monthly or quarterly, depending on your business. Using accounting software, running financial statements takes less than a minute, but the details in those reports can tell you a lot about your business.

If you maintain month-end closing financial statements, your bank reconciliation should be included with the financial statements to make sure that your general ledger balance and bank balance match.

Accounting and bookkeeping options for your startup

If you’re still on the fence about handling basic bookkeeping or accounting for your business, you’re not alone. If the thought of doing your books is overwhelming, you have plenty of other options including enlisting the help of a CPA. You can also hire an experienced bookkeeper or accountant for your business, or just outsource the entire process.

When you should do your startup accounting yourself

If the word “never” comes to mind, you may want to skip this part. However, if you’re game, there are times when you should probably handle accounting for your business.

• When you’re just starting: Enlisting the help of an expert to set up your business accounting may be a good idea. However, if you’re just starting, you can probably handle bookkeeping without too much extra work.

• When you use accounting software: Today’s software applications are designed to make the bookkeeping process much easier. You may be surprised just how easy it can be.

• When you want to manage all aspects of the business: It may be tempting to turn over the bookkeeping to an outside agency, but keeping track of your financials with reports such as a cash flow statement can give you a much better sense of how your business is performing.

When you should look for additional help

Do you still not know the difference between a balance sheet and an income statement? Are you starting to calculate numbers in your sleep? Do the numbers on your financial statement still confuse you? If you don’t know the difference between financial statement analysis and financial forecasting, you may want to consider seeking some help.

• When day-to-day transactions increase: If you find yourself spending more time on bookkeeping and less time on your business, it’s time to look for alternatives.

• When transactions start to pile up: Do you have a stack of unpaid bills on your desk? Has it been weeks or even months since you posted a transaction, looked at your bank statement, or recorded a payment? If so, it’s time to get some help.

• You have creditors or investors to answer to: If you have a bank loan or active investors, it’s even more important that your finances are managed properly. Find an accountant or a CPA to help you out sooner rather than later.

Start your startup the right way

As a business owner, it’s up to you to decide whether you want to do the heavy lifting and handle the accounting on your own or find some help. As the owner, you’ll find that it’s easy to become wrapped up in the day-to-day tasks of running your business while ignoring that growing stack of papers on your desk. But ignoring that stack of papers can create more work for you down the road.

Managing your bookkeeping and accounting right from the start will allow you to keep better control of your finances. You’ll also know when you’re overspending and when you need to increase sales. So, whether you do the bookkeeping on your own, hire a bookkeeper or accountant, or outsource those tasks completely, remember that the better your business is managed from day one, the more likely it is to succeed.

The post Accounting for Startups: What You Need to Know appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint