The reality is that most people aren’t saving nearly enough.

Despite a strong economy, a growing number of Americans have little or no savings at all.

In fact, nearly 70% have less than $1,000 in a savings account, up from 58% a year earlier, according to a recent report by GoBankingRates.

Further, almost half of those polled — 45% — said they have nothing in a savings account.

Yet, that doesn’t mean they can’t catch up.

Scaling back your spending is a good start. Making the most of the cash you’ve freed up is next — especially if you are starting from behind.

Tip 1: Put your savings on autopilot

When it comes to saving, the first step is to make it a habit.

Many financial advisors recommend beginning with an emergency fund, which is the key to keep from reaching for a credit card when something unexpected pops up, such as a broken appliance or a medical bill. Or, worse, a lost job and income.

Aim to have at least six months’ worth of expenses, or more, set aside if you are the head of a household.

Although that amount may seem like a lot, think small: For example, a good goal is to build up to $1,000 in a bank account by the end of the year.

If you break that down to a weekly savings target, it’s roughly the equivalent of setting aside $20 every Friday.

To accomplish this, set up a direct deposit from your paycheck into a dedicated savings account. In some cases, your human resources department may even be able to do this for you.

Tip 2: Rethink where to stash your cash

As your savings grows, it will begin to compound. That’s where interest rates play a crucial role.

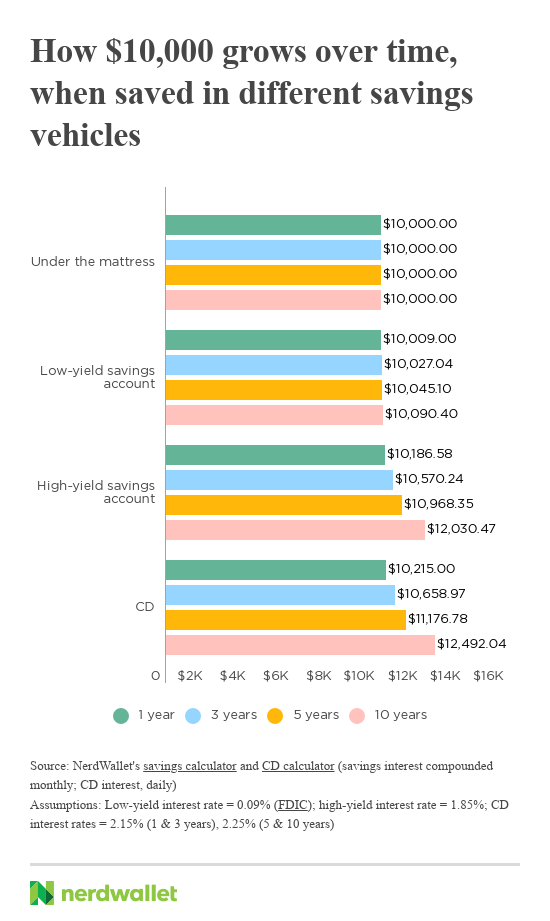

According to the FDIC, the average savings account rate is a mere 0.09% or even less at some of the largest retail banks. Online banks pay 10 or 20 times that. To make the most of your money, snag significantly higher savings rates by shopping around.

“It’s going to really pay off in the long term,” said Arielle O’Shea, a banking and investing specialist for NerdWallet.

Online banks are able to offer higher-yielding accounts because they have fewer overhead expenses than traditional brick-and-mortar banks.

The best ones also offer perks such as no minimum balance and free ATM access. You can even link an online savings account to the checking account at your local bank to access cash when you need it.

To get an even higher rate of return, putting money into the stock market has been a much better bet than just keeping it in cash.

As a general rule, if you take on more risk, the rewards tend to be greater over time. However, the likelihood of losing money increases as well.

That’s where a financial advisor, robo-advisor or even apps can help.

Tip 3: Give your retirement savings a turbo-boost

Your workplace retirement plan, or 401(k), offers another opportunity to multiply your money — thanks to the employer match.

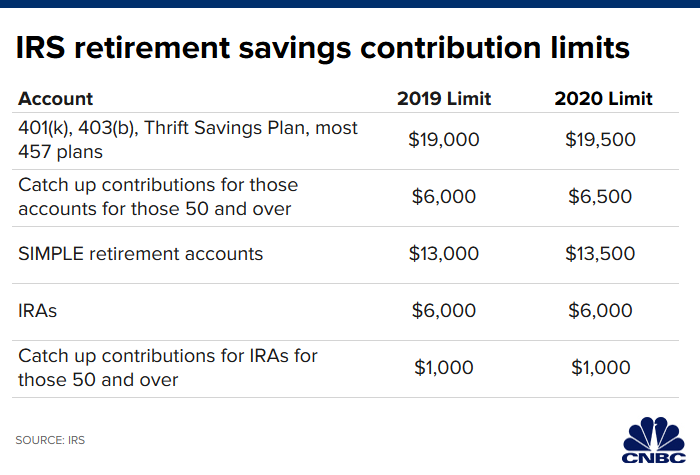

You want to contribute at least enough money to your workplace retirement account to get the company’s full matching contribution. “These are free dollars,” O’Shea said.

“The employer match is one of the only ways you can get a guaranteed return on your investment,” she added. “That could be a 50% or 100% return.”

At the same time, opt into an auto-escalation feature, if your employer offers it, which will automatically boost your savings rate by 1% or 2% each year.

If you work for a small business or save on your own through an individual retirement account, you can adopt the same approach.

“Your goal should be aiming to increase those contributions up to the limit,” O’Shea said.

The post The secret to multiplying your savings appeared first on CNBC news and is written by Sharon Epperson and Jessica Dickler

Original source: CNBC news