Financial statements can tell you a lot about your business. They display the value of your assets, the amount of money you owe, the amount of revenue you’ve earned in a particular time frame, and even how much cash has gone into and out of your business.

But financial statements may not provide the answers to all the questions you have about your business. That’s where accounting ratios like the current ratio come in. The current ratio, like all accounting ratios, gives you answers to very specific questions. For example, if you want to know if your business has enough money to pay its bills, the current ratio can answer that question.

Overview: What is the current ratio?

For small business owners who don’t have an accounting background, accounting ratios may seem complex. While some of them are, most of the ratios that are useful for small businesses are easily calculated and require only a basic understanding of accounting.

That’s certainly the case with the current ratio. As a simple calculation, the current ratio answers one question: “Does my business have enough current assets to cover its current liabilities?”

In other words, if all the bills you have suddenly became due tomorrow, would you have enough current or liquid assets to cover them? Since the current ratio is only concerned with current assets and current liabilities, it’s one of the easiest ratios to calculate.

Your current or short-term assets may include the following:

• Cash and cash equivalents

• Accounts receivable

• Inventory

• Prepaid expenses

• Investments and securities

Current liabilities or current debt that should be included in the current ratio are:

• Accounts payable

• Notes payable (due in less than 12 months)

• Accrued expenses

If you’re using accounting software to help manage your business transactions, your balance sheet will automatically categorize current assets and current liabilities. If not, be sure to exclude fixed assets and long-term liabilities from your calculation.

How to calculate the current ratio

To calculate the current ratio for your business, you’ll need a current balance sheet. Once you have the balance sheet, you’ll need to locate your current asset balance and divide that by your current liability balance. The current ratio formula is:

Current ratio = Current Assets ÷ Current Liabilities

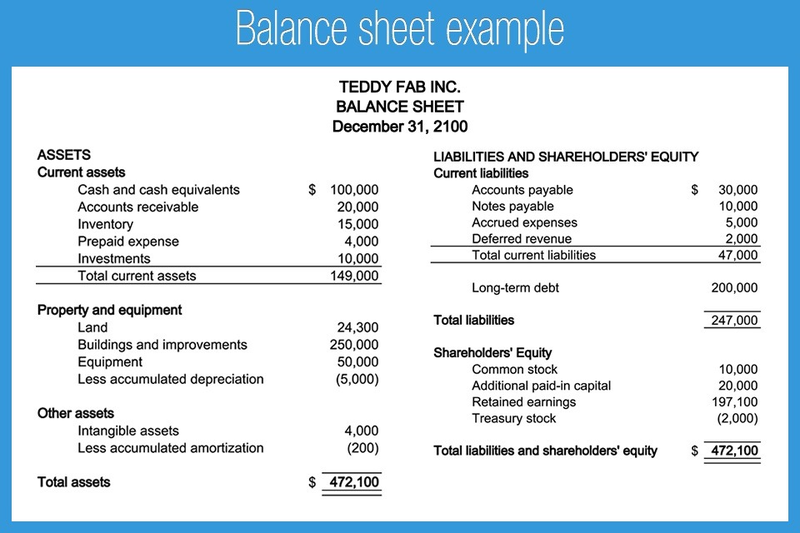

Using the balance sheet example for Teddy Fab Inc., let’s go ahead and calculate the current ratio.

$149,000 ÷ $47,000 = 3.17

This means that for every $1 that Teddy Fab has in liabilities, it has $3.17 worth of current assets. Businesses should ideally strive for a current ratio of at least 2, which indicates that the business has twice as much in assets as it does in liabilities.

What the current ratio tells you about a company

If you run the current ratio for your business, you’ll be able to see how financially stable your business is. Investors may also find the current ratio helpful when deciding to invest in a business.

Here are a few other things that the current ratio can tell you about the financial health of a business.

Whether the business can pay its bills

First and foremost, the current ratio tells you whether a company is in a position to pay its bills. Though many people look for a current ratio of at least 2, even 1.5 is considered adequate since it indicates that there are more current assets available to cover current liabilities.

If it will run out of money within the year

No one can predict this with guaranteed accuracy, but a current ratio of less than 1 can indicate that a company is in danger of running out of money within a year unless they’re able to increase cash flow or obtain funds from outside sources such as a loan from a financial institution or funds from an investor.

Whether revenue is being invested properly

While a low current ratio indicates possible financial difficulties, a high current ratio can signal that the company is not reinvesting in the business or paying dividends on earnings. And though a current ratio of 2 or higher is good, if it climbs too high, it may signal to investors a reluctance to invest in future company growth.

Limitations of the current ratio formula

The current ratio provides quick insight into a company’s finances, but it doesn’t present a complete picture. For example, a company with a current ratio of 4 due to high inventory value may not be as financially secure as a business with a current ratio of 3 that has a high value of cash and cash equivalents.

It doesn’t tell a complete story

The current ratio can tell you if you have enough assets to cover your liabilities. However, that information is only valuable if you know the story behind the numbers you’re using to calculate the current ratio.

For example, let’s compare the balance sheet accounts for two companies — Hannah’s Hula Hoops and Bob’s Baseballs.

| Cash and Cash Equivalents | $ 15,000 | $ 40,000 |

| Accounts Receivable | $ 25,000 | $ 30,000 |

| Inventory | $ 40,000 | $ 10,000 |

| Prepaid Expenses | $ 10,000 | $ 0.00 |

| Short-Term Investments | $ 12,000 | $ 22,000 |

| Total Current Assets | $102,000 | $102,000 |

| Accounts Payable | $ 25,000 | $ 30,000 |

| Short-Term Notes Payable | $ 25,000 | $ 20,000 |

| Total Liabilities | $ 50,000 | $ 50,000 |

You’ll see that both Hannah’s Hula Hoops and Bob’s Baseballs have current assets and current liabilities in the same amount, resulting in the same current ratio.

$102,000 ÷ $50,000 = 2.04

However, both companies are not performing equally. If you examine the balance sheet numbers closely, you’ll see that much of Hannah’s current assets come from inventory, while Bob’s inventory is much lower. This is important to note because although inventory is a current asset, it’s also less liquid than other current assets.

You’ll also see that Bob’s cash and cash equivalents are much higher than Hannah’s. Bob’s also has a slightly higher accounts payable total than Hannah’s, but it’s not significant enough to make a difference.

When looking at the two companies, it’s evident that Bob’s Baseballs has more liquid assets than Hannah’s Hula Hoops, putting it in a more solvent position. But if all you knew about these two companies was their current ratio, you would assume they were in similar financial positions.

Comparison is limited

The current ratio can be helpful when analyzing your company’s financial liquidity, but how do you know how your company is performing against other companies?

The short answer is that you won’t unless you compare your company’s current ratio against a company in the same industry. If you own a sporting goods company, you should be comparing your current ratio results against other sporting goods companies, not the small manufacturing company that produces computer parts.

A final word about the current ratio

The current ratio is a good starting point for small business owners who want to stay on top of their business finances. While a current ratio can tell you a lot, there’s a lot that it doesn’t readily portray. So if you do calculate the current ratio for your business, be sure to take a closer look at the numbers behind that calculation.

When you feel comfortable with calculating ratios, consider calculating some other ratios that are particularly helpful for small businesses, including the quick ratio, net profit margin, and the asset turnover ratio.

The post A Guide to the Current Ratio and How to Use It in Your Business appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint