All business owners go into business intending to make a profit. But profit doesn’t just happen. It also needs to be properly planned for. In this article, we’ll explain what profit planning is, what the benefits are of profit planning, and some suggestions for getting the most out of your plan.

Whether your business is run from your dining room table, a small office, or a large manufacturing plant, you should be using profit planning. A profit plan not only looks at how your business will earn a profit today but also creates a plan for future profits.

Profit planning doesn’t have to be complicated, but it does need to be put into writing and carried out accordingly. Profit planning helps you set business goals while creating a plan for reaching those goals. The profit plan for a small business will initially be very simple but will grow in complexity as the business grows.

A profit plan is always created as part of a larger plan, such as a master budget or a strategic plan, and should include the following information:

• Target market

• Product or service pricing

• Staffing

• Marketing and advertising

• Collection processes

• Business investment

• Operating expenses

Why profit planning is important for your business

What is your goal for your business? Do you want to break even your first year and continue to grow year after year, or would you rather start strong and sustain your profits in the coming years? Profit planning answers those questions and a lot more, allowing you to carefully plan out not just how much profit you’d like to earn, but the steps necessary to achieve those goals.

As an integral part of the planning process, profit planning should always be part of any business plan or forecast you create for your business and not just the number left over after expenses have been subtracted from revenues. By planning for profit intentionally, rather than by default, you’re more likely to build profit levels each year.

For example, you manufacture and sell coffee mugs for $10. For your first year in business, your goal is to earn a $2 profit for every coffee mug you sell. By planning for profit first, you now know that only $8 per cup sold is available for all of the other expenses involved in selling your coffee cups. And because you know that, you can plan your expenses accordingly, including materials, labor, selling costs, and even a business emergency fund.

Profit is the most important part of your business. It should always come first. These are just a few of the reasons why.

It helps business owners achieve their goals

If you don’t plan for profit, how will you know if you’ve achieved your goals? In your head you may be thinking, “I want to earn $50,000 a year in profit,” but in reality, you have no idea how you’re going to make that happen. Before you can earn your $50,000 profit, you’ll have to create a method for achieving that goal. That’s what profit planning does.

Assists with future decisions

Profit planning can be used to achieve both short-term and long-term objectives. For example, you start a business in January of 2021, with the modest goal of earning $40,000 in profit your first year in business. However, as your brand becomes better known and your sales techniques improve, you expect your profit in 2022 to double to $80,000.

While these are achievable goals, profit planning provides the details you need to give you the best shot at achieving them by taking into account details such as increased materials costs and labor costs.

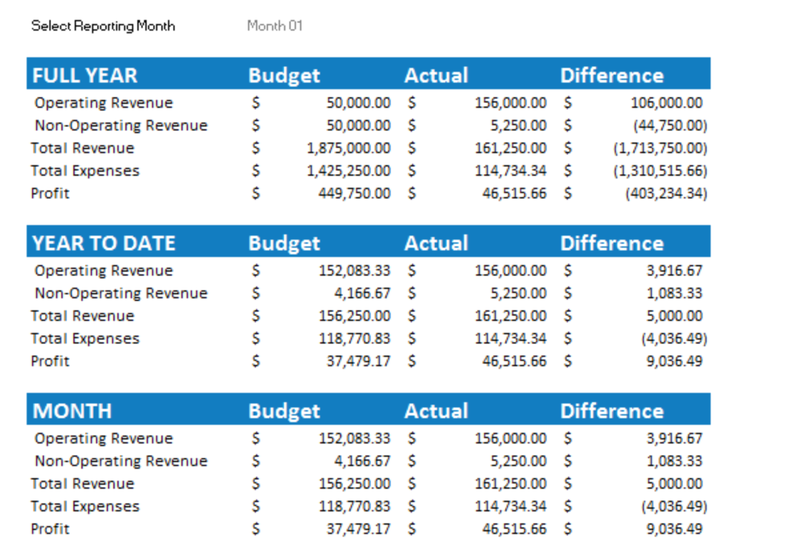

Provides a baseline to measure against

It’s important to establish a baseline to measure success against. In our earlier example, we talked about the business owner that wanted to earn $50,000 a year but didn’t have a plan in place. Do you think that a business owner would feel successful if they earned $25,000 their first year?

Probably not. Establishing a baseline, and continuing to measure against that baseline as your business grows will allow you to make adjustments along the way, giving your business a better shot at success.

Benefits of profit planning

Simply wanting to earn a profit is not an achievable goal. Profit planning provides you with a way to set and achieve your goals. There are a lot of benefits to profit planning. The following are just a few.

It allows you to set a target and create a roadmap to that target

The most important thing about profit planning is that it allows you to create a target profit and then build a detailed plan around it. For example, if your target profit for the year is $100,000, you can then devise a strategy around achieving that goal by answering the following questions:

Once these questions have been answered, you’re well on your way to creating a sound business budget to go along with your profit plan.

It strengthens the business overall

A profit plan is designed to be used with other financial projections such as a business plan, financial forecast, or organizational budget. When you create a detailed profit plan, you can compare progress each accounting period to see just how close or how far away you are from your initial targeted profit, and more importantly, take corrective action to get back on track.

It provides owners, managers, and employees with clear objectives

It’s only fair that all key employees are on the same page about the strategic goals of your business. It’s difficult to hold an employee responsible for underselling if they have no idea or input into your profit-planning process. Bringing your employees into the process provides them with a key stake in the outcomes and also gives them a much clearer picture of expectations.

Disadvantages of profit planning

Aside from the time spent putting your profit plan together, there are no downsides to profit planning. Even if your initial planning is miles away from your actual results, you can adjust your plan going forward to better suit your business.

4 best practices for profit planning

If you’re a new business owner, chances are that you’ve created a rudimentary business plan and didn’t pay a lot of attention to profit; it was just what was left over after your expenses were subtracted from your revenue. But detailed profit planning is important, even for smaller businesses. So let’s get started planning today, using some of these best practices.

1. Create a profit plan as part of a business plan

A profit plan should always be part of a business plan or strategic plan. Planning for profit is impossible without using a complete budget approach for profit planning, which includes expense budgeting and estimating production levels.

2. Use a cash flow forecast to map out goals

Once profit planning and expense budgeting are complete, create a cash flow forecast that provides the details of your plan. Not only does this give key players a guide to use, but it can also help you see where your projections are off, allowing you to make changes when needed.

3. Plan for profit first

Always define the profit level you wish to achieve and then plan your expenses around it, instead of the other way around. While this sounds simple, in reality, many business owners estimate revenue and expenses, with operating profit anything that’s left over. By determining the profit that you wish to make and by planning for it properly, you’re much more likely to achieve your goals.

4. Hold yourself (and others) accountable

Having a strategic plan in place that includes a detailed plan for profit helps to hold you, your managers, and your employees accountable. It’s impossible to achieve a goal without knowing what goal it is you wish to achieve. Be as detailed as you can, and rely on your team to make it happen.

Profit planning is important for all businesses

Even the smallest business will benefit from profit planning. By setting financial goals and putting them into action, you’re much more likely to achieve the business profit that you’ve planned for.

Profit planning should always be part of any master budget that you create for your business. Taking the time to properly plan for profit will result in a clear road map for you to follow on the path to growing your business — and your profit.

The post Why Profit Planning Is Important for Your Small Businesscuring Contract Financing appeared first on The blueprint and is written by Mary Girsch-Bock

Original source: The blueprint