Are you a small business with employees? If you are, you need to have worker’s compensation coverage to protect yourself, your employees and your business at all times.

Are you hiring a steady stream of contractors? The same holds true here as well. You should start researching worker’s compensation coverage, so that you’re ready the day someone gets classified as an employee.

Here are some of the worker’s compensation secrets for small business that shouldn’t be so secret.

Worker’s Compensation Claims Aren’t Limited to Industrial Worksites

The classic worker’s compensation case involves a construction worker falling off a roof or an industrial worker maimed by equipment. However, worker’s compensation claims can arise in almost any workplace.

An employee injured in a car crash while driving your delivery van can file a worker’s comp claim. Office workers are more likely to file worker’s compensation claims for repetitive stress injuries, but they could get hurt carrying boxes down stairs or getting sick when exposed to chemical fumes.

Worker’s Compensation Claims Can Lead to Legal Battles

Worker’s compensation claims can lead to legal fights. An employee can fight for greater compensation, and they should fight allegations that the workplace injury didn’t occur in the workplace. After all, a finding that the injury occurred off-site or is unrelated to work means they don’t have a worker’s comp claim. If the boss ordered people to work in unsafe conditions or pushed them to violate rules in place for people’s safety, the company doesn’t just have a worker’s comp claim when someone is hurt. They’re also liable for safety violations.

Employees often get legal help, because getting a settlement can be difficult. They may be unable to fill out detailed paperwork because of a traumatic brain injury or when taking pain medication. Or they may have trouble getting all the paperwork together to get the full compensation they’re owed.

For example, they may have requested compensation for their emergency room visit but not yet addressed the mounting bills for ongoing care. Insurers who are slow to pay bills create an undue burden on the employee, and this can lead to interest and penalties as well as legal bills for everyone involved.

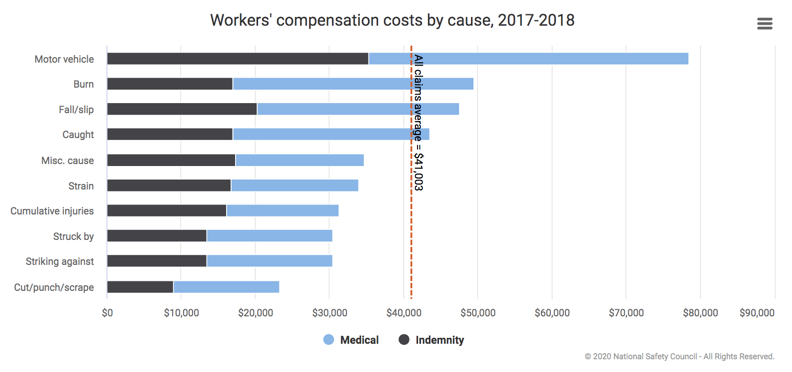

According to the NCS, the majority of worker’s compensation costs by cause through 2017-2018 were as a result of motor vehicles, burns, falls and slips, and more.

As you can imagine, in nearly all of these scenarios, the incident probably could have been avoided — which means there is no reason for employees to ever be injured while on the job.

Worker’s Compensation Is Similar to Every Other Insurance Policy You Pay For

Worker’s compensation is a form of insurance. You pay premiums based on several key risk factors. One is location. The premiums will be based in part on the state you work in, because different states have different rules. The type of work is a major factor.

Some industries are much more dangerous; construction and industrial workplaces are two such examples. Logging, fishing, and agriculture have greater than average risks, too. Premiums are also based on your payroll. You pay more when you have more people to cover. Then there is one’s claims history. If you have more accidents than average, you’re going to pay far higher worker’s compensation insurance premiums.

On the other hand, if you work with the insurer to mitigate obvious risks, your premiums may go down. If you make changes and no longer generate a steady stream of claims, your insurance company will eventually lower the premiums. Workers’ compensation typically considers the employer’s liability to be limited, but bad practices that cause people to be regularly injured or oversight that results in a major accident can leave you liable.

Worker’s Compensation Is Not Just For Big Business

Are you hiring contractors? You may want to prohibit someone from being hired for a job unless they carry their own workers’ compensation insurance. Sole proprietors can buy worker’s compensation to protect themselves, too.

The post Workers Compensation Secrets for Small Businesses Revealed appeared first on Zac Johnson.

Source: Zac Johnson